Linear Value

Introduction

The value of an asset that is reported or carried on the owner’s balance sheet is commonly known as the book value. It is derived from the acquisition cost of the asset less its accumulated depreciation and any impairment. VesselsValue offers an automated approximation of this figure without impairment. We employ the widely used accounting technique of straight line or linear depreciation and call this value “Linear Value,” which we publish daily for each vessel. The book or carrying value of a vessel is an important financial consideration. This includes periodic tests for impairment to assess whether or not the value on the balance sheet exceeds the recoverable amount. The range of automated values provided by VesselsValue enables the Linear Value of a vessel to be compared against its Market Value and its DCF Value.

Depreciation

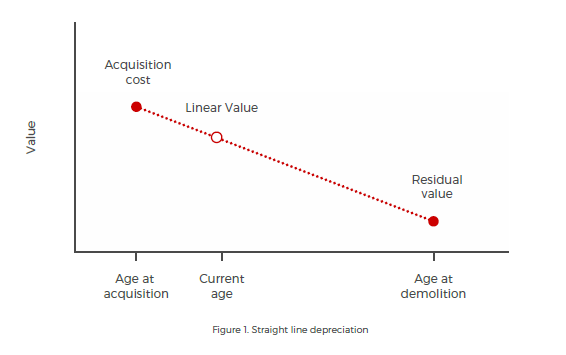

The principle of straight line depreciation is illustrated in Figure 1.

Figure 1. Straight line depreciation

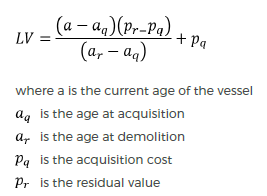

The corresponding formula for the Linear Value of a vessel during its useful life can be written as:

Figure 2. Linear Valuation calculation

During the build period, namely from the order date to the build date on which a new vessel is delivered, it is assumed that no depreciation takes place and the Linear Value, based on the order price or an estimate of it, remains constant. If a resale takes place the value is adjusted accordingly. On the build date straight line depreciation to the assumed demolition date and residual value commences. If over its life the vessel is sold, which may occur more than once, then on the sale date the Linear Value is set to the new acquisition price or an estimate of it and straight line depreciation to what may be a revised demolition date and residual value recommences.

If and when the assumed demolition date is reached with the vessel still live then depreciation ceases and the Linear Value reverts to a constant, based on the residual value. The way that Linear Value varies in practice over time can be seen from the analysis chart for a vessel.

Shipping data

The accuracy of any value is dependent on the accuracy of the data that drives it. VesselsValue maintains an extensive database of ship and market data, and this is the starting point for Linear Value. When a vessel is ordered we use the order date and order price, if reported; otherwise we use an estimated order date, based on the average build period for that ship type, and the newbuild value of the vessel (obtained from our automated Market Values) on that date. We use the recorded build date for all vessels. We maintain a comprehensive record of sale dates including resales and use the sale price, if reported; otherwise we use the Market Value of the vessel on the date of sale.

VesselsValue records the scrappage dates of vessels which enables us to derive an empirical short and long-term average life for vessel types. We use figures for ship life, relevant at the time of the order or sale, to determine the assumed demolition date. We record the actual LTD, sister LTD or estimated LTD for each vessel and scrap prices, over time, for shipping. This data along with a coefficient, currently set at 0.7, is used to determine the residual value of the vessel at the time of the order or sale, called the adjusted demolition value.

Customized values

Our interface enables the user to edit the default assumptions, we have set, and generate a customized Linear Value for any vessel. This information includes the ship life, LDT, demolition date, demolition coefficient, the date and value of each transaction, and the scrap price or adjusted demolition value.