Forecast Market Value

The Forecast Market Value service provides a combination of our forecast analyst team’s expert fundamental analysis, human perspective and market narrative with VesselsValue’s machine based algorithms, data and analytics.

VesselsValue provide Forecast Market Values for each vessel in the Tanker, Bulker, Container, LPG and MPP fleet. These vessel specific Forecast Market Values are accessible on VesselsValue. This document describes the Forecast Market Values product and methodologies.

Overview

Forecast Market Values are forecasts of the Market Values of vessels until the end of their economic life. The forecasts are provided for the circa 42,000 Tanker, Bulker, Container, LPG and MPP vessels in the global fleet,

including current newbuildings and future contracts as they are ordered.

The Forecast Market Values are specific to each vessel and take into account the vessel’s features that affect value. These include: builder, age, size, capacities, engine, cargo equipment, specialty features and more.

Summary of the Forecast Market Value Service

The Forecast Market Values are derived from a combination of three separate forecasts:

The Short Term Forecast

A fundamental based forecast from the current quarter to four years into the future. The forecasts are updated daily alongside the market value. Detailed analysis and forecast values are provided on a quarterly basis for sectors including Tankers, Bulkers, Containers, LPG and MPPs. Analysis takes into consideration underlying market fundamentals (i.e. Macroeconomy, Industrial Activity, Fixed Assets Investments, Energy Prices, Commodities, Consumer, Shipbuilding and Tonnage Supply and

International Trade etc).

The forecasts are provided for standard vessel types of different ages and are then converted to vessel specific forecasts by VesselsValue’s proprietary algorithms.

The VV maritime analyst team has a combined total of over 100 years of shipping market experience between them and are advisors to some of the world’s largest shipowners.

The Transitional Forecast

An algorithm based forecast for five to nine years in the future. This bridges the gap between the fundamental short term and statistical long term forecasts. The algorithm provides the transition which moves smoothly between the short term and long term forecasts.

The Long Term Forecast

A statistical based forecast from ten years in the future to the end of the vessel’s life. This is based on the daily updated and vessel specific distribution of historical valuations produced by VesselsValue’s algorithms.

The long term forecast methodology is based on the premise that the distribution of a vessel’s value in the far future is well approximated by the distribution of a sufficiently long history of its observed values.

Fundamental analysis, as used in the Short Term Forecast, is not performed beyond four years due to inherent long term unpredictability of global economic interactivity. Therefore, the statistical and transitional forecast is used to extend the forecast beyond four years.

Forecast Methodologies

Short Term Forecast

The short term forecast consists of Forecast Market Values for the first sixteen quarters of the vessel’s future life, i.e. years 0 to 4. These are based on quarterly updated fundamental analysis performed on all the main generic vessel types i.e. Capesize to Handy, VLCC to MR, VLGC to Fully Pressurized, ULCV to Feeder, MPP (Large) to MPP (Small) and the underlying markets. Market commentary is also provided to give a narrative to the main drivers of the forecasts.

The forecasts are calculated using our Asset Market Model which was developed in the early 2000s and is continually refined and optimized.

This fundamental analysis is very detailed and time consuming and takes approximately 50 days to be completed in full by our analytical team. Therefore, the maximum possible update frequency of the fundamental driven short term analysis is 90 days (i.e. each quarter). Once each quarter is complete, the whole process is started again. There are two models with separate components, one which forecasts future freight earnings in each market segment and one which forecasts future newbuilding prices and second hand values. They are:

A demand side freight market analysis which forecasts vessel earnings from sector specific and macroeconomic data.

A demand side utilization analysis which incorporates demand for new orders from each market sector into the newbuilding price forecast.

A supply side shipyard analysis which incorporates yard capacity and orderbook data into the newbuilding price forecast and second hand value forecast. The newbuilding price and earnings forecasts are then merged to produce forecasted Market Values for secondhand vessels of generic size and specification. Finally, these generic forecasts are scaled up or down to reflect the future values of specific vessels using the age, size, and feature components of VesselsValue’s market value algorithm. These are described in the document ‘Methodology: The Mathematics of Market Value’.

Transitional Forecast

The transitional forecast applies to a fixed period of time between the end of our short term forecast and the beginning of VesselsValue’s long term forecast, i.e. years five to nine of the vessel’s future life.

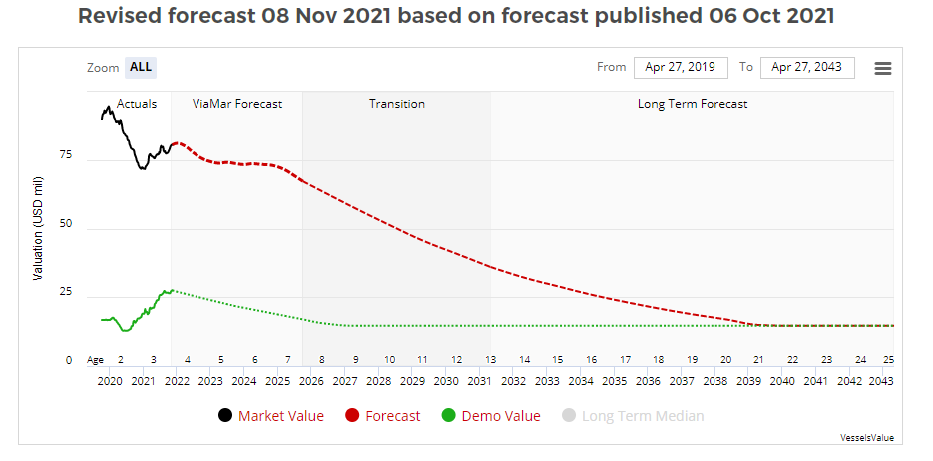

It moves smoothly between the short term and long term forecasts. The complete Forecast Market Value is shown for an example vessel in Figure 1. During the transition period, the Forecast Market Value decays exponentially from the final short term value in quarter 16 so that it reaches the first long term value in year 10.

Figure 1. Forecast Market Value chart for an example vessel, including actual historical valuations and the three forecast types (short term, transitional, long term).

Long Term Forecast

The long term forecast consists of Forecast Market Values for year 10 to the end of the vessel’s life. These are based on the assumption that the distribution of vessel values in the far future will resemble the distribution of a sufficiently long history of observed values.

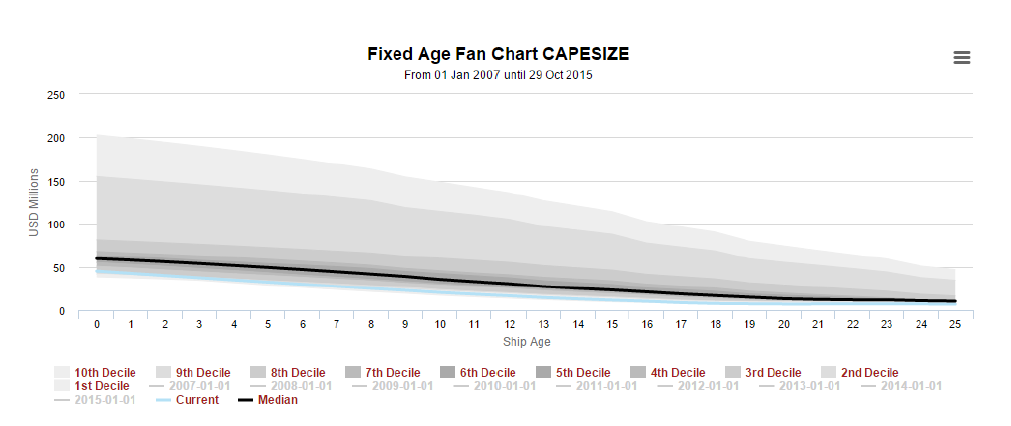

Figure 2. Historical distribution of Capesize values by age from VesselsValue's Fixed Age module. The median (black line) is the basis of the long term Forecast Market Value.

The median of this distribution, which depreciates with age, forms the basis of the long term forecast. It is scaled up or down to produce a value which reflects the exact age, size, and specifications of the vessel under consideration.

The long term forecast is entirely data driven and based on a clear and simple premise. It is made possible by VesselsValue’s automated valuation model, which allows the production of large valuation datasets for long historical periods.

Newbuild Forecast Index

The newbuild forecast index are related to annual average newbuilding price developments. A positive movement with the index indicates prices are forecasted to increase > 2%, and vice versa. A flat line indicates stable prices/ little movement.

Earnings Forecast Index

Within the earning forecast the positive movement indicates a firming of the rates >10%, a negative movement indicates a softening of the rates >-10%.

The VesselsValue market value algorithms generate daily historical valuations from 1992 to present day. Valuations of generic vessels of fixed ages over this period are compiled into an empirical distribution, available in VesselsValue’s Fixed Age module and shown in Figure 2.

Demolition Value Forecast

The demolition value forecast is calculated using the long term median of historical demolition values back to 1992.

Combining Man and Machine

The Forecast Market Value service provides a combination of our expert fundamental analysis, human perspective and market narrative with VesselsValue’s machine based algorithms, data and analytics. This enables the Forecast Market Value service to provide transparent forecasts for financial institutions regulatory needs as well as market intelligence to support investment or divestment decisions.