IMOS - Capturing and Tracking EUA Futures

You can use the Commodity Trade functionality to capture European Union Allowance (EUA) Futures trades and other Carbon Futures trades in the Veson IMOS Platform. Capturing these trades in the Veson IMOS Platform will allow you to offset your carbon exposure in preparation for EU ETS being implemented in 2023. It will also allow you to ensure that the costs incurred or revenue generated by these paper trades are properly reflected both in your Trading P&L as well as your Voyage P&L.

Setting up Carbon Future Symbol and Market

To set up a Carbon Future Symbol and Market, take the following steps:

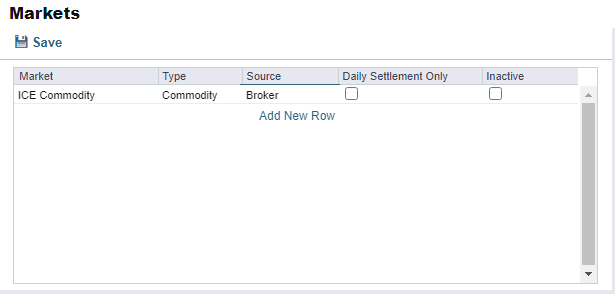

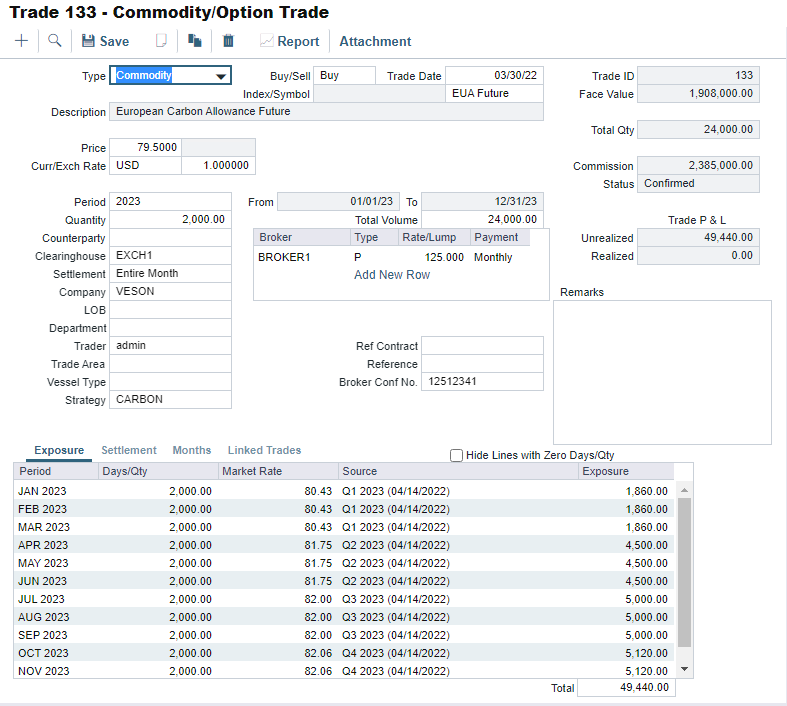

Add a new record in the Markets grid with the type Commodity. Be sure to utilize a market name that will reflect the pricing source, such as ICE or EEX.

Add a new Commodity Symbol in the Commodity Symbol grid called EUA Future and add the Market to CFGCommodityMarket.

The default unit used when left blank will be $/ton, and the currency can be set at the contract level to be EUR. If requiring a new unit of measure, the configuration flag CFGEnableCommodityUOM will need to be enabled, and it will need to be added to the Unit of Measure table with the type 'T'

For non-USD priced EUA Future symbols and contracts, the configuration flag CFGCommodityMarketCurr will need to be enabled. This adds the currency to the Commodity Symbol form and adjusts the exposure calculation on the contract for the exchange rate.

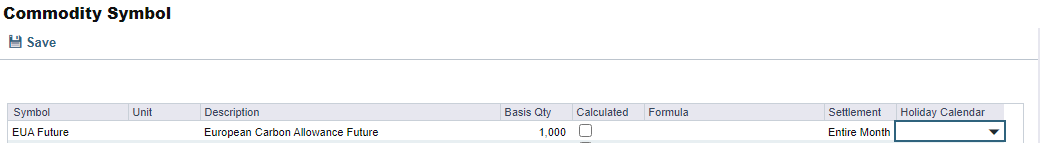

Enter SPOT and Forward market prices for the symbol manually using the Market Data form, selecting the market and symbol that has been created

If you have a market data feed for this, then that will need to be configured using the market data integration, and you will need to consult with our Account Manager on getting it configured

Creating a Carbon Future

To create a Carbon Future, take the following steps:

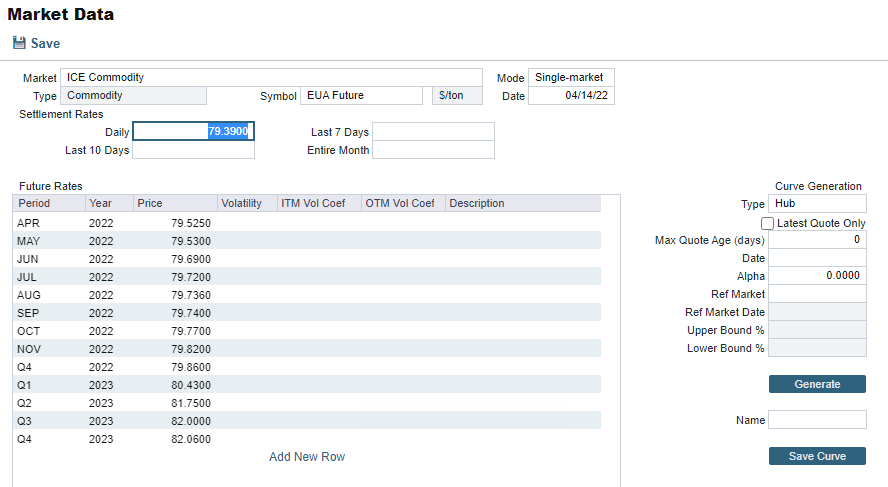

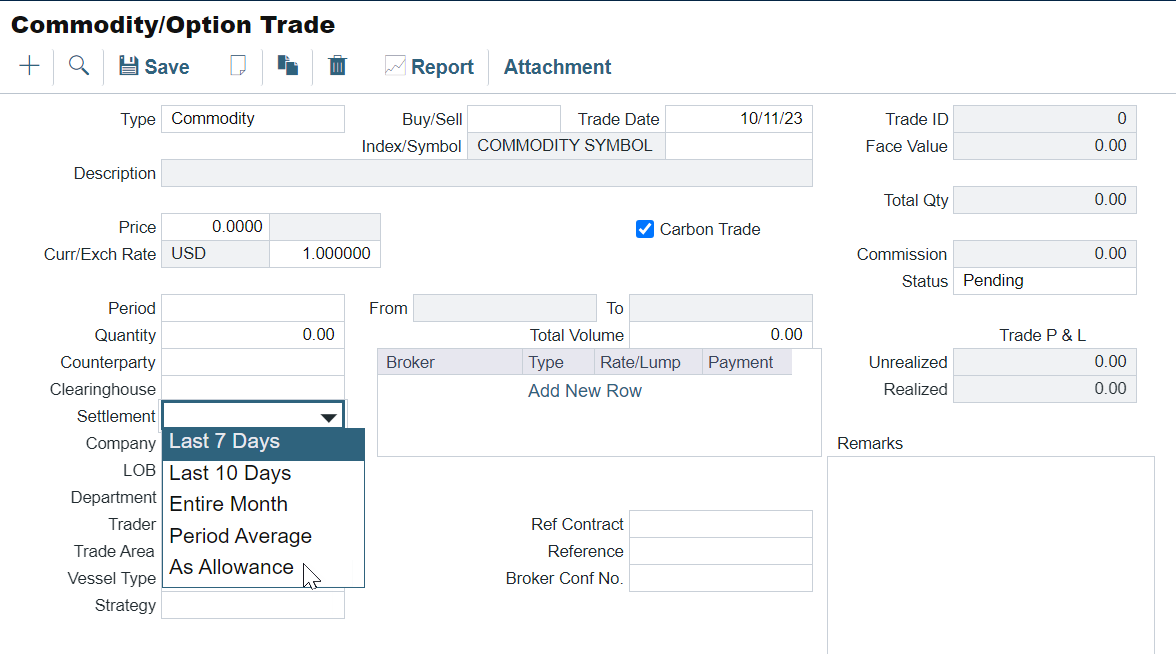

In the Trading Module, open a blank Commodity/Option Trade form

Select the type of Commodity, Buy or Sell, and the EUA Future symbol that was created

Enter in your EUA Future details

This trade can now be viewed in the Commodity / Option Trade - List.

If the contract is transacted to hedge against a specific Vessel Type, Strategy, or Trade Area, then add these details to make it easier to track in the Trading P&L Summary and Details List

If Market data does not populate in the Exposure tab, ensure the Commodity Market (‘ICE Commodity' in the example above) is set under CFGCommodityMarket.

Tracking Exposure and Linking

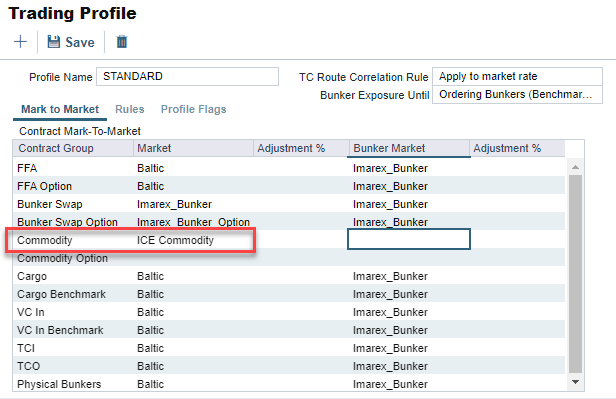

In your Trading Profile, select the market that you created as the Commodity market

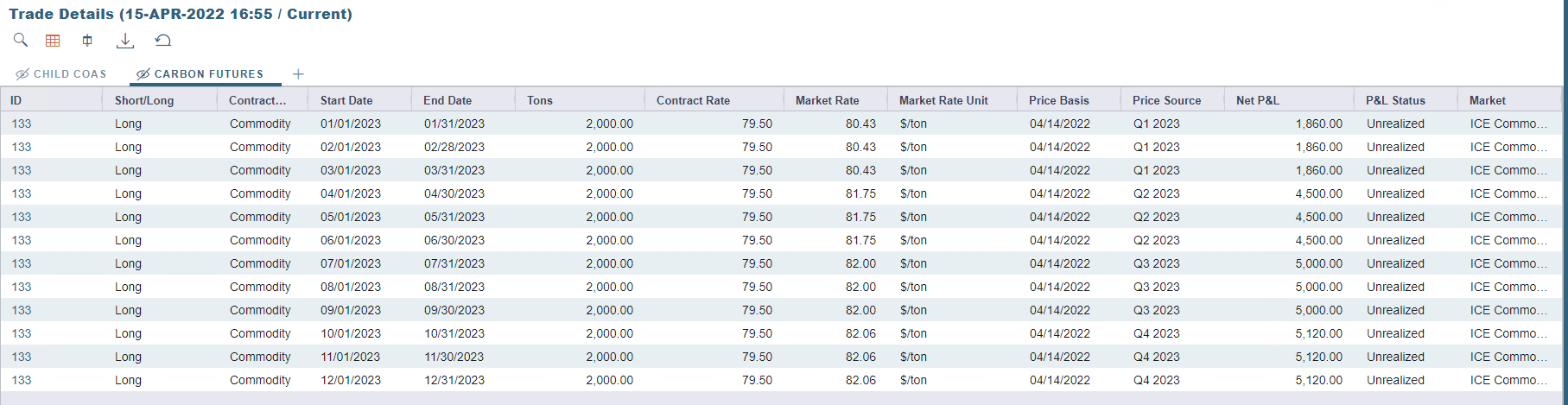

If you want to just see your EUA Futures, you can create a Trading Filter and filter on just the Commodity Trade contract type

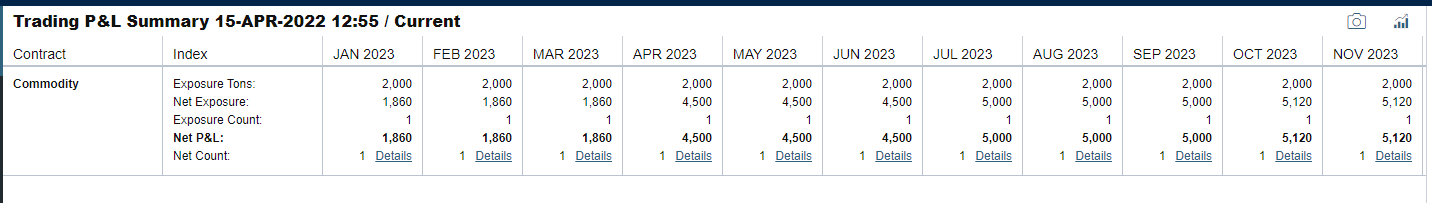

Be sure to include the Exposure Tons value in the fields to show, as this is where the contract tons will be displayed

You can see the EUA Future Exposure under the Commodity Contract Type

Linking EUA Future to a Cargo Contract

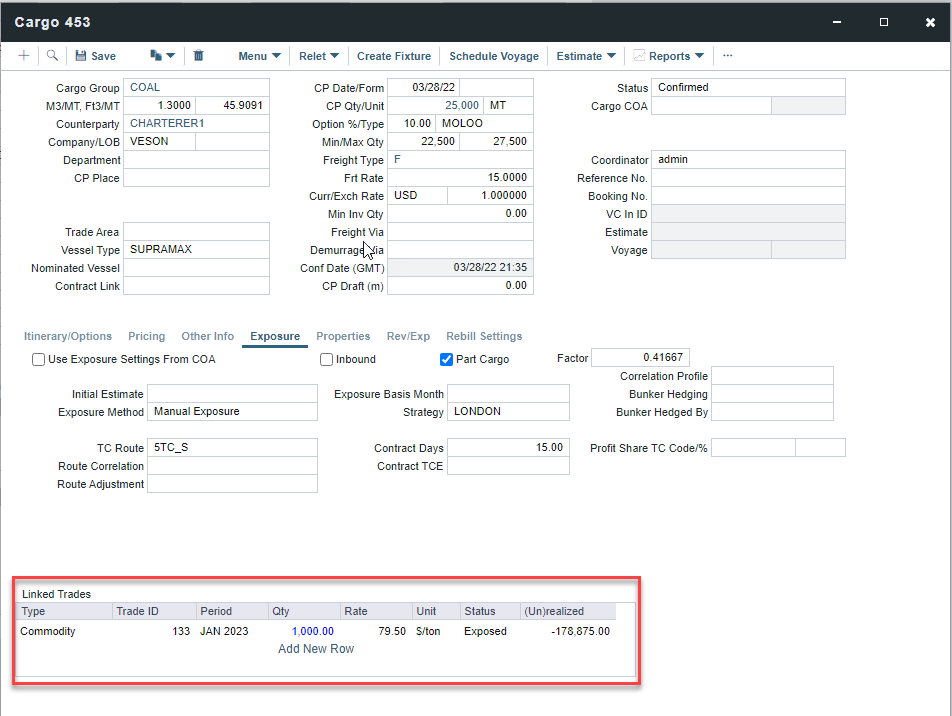

If the EUA Future was transacted to hedge a specific contract or multiple specific contracts, you can link it to those contracts using the Linked Trades workflow, similar to linking Bunker Swaps. To do so, take the following steps:

In the Cargo Contract, under the Linked Trades grid, select the EUA Future you want to link

Set the period and the quantity

Save the contract

When the contract is fixed, you will now see the unrealized and eventual settlement amount for the trade on the Voyage P&L. You will also be able to see this in the Linked Trades grid on the EUA Contract, as well as report on it in the Linked Trades table.

Settling As Allowance

Requires the CFGEnableCO2Exposure flag to be enabled.

A new settlement option, “As Allowance,” shows on the Commodity Trade form when the Carbon checkbox is selected. When you use this settlement type on the trade, the trade settles by converting into a Carbon Allowance trade on expiration. The trade can be settled with cash or as allowances.

Enable the configuration flag CFGEnableCO2Exposure and select the Carbon Trade checkbox on the Commodity / Option Trade form.

Select the As Allowance settlement option that appears in the dropdown list.

As Allowance Settlement option on Commodity/Option Trade form

When this option is selected, the contract at the end of the trade period will be converted into a Carbon Allowance contract in the system for the quantity laid out in the contract:

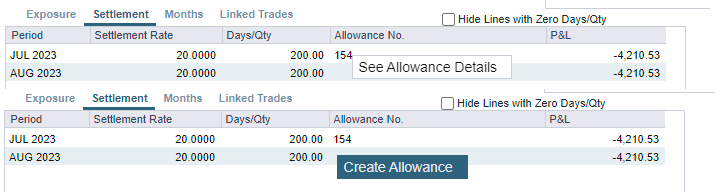

The Settlement Grid displays a row for the settlement period. If there are multiple months, then it will display multiple rows.

The Period column displays the period that can be settled

The Settlement Rate pulls from the Price

The Days/Qty column will pull from the Quantity

The Invoice No. column will be renamed to "Allowance ID. “

The P&L will display the difference between the contract rate and the market rate on the last pricing day of the period

Create Allowance/See Allowance Details

You can right-click on the row to "Create Allowance“ if no allowance has been created. When an allowance is already created, you can right-click "See Allowance Details.”

See Allowance Details / Create Allowance options in the Settlement tab

When the "Create Allowance“ option is selected from the row, a new Carbon Allowance form will be opened with all of the matching details from the underlying Commodity Option trade populated, such as:

The Allowance Price is the Trade Price

The Allowance Quantity is the Trade Quantity

If the Commodity / Option is a buy, then the Allowance will be a buy; if it is a sell, the Allowance will be a sell.

After the Carbon Allowance is created, the Allowance ID column in the Commodity / Option form will be updated to show the Trade ID for the allowance.