Liftboat Valuation Variables

Introduction

The VesselsValue valuation methodology for the Offshore sector incorporates the 5-factor algorithm (Size, Age, Type, Features and Sentiment) described in our Mathematics of Market Valuation methodology and enables market valuations of vessels to be calculated in even the most illiquid markets. The following document outlines the specific features that are taken into consideration when valuing Liftboats, allowing for accurate and unbiased values to be calculated.

Ship Type

VesselsValue defines a Liftboat as an asset that is BOTH self-elevating AND self-propelled. Only assets that meet this criteria will be applicable to live valuations.

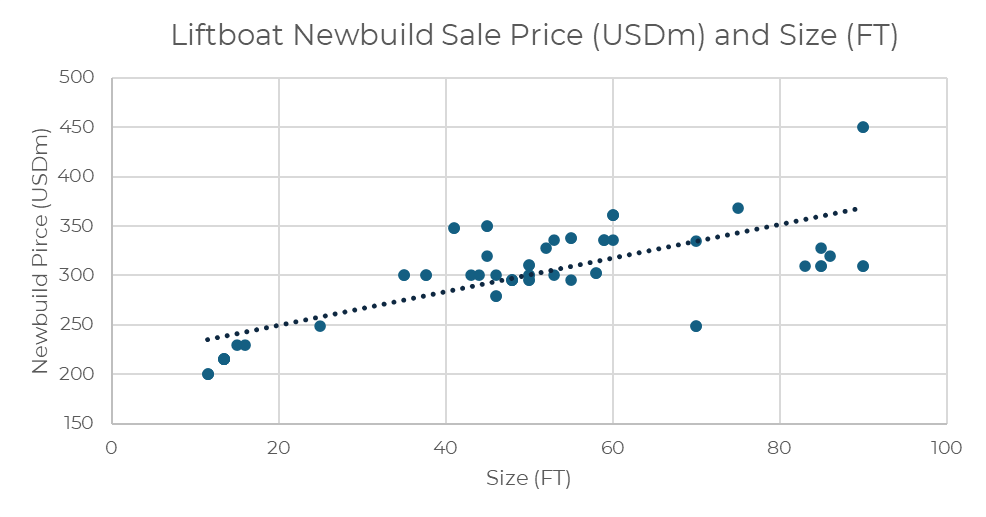

Size

All Liftboats use Leg Length, measured in feet (FT) as their valuation size. This was found to have the strongest correlation with value. Fig 1 shows the relationship between newbuild price (USD mil) and size (FT) for Liftboats. The size premiums and discounts are calculated daily by the VV algorithms.

Figure 1. Liftboat Newbuild Sale Price (USDm) and Size (FT)

Age

The vessels age depreciation profile is calculated daily by the VV algorithms and is not simply a matter of straight-line depreciation. The depreciation profile depends on market conditions

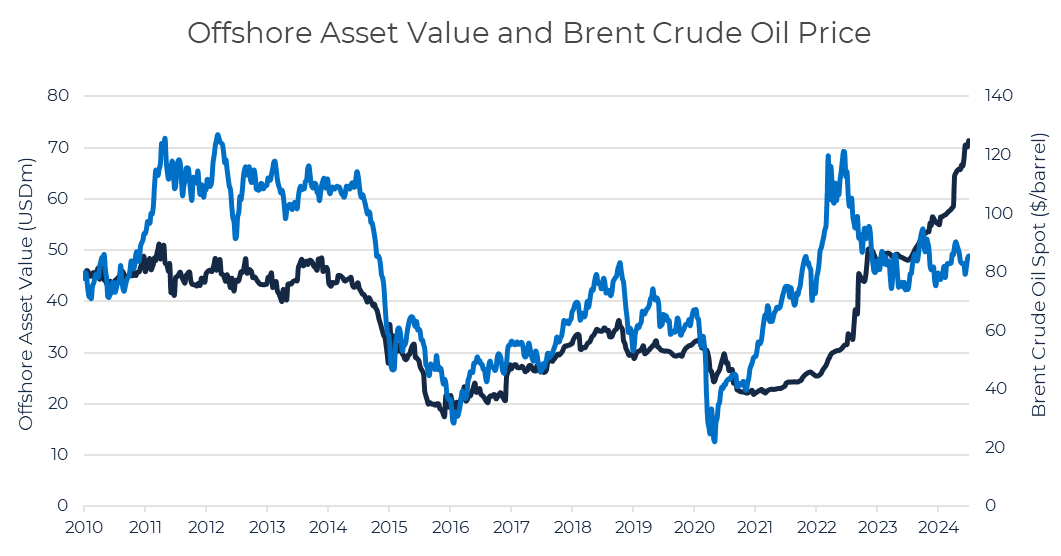

State of the Market (Earning Sentiment)

The best proxy for Offshore earnings sentiment is an index derived from a long and short term rolling average of the Brent Crude price. The oil price is the prime driver for the Offshore market, and effects vessel utilization, charter rates and market values. The correlation has been tested historically. Fig. 2 illustrates the relationship between the Brent Crude price and Offshore asset values.

Figure 2. Offshore Asset Value and Brent Crude Oil Price

Features

Liftboats are highly complex assets and the VV algorithm takes into consideration several other Liftboat specific features. These include but are not limited to:

Builder

As with cargo shipping, the builder is a very significant variable to value. Please note that the builder premiums and discounts for Offshore vessels can be different to those for cargo vessels. These premiums and discounts are derived from the newbuilding and secondhand markets.

Dynamic Positioning

Premium based on what DP class it is. No discount applied for DP incapable vessels. DP 0/1/2/3represents how many back up computer systems are on board should one fail.