IMOS - Calculate Future TCE Rates for Tanker Routes

Introduction

This feature addresses the business need to calculate the $/day TCE future rates for Tanker Routes published by market data providers in $/ton. Once calculated, these routes can be used within IMOS to price Tanker Time Charter contracts based on a floating index and/or as an exposure Mark-to-Market calculation in the Trading & Risk Module.

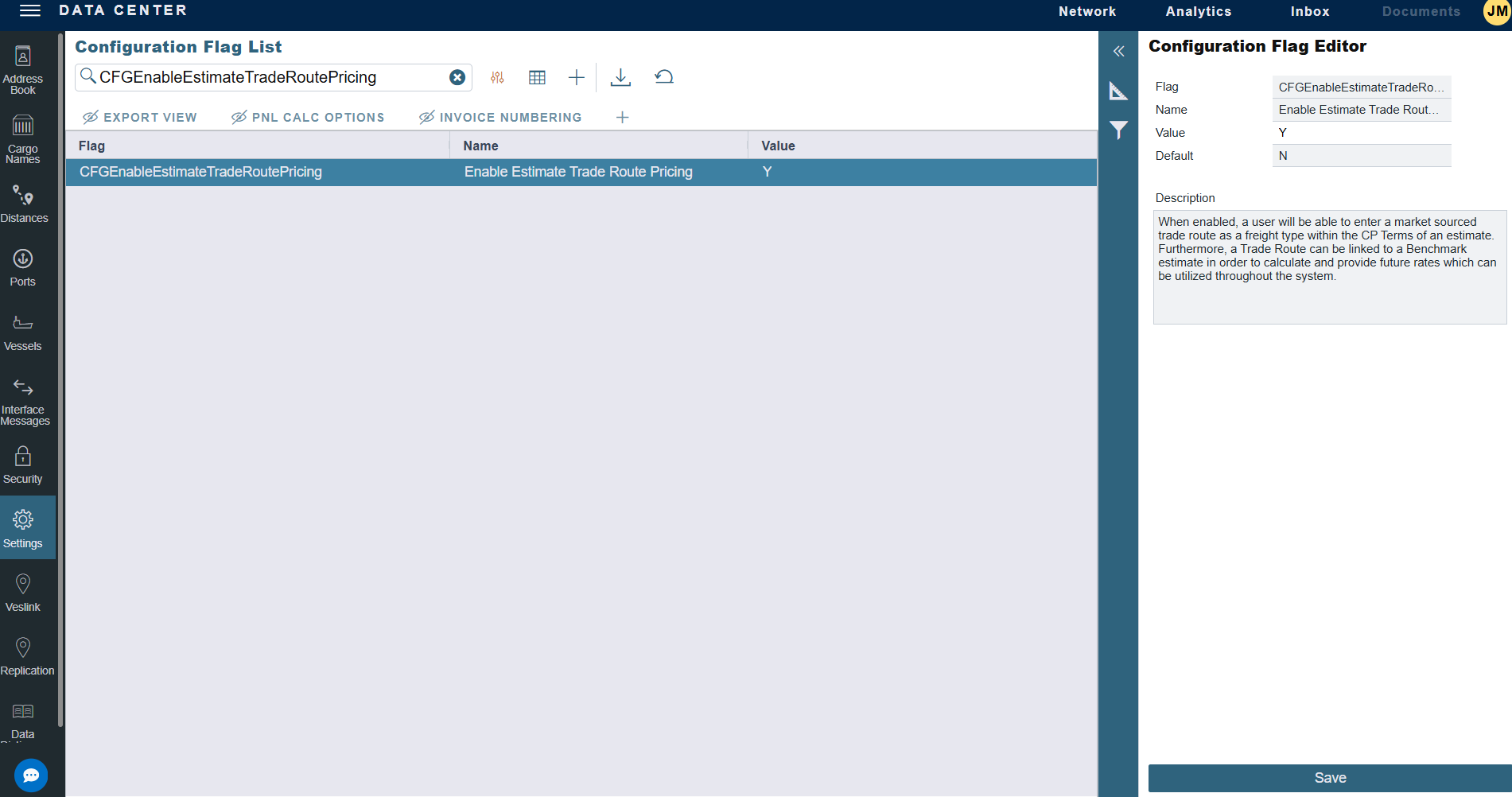

Setup

Go to the Data Center and select Settings. Type CFGEnableEstimateTradeRoutePricing into the search bar, and set the value to Y. This will enable the functionality to be able to “link” a custom trade route to a benchmark estimate and utilize the TCE calculation in the Estimate as the trade route price.

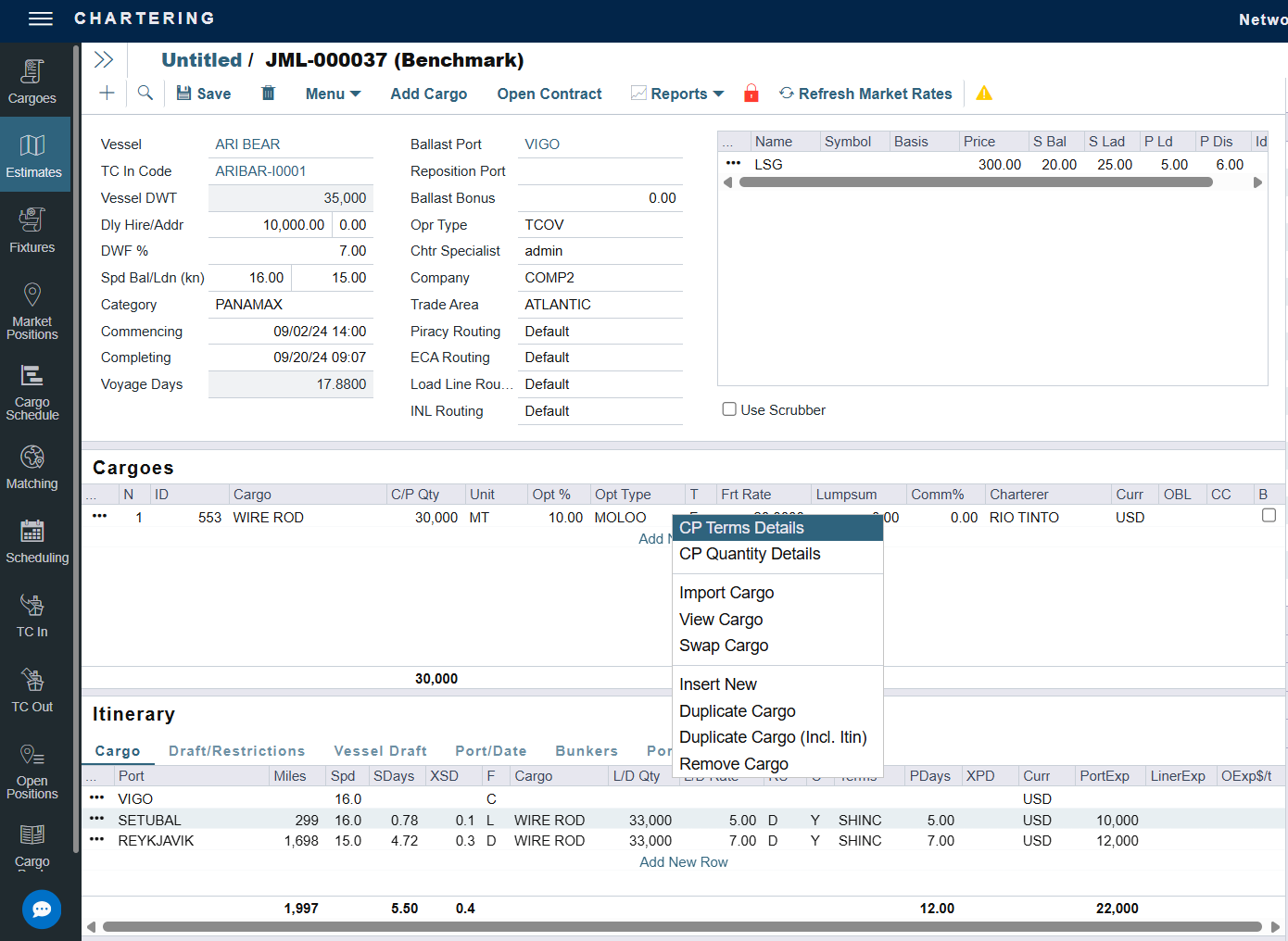

Voyage Estimate

Within an Estimate, right-click on the cargo line and select CP Terms Details.

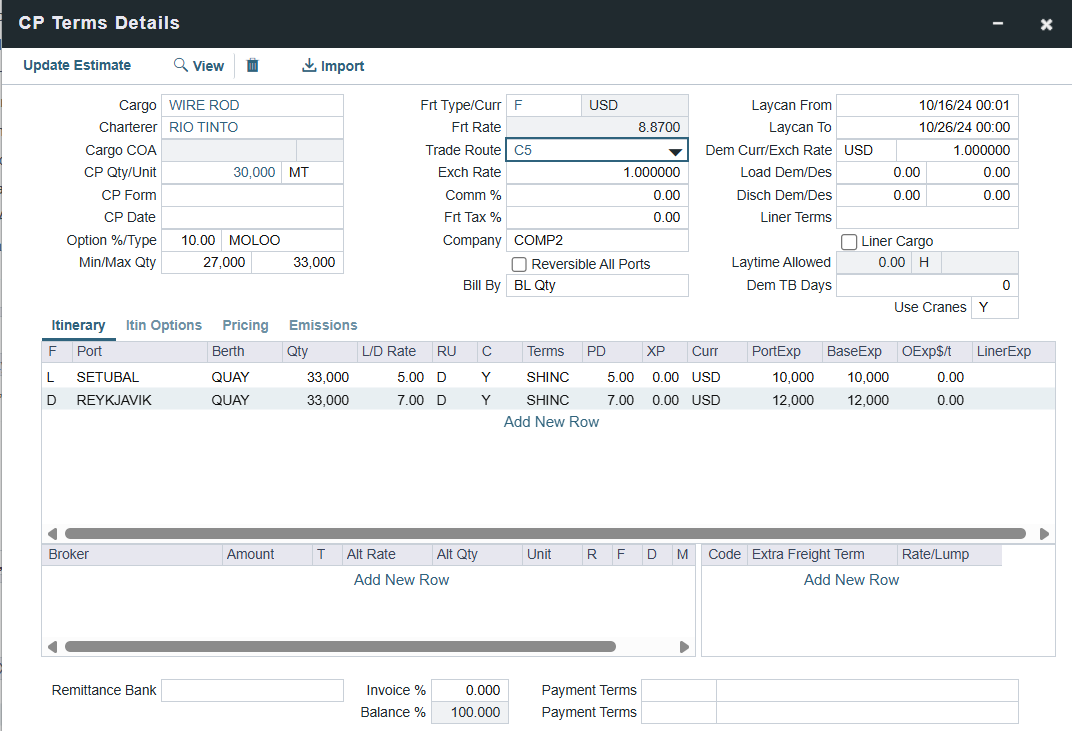

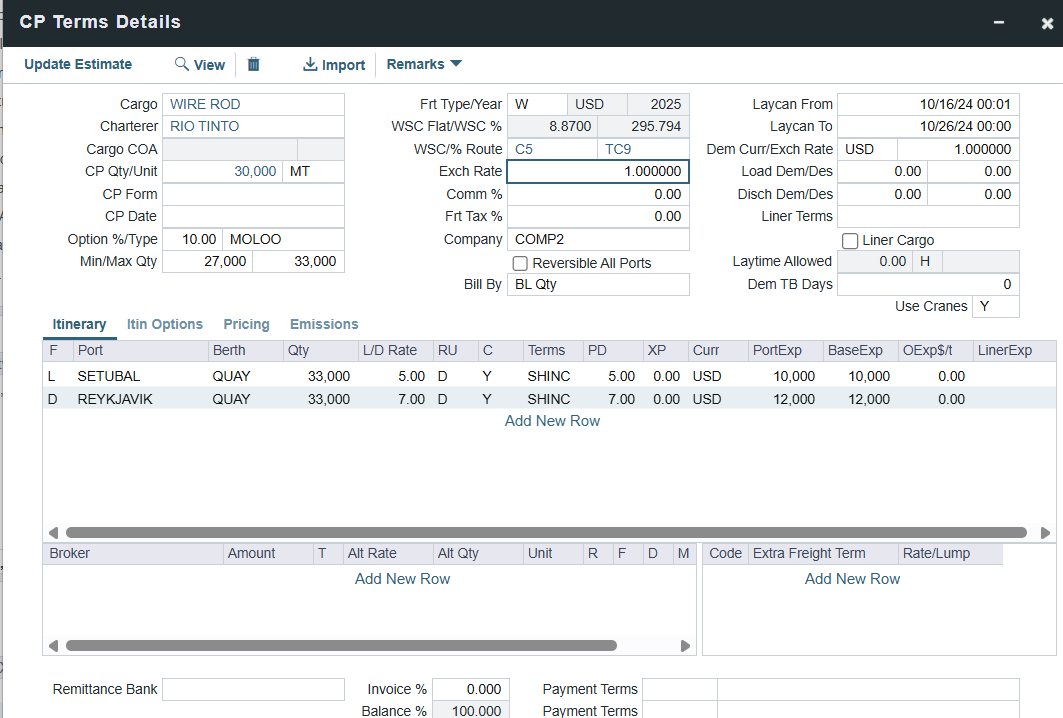

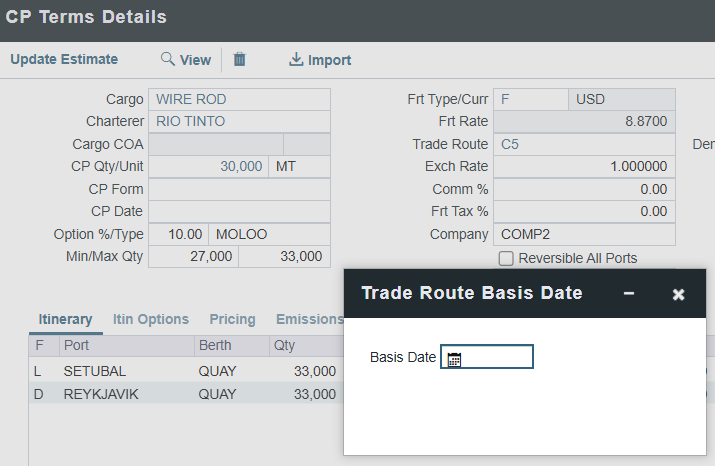

Within the CP Terms Details, you can now select a Trade Route rather than utilizing a static value and use the market data value for that trade route. When selecting F (Freight Rate) as the Freight Type, all $/ton trade routes will be available to be chosen. When selecting W (Worldscale), the combination of $/ton and Worldscale routes will be available for selection.

When using a Trade Route symbol, the rates are non-editable, and the value is the latest spot rate stored in IMOS.

Note: Clicking on the Trade Route will open a Basis Date dialog. Inputting a basis date will use the spot value of the route from that day for all future periods.

Note the change in Net Daily TCE value on the Estimate P&L. Save the Estimate as a Benchmark Estimate so that it can be used with a custom route as detailed in the next section.

Trade Routes

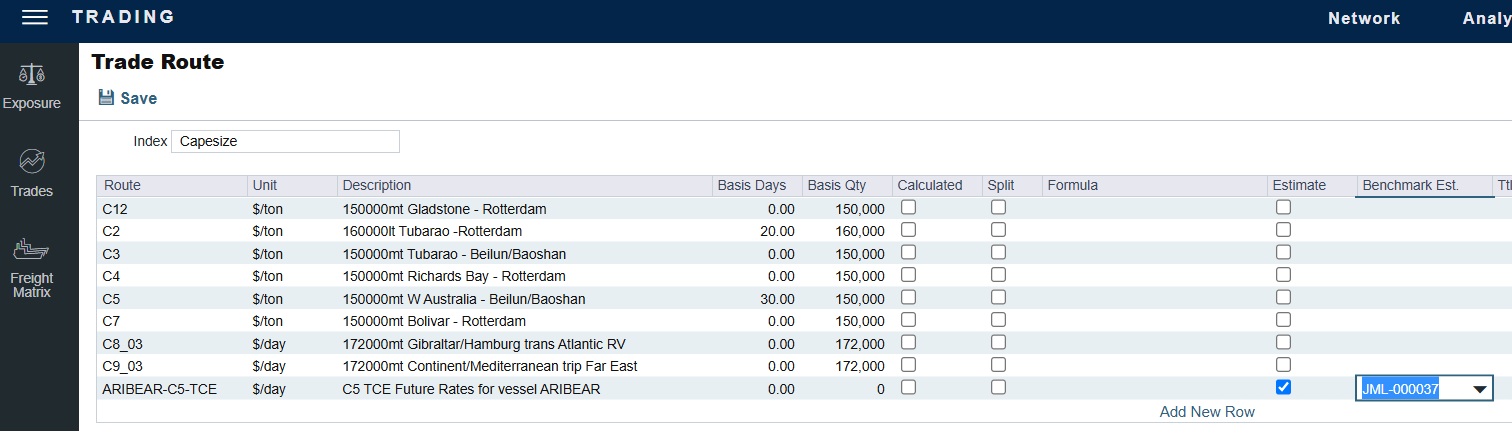

With the setting CFGEnableEstimateTradeRoutePricing turned on, a custom trade route can be linked to the Net Daily TCE calculation from a Benchmark Estimate.

Navigate to the Market Data Trade Routes section through either the Data Center or Trading workspace. Within your desired index grouping, click the Add New Row option at the bottom of the table to create a new trade route. You’ll now have the option to mark this route as tied to an Estimate by checking the Estimate dialog option and then selecting the appropriate Benchmark Estimate from the available list in the dropdown.

Time Charter Contracts

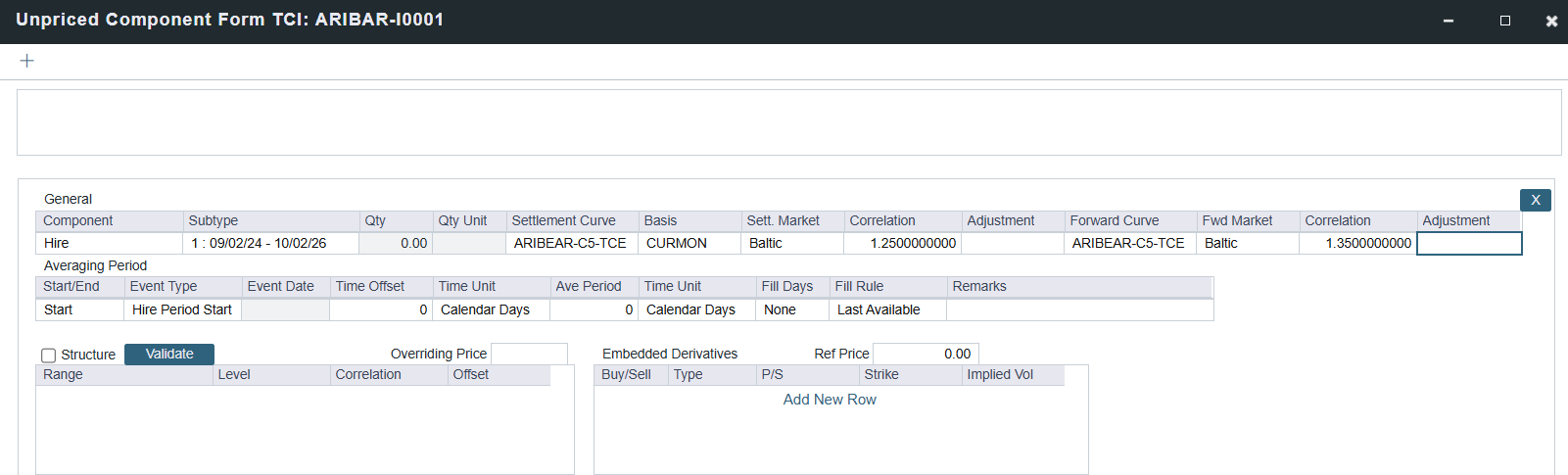

The custom trade route can now be leveraged as any other trade route in IMOS. Specifically for a Tanker TC Contract, it can be used to price the contract’s hire rate as an Unpriced Component:

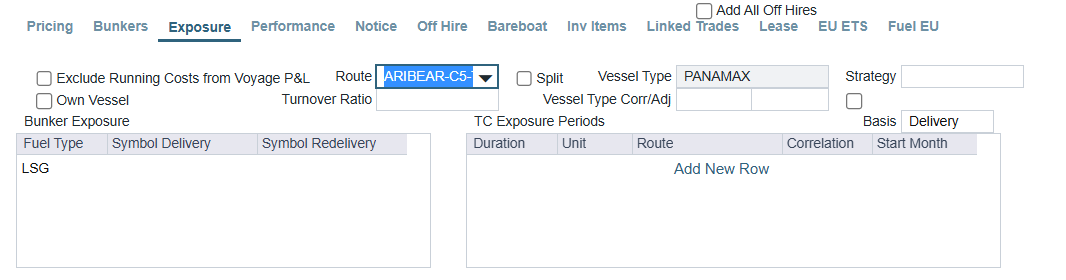

It can also be used as the mark-to-market route in the Exposure tab:

When viewing this contract within the Trading & Risk module, the contract rate and the market rate for future periods should now utilize the calculated future TCE rate from the Voyage Estimate, with the underlying cargo freight rate tied to the future rates published in the system for those symbols.