IMOS - Provisional Invoicing

Requires the configuration flag CFGEnableProvisionInvoice to be enabled.

Overview

The Provisional Invoicing enhancement allows you to record expected expenses earlier, track them in the P&L, and then draw down from those when the actual invoices come in. You can indicate a provisional invoice in three ways: from a Freight Invoice, an Equipment Hire Payment Invoice, or a Rebill invoice.

Setup

Enable the configuration flag CFGEnableProvisionInvoice.

Create a provisional invoice

To draw down from a provisional invoice, you must first create it.

Do one of the following:

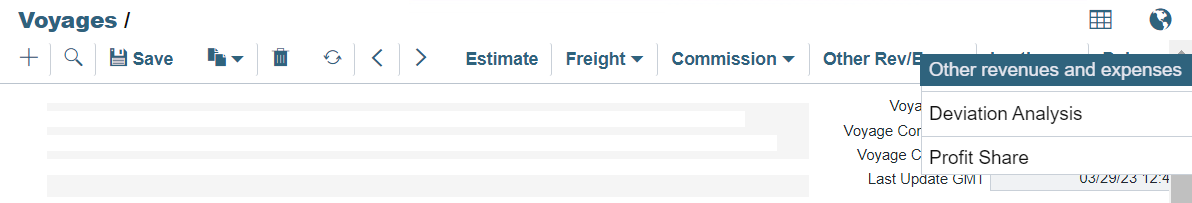

On the Operations menu, under Port/Other Costs, click Other Revenues/Expenses. Select the Vessel and Voyage Number.

On the Voyage Manager, click Other Rev/Exp and then click Other Revenues and Expenses.

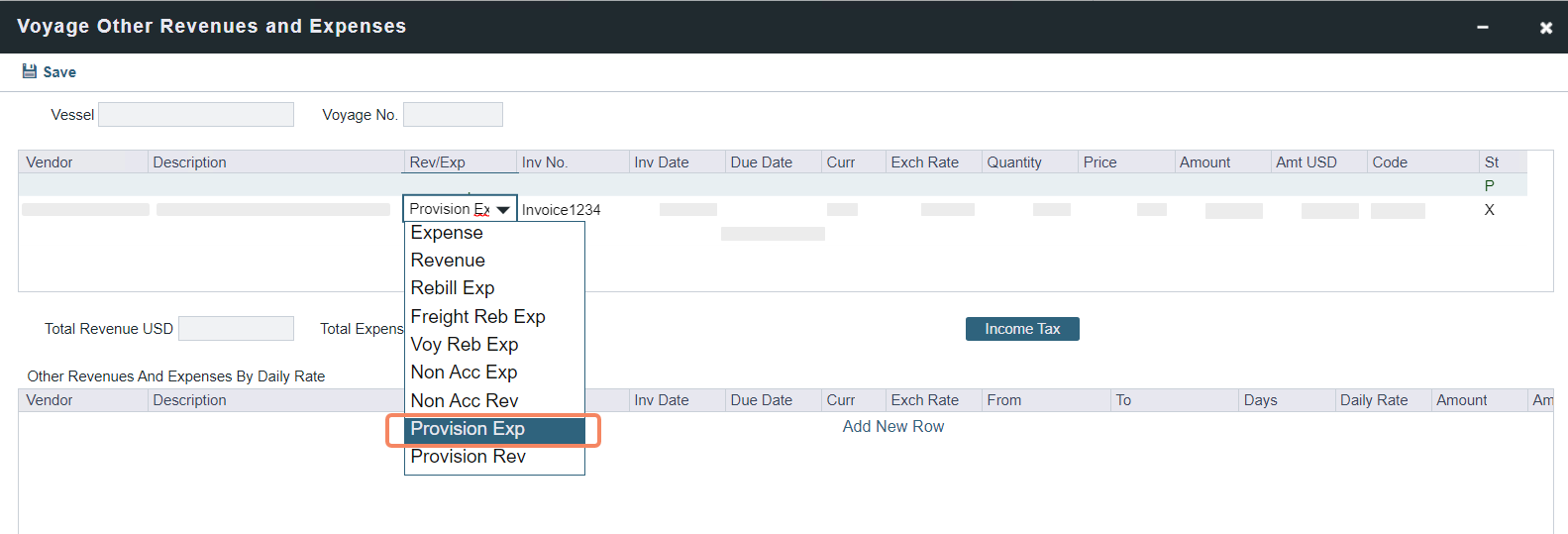

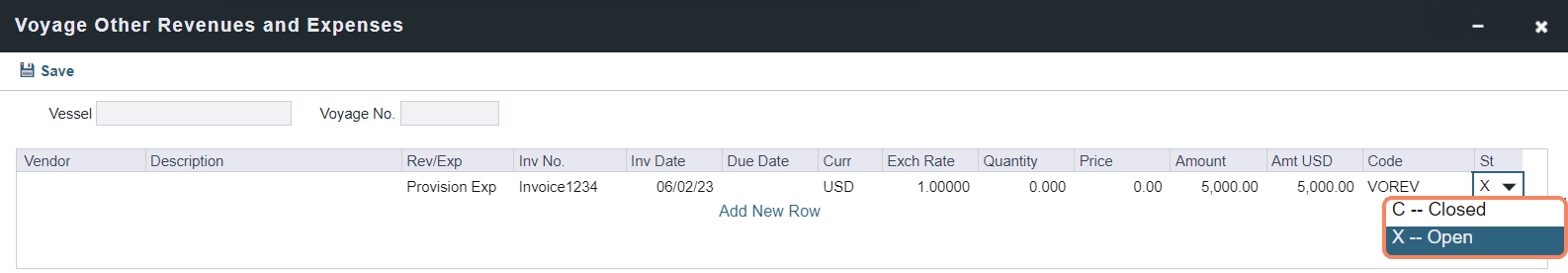

As you create the invoice, select the Provision Exp invoice type. The provisional invoice will appear in the P&L. This option is only available in the dropdown list when the configuration flag CFGEnableProvisionInvoice is enabled.

Provision Exp option in Voyage Other Revenues and Expenses

Select one of the following invoice types.

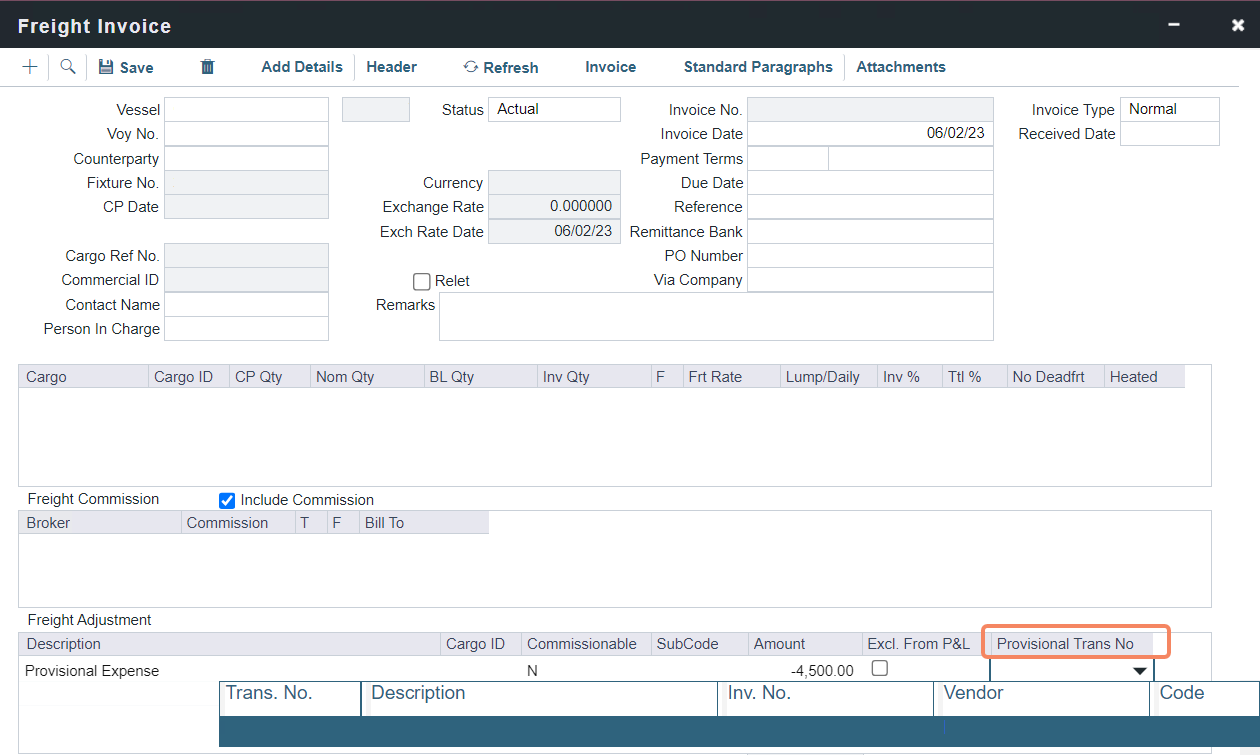

Freight Invoice

Select the provisional invoice in the Freight Adjustment grid to draw from a Freight Invoice at the line-item level. In the Provisional Trans No dropdown list, choose the invoice you created in the previous step as your provisional invoice to draw down from.

Freight Invoice

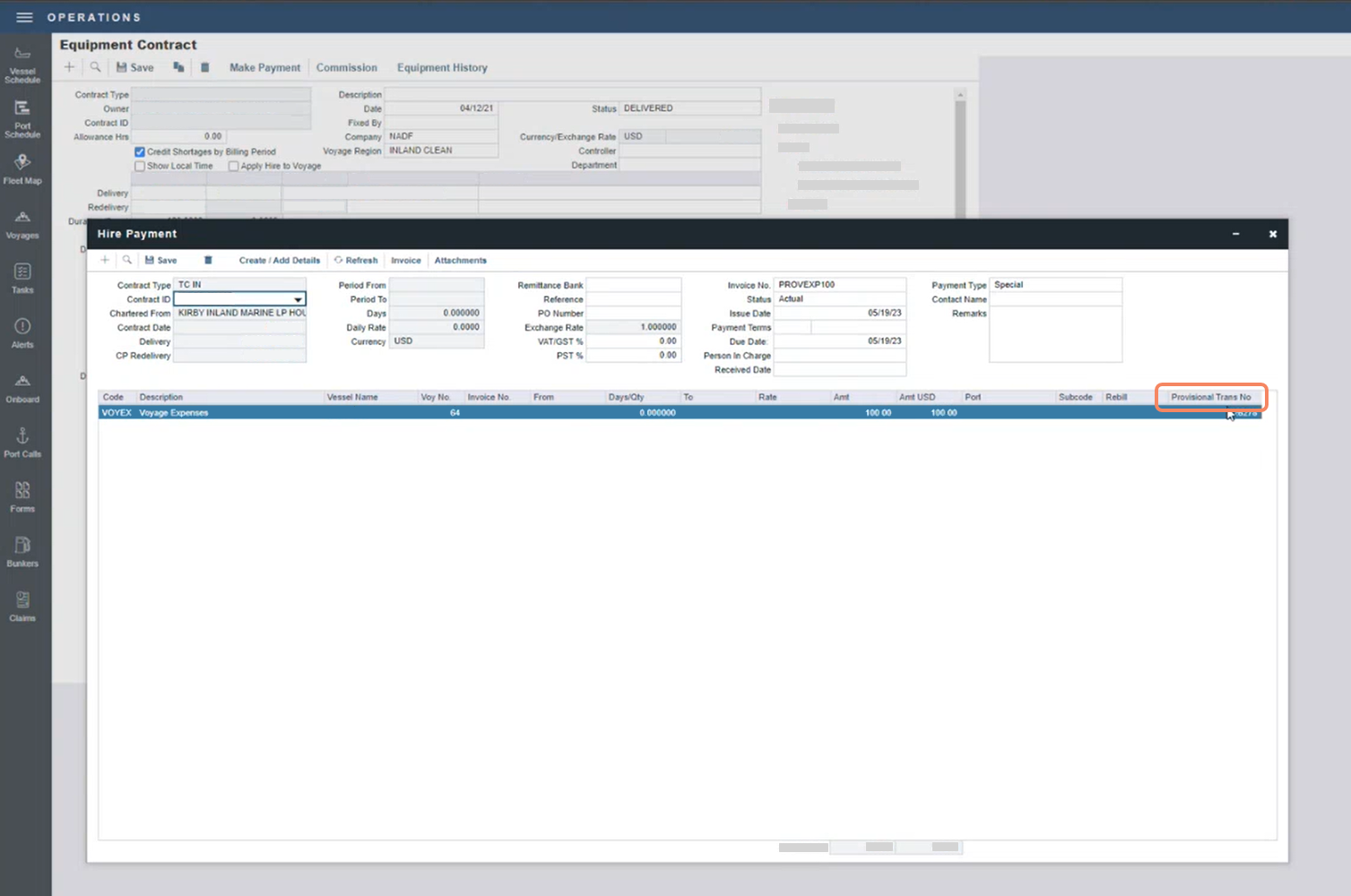

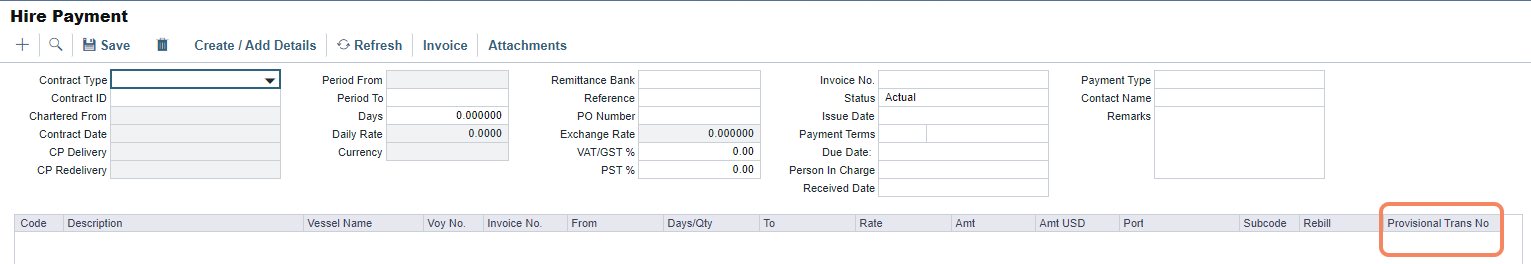

Equipment Hire

Select the provisional invoice in the Hire Payment Details grid to draw down the amount in an Equipment Hire Payment invoice at the line-item level. The option is only available for Voyage Expense items (Add details > Voyage Expense). In the Provisional Trans No dropdown list, choose the invoice you created in the previous step as your provisional invoice to draw down from.

Equipment Contract

Hire Payment Details grid

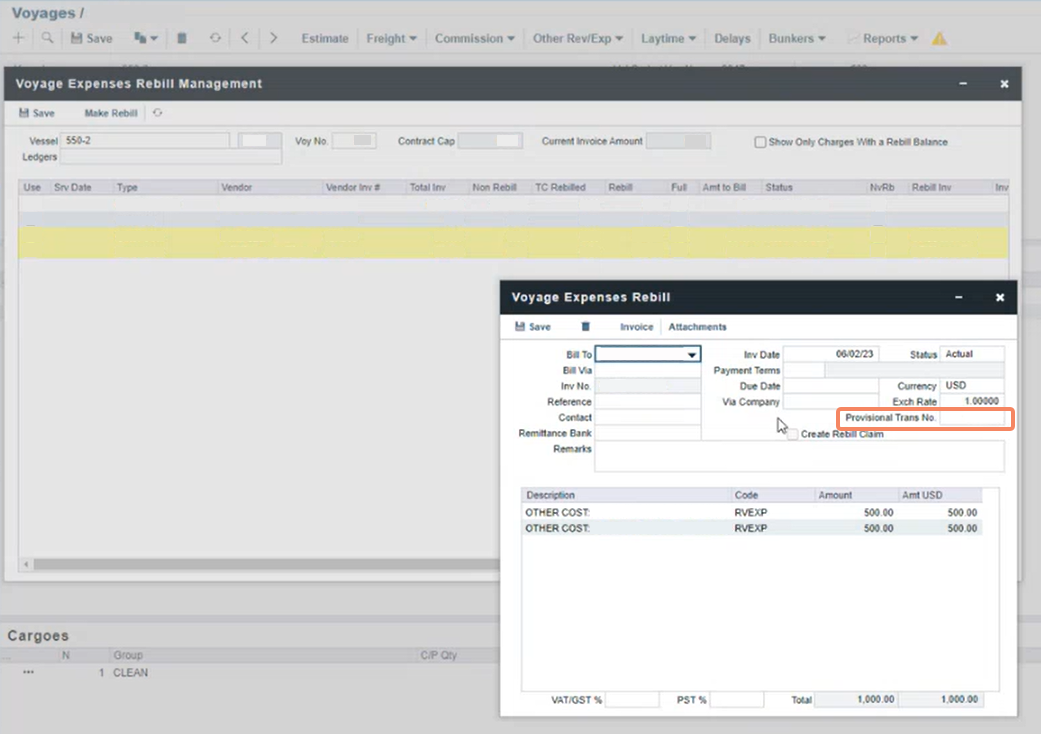

Rebill invoice

When creating a Rebill invoice using the Voyage Expenses Rebill form, use the Provisional Trans No. field to draw down the amount from a Provisional Revenue invoice created in the previous step.

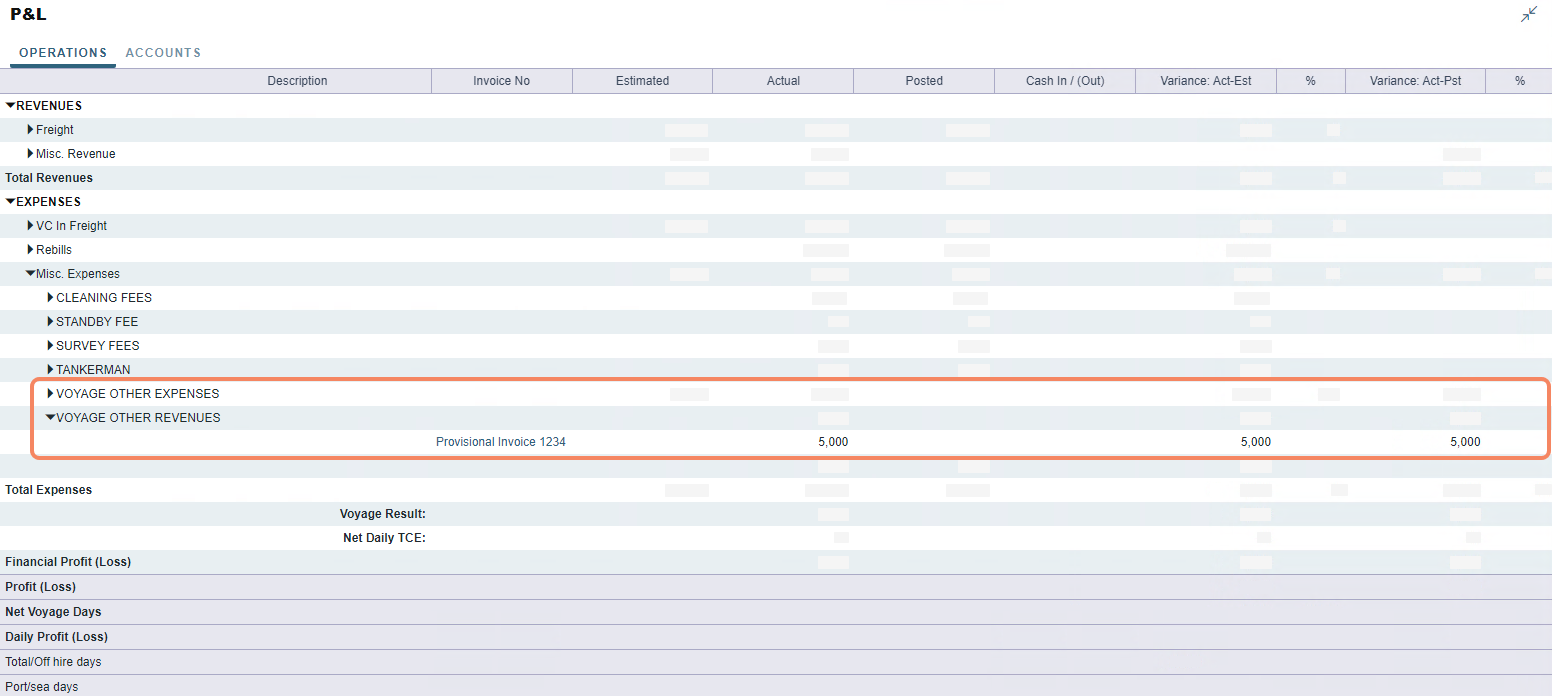

Use provisional invoices in the P&L

Once you use the provisional invoice as stated previously, its amount on the P&L will be reduced by the amount of the line item/invoice you indicated. The new invoice you created will also be on the P&L.

P&L

Change the status of a provisional invoice

Provisional invoices can have only 2 statuses: Open and Closed. Once you set a provisional invoice to Closed, it disappears from the P&L even if you didn’t use it. For example, you can set the provisional invoice to Closed to remove it in the following scenarios:

An invoice you were expecting did not arrive.

An invoice is less than expected, so you must eliminate the extra amount.

Provisional invoice status field

Other provisional invoice methods

Previously, Other Revenues and Expenses were the only invoice types that could draw down from a provisional invoice. You can draw down from an Other Revenues and Expenses invoice type in the Transaction Data Entry TDE or the top-level (above the details grid) on the Voyage Other Revenue Expenses > Details form.

FAQs

Can I use mirrored contracts for provisional invoicing?

Provisional transaction number information is not mirrored between the parent and mirror invoices. You can fill out a provisional transaction number in the parent invoice, and the system will draw down in the parent invoice’s voyage P&L, but this information will not carry over to the mirror invoice or its voyage.