Discounted Cash Flow (DCF)

Introduction to Cash Flow Analysis

Historically, the primary measure of the value of a ship has been seen as its market value: the estimated price for which the vessel could be bought or sold in a fair and open market. However, when prices fell dramatically in 2008 on account of the global economic crisis, questions were asked about whether market values necessarily represented the true worth of a ship. Various alternatives are possible but interest focused on the income approach, which determines the amount the vessel would be expected to earn during its remaining working life. The way to do this is widely accepted to be discounted cash flow analysis (DCF) and the outcome is variously referred to as value in use, present value, long term asset value or DCF value.

The basic principles of discounted cash flow analysis are straightforward. For each period or year in the life of the asset the anticipated revenue and expenditure, after inflation, are determined. The net cash flow, that is revenue less expenditure, is then reduced by means of a discount factor. This factor converts the net amount into today’s terms by reflecting what the money might otherwise have earned, adjusted for risk. In essence, it accounts for the economic fact that an amount of money to be received in the future is worth less than the same amount of money received today. The residual value, such as the demolition value of a ship, is similarly discounted. Finally, the value of the asset is calculated as the sum of the yearly discounted cash flows plus the discounted residual value.

Representing the calculations

The DCF process comprises a set of assumptions - which in the case of a ship would be its age, anticipated charter rate, OPEX and so on– along with a series of procedures, typically performed by spreadsheet, to calculate the value.

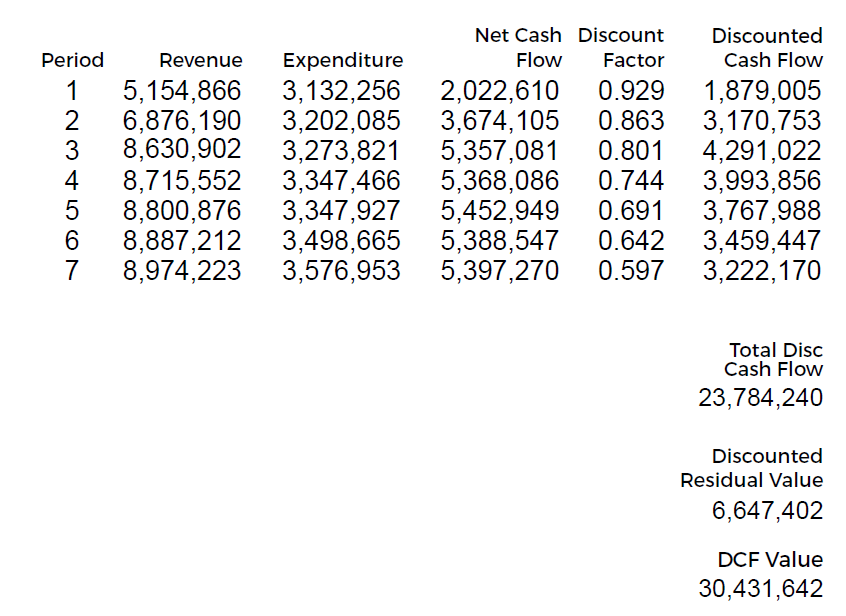

There are various ways to set out these calculations. The most common is a table of figures such as the simple example given in Figure 1.

Figure 1. Common representation of DCF calculations

The mathematical model which underpins the numbers can be represented by a formula. The standard version for the Long Term Asset Value of a ship is:

where

and

Precise dates

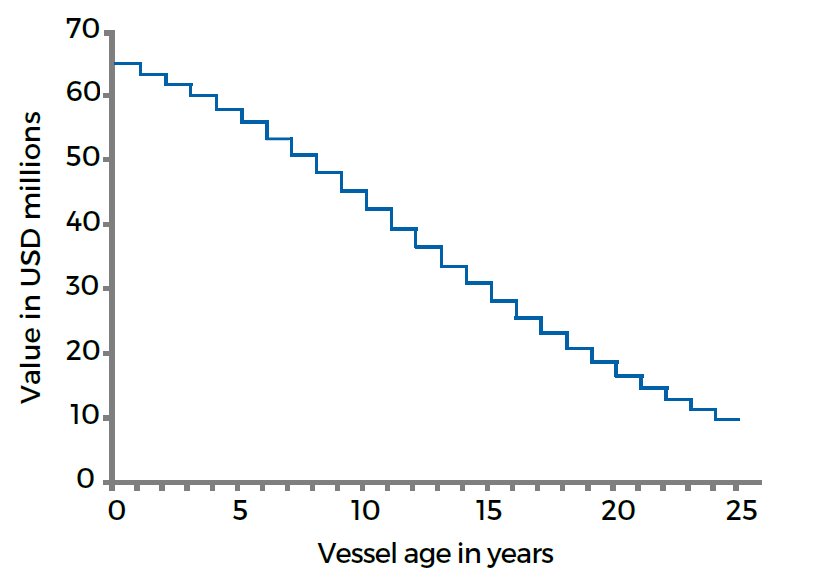

Whole years (typically calendar years from 1 January to 31 December) are often used for the DCF period in shipping and no account is made for periods that are shorter. This simplification has consequences. Since both the date of valuation and the age of the ship are approximations some inaccuracy is inevitable. Furthermore, if the value were calculated daily and all variables other than time were kept constant then the value would fall abruptly on the 1 January of each year as one year fewer was included in the sum. This is demonstrated in Figure 2 below, where the value follows a step function over time.

Figure 2. An example chart showing how the value in USD millions would step down over time when using whole years

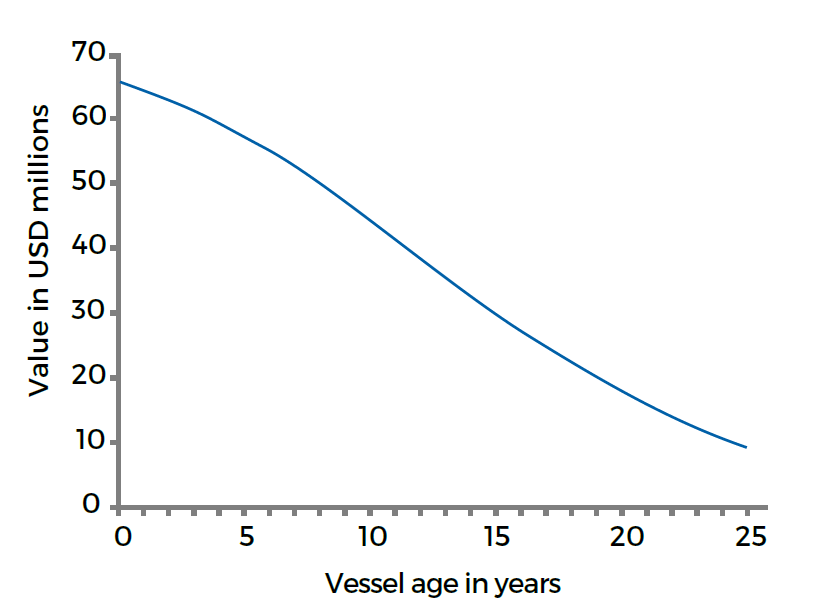

In contrast, the VesselsValue DCF model uses precise dates and the exact remaining life of the vessel. The first period, which is normally less than one year long, runs from the day of valuation until the day before the next anniversary of the vessel’s built date (i.e. the day before its next ‘birthday’. Subsequent periods, which are exactly one year long, run from the anniversary to the day before the following anniversary. Consequently, our value is strictly linked to the exact day of valuation. This means the daily value falls smoothly as the first period is reduced one day at a time, as shown in Figure 3.

Figure 3. An example chart showing how by using the precise dates and remaining life of the vessel smooths the curve of USD millions over time

The formula for the VesselsValue model is:

where

In this formula the exponent

Using what might be called ‘vessel years’ for the period has other important implications for the model.

Charter rates, which are normally expressed in calendar years, have to be converted into rates for vessel years. It also means that inflation and other rates which are annual have to be treated accordingly. On the other hand, factors which are dependent on the age of the ship, such as survey days and survey cost, are naturally expressed in terms of ship years. To aid calculation, calendar dates and intervals of time are converted into decimals using a 365/365 algorithm. The ability to handle precise dates gives VesselsValue the capacity to generate daily historical values.

Assumptions

Any discounted cash flow value is highly dependent on the assumptions that underpin it and there are many factors that contribute to the amount a merchant vessel will earn. Our DCF model organises these assumptions under four headings: vessel, revenue, expenditure and residual. Some, like charter rate, are highly influenced by a volatile market yet can sometimes be fixed for an agreed length of time; others, like discount or inflation rates are the result of longer-term economic trends; certain aspects, for example OPEX, are more particular to the ship; and some factors, such as charter rate or OPEX, are themselves dependent on another set of factors, principally the age, size and specific features of the ship. To accommodate this complex situation, we have designed a highly flexible and responsive model in which each of the contributing factors can be separately specified as an assumption. It enables the system to generate automated and customised values.

Automated values

The starting point for an automated valuation is the specification of the vessel. Information on ship type, built date, size, features and lightweight is obtained from the VesselsValue database, which currently holds the details of over 39,000 bulkers, tankers, container ships and gas carriers. Using methods we originally developed to automate market value calculations, information on size and features is converted into scores which can be applied other inputs.

Shipping experience and our own studies indicate that the assumption for charter rates has the greatest effect of any factor. So the generation of charter rates is critical for automated values. Our underlying premise is that in the short-term future rates will reflect current short-term rates and that in the long-term they will reflect either historical average rates or long-term forward looking rates.

We, therefore, identify representative time series of charter rates for the ship type - usually derived by VesselsValue from multiple data sources - and calculate a short-term and a long-term rate. These rates for the generic type are then converted into short and long-term rates for the actual vessel by applying the size and feature scores and by taking into account any reduction in charter rate owing to the age of the vessel.

Charter rates for each period are calculated from the short and long-term rates by means of linear interpolation, using the following formula:

where

The charter rate for the period is calculated as the mean of the daily rate.

Charter rates are further adjusted for inflation and any fixed charters to determine the displayed charter rate for the vessel. These rates, along with the number of booked days and the commission and fees, are used to calculate the displayed revenue for the period.

Information on OPEX and survey costs is collated by VesselValue to generate representative figures for each ship type. In an analogous manner to charter, the size and feature scores along with any increase due to age are used to transform the OPEX figure for a generic ship into a figure for the actual vessel, which is adjusted for inflation to generate the displayed OPEX per day and OPEX costs per annum. Similarly, size and feature scores plus inflation are applied to determine to the displayed annual survey costs. Current and long-term historic scrap prices for steel are used in conjunction with the lightweight to determine the residual value of the vessel. Economic trends in shipping are used to set the requisite inflation rates.

A factor that has in the past proved difficult to determine is the length of the working life of the vessel. Some earlier models have lengthened the normal life of the ship part way through it but this has led to a jump in value when the life is extended.

Like the anticipated charter rate, vessel life is in effect a prediction about the future and therefore can be estimated from historical practices. By analysing the database of ships, VesselsValue are able to determine the typical life of any ship type. If a vessel continues beyond its normal life we make the assumption it will continue until the next major survey.

One other figure is crucial in any discounted cash flow calculation: the discount rate itself. VesselsValue, as a member of the LTAV Association, is supplied with quarterly rates for bulkers, tankers and containers over 5, 10, 15, 20 and 25 year terms by accountancy firm PwC. We use linear interpolation and extrapolation to calculate the specific discount rate for the vessel on the valuation day.

Customized values

The DCF interface enables the user to edit all the default assumptions and generate a customised value for any vessel. The specialist knowledge that users possess of their own fleets can be applied to the detailed array of assumptions which are initially used to provide an automated value. How this works will be made clear with some examples.

By changing the assumptions for the vessel the user is able to amend the overall parameters that influence the DCF values. These are the size of the vessel, the date on which it was built, the length of its working life and the discount rate that will be applied to the net cash flow and the residual value.

The greatest flexibility is provided for setting the elements which make up the revenue. The user can choose whether to specify the charter rates for a generic ship of that type or for the actual vessel. The method used to calculate the average from the time series, the interval over which the average is calculated and in some cases the time series itself can be reset. Alternatively, the figures for the long-term and short-term rates can be input directly. The inflation rate and the annual percentage reduction in charter rate owing to age, the percentage for commission and fees, any additional flat fee and the number of working days can be altered. The resultant figures that have been inflated and displayed in the calculation table can also be edited by the user. Finally, a fixed charter tool enables the user to enter the details of one or more charter agreements by specifying the start and end dates and agreed rates. Fixed charters override other rates. This gives the user the opportunity to select the rates in a variety of ways, to decide whether or not to apply the VesselsValue adjustments for size, features and age, and to modify the result.

A similar range of facilities enables the inputs for OPEX or survey costs, which together constitute expenditure, to be amended or replaced: the vessel or type can be selected, the figures can be directly entered and alter the increase in OPEX due to age and the rate of inflation can be altered.

The user is also able to edit the data that determine the residual value. Average or spot scrap prices for steel can be obtained from time series for demolition in the Indian sub-continent or China by setting the method and interval. The lightweight of the vessel and the inflation rate for scrap and the demolition commission can be altered. The residual value itself can be directly entered, rather than calculated from other data.

Many of the inputs are interconnected within a hierarchy of dependency. Amending vessel life or the date on which it was built will not only alter the remaining useful life of the vessel but this in turn will affect the calculated discount rate since that rate is determined by the length of the term. Changing the inflation rate for expenditure will change the calculated OPEX rate, management fee and the survey charges: this is because all flat fees are subject to inflation or deflation from the date at which they were entered into the database. A change in the size of the vessel will alter its size score and thereby cause a change in the calculated charter rates, OPEX rate and survey charges for the vessel that are displayed in the table.

Analysis

The DCF calculator is designed not just to compute values but also to analyse them. We have developed a number of tools which help the user to investigate what inputs would generate what outputs and why.

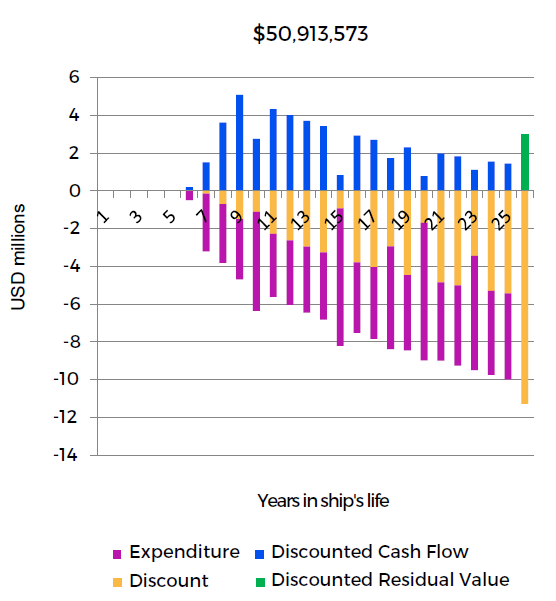

Any set of assumptions can be calculated from at any time, can be amended and recalculated again. The breakdown of results in the calculation table is summarised in a value analysis chart. This colour coded bar chart is dynamically updated to give a visual representation of the calculation in a way that can often be grasped more quickly than the numbers in the table. It is illustrated in Figure 4. It shows, inter alia, the transition in the charter rate from short-term (period 1) to long-term (period 3 onwards), the increasing effect of the discount factor over time and the relative shift from income to expenditure in survey years.

Figure 4. A chart showing the transition in the charter rate from short-term (period 1) to long-term (period 3 onwards).

The principal output of the model is the DCF value itself. However, the model also computes the average charter rate, calculated from the total charter income divided by the total number of booked days over the remaining life of the vessel. This encapsulates in a single figure the average charter rate necessary to achieve a specific value.

The model also incorporates a goal seeking tool which enables the user to reverse the normal process of calculation and go from output to input. Applying a mathematical root finding algorithm, the tool iteratively determines the discount rate or short-term, long-term or average charter rate that would lead to a specified value. VesselsValue has used the goal seeking tool to calculate the average charter rate implied by the market value of the vessel.