Calculation Logic for Monthly CVE Rate Type for Leap vs Non-Leap Years

This article expands the FAQ - What is the calculation logic behind each CVE "Rate Type" for Monthly CVE Rate Type to account for calculation logic between leap years and non-leap years.

Why This Happens: Leap Year Effect

A leap year occurs every 4 years (e.g., 2020, 2024, 2028), except for years divisible by 100 but not by 400.

In a leap year, February has 29 days instead of 28.

This additional day can affect calculations when determining whether a given period is counted as a full month for CVE purposes.

Example Scenario

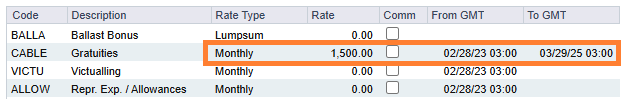

CVE Rate Type: Monthly

Rate: 1,500 USD per month

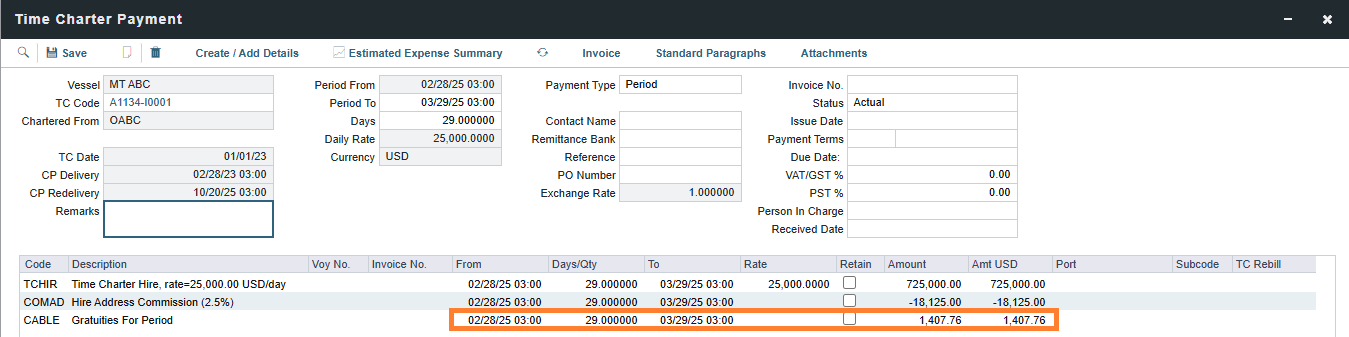

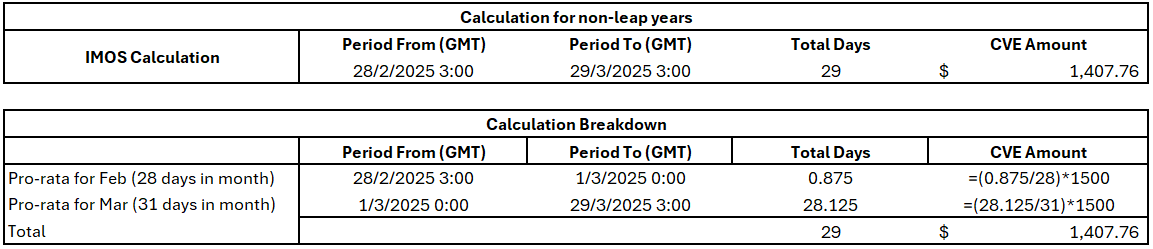

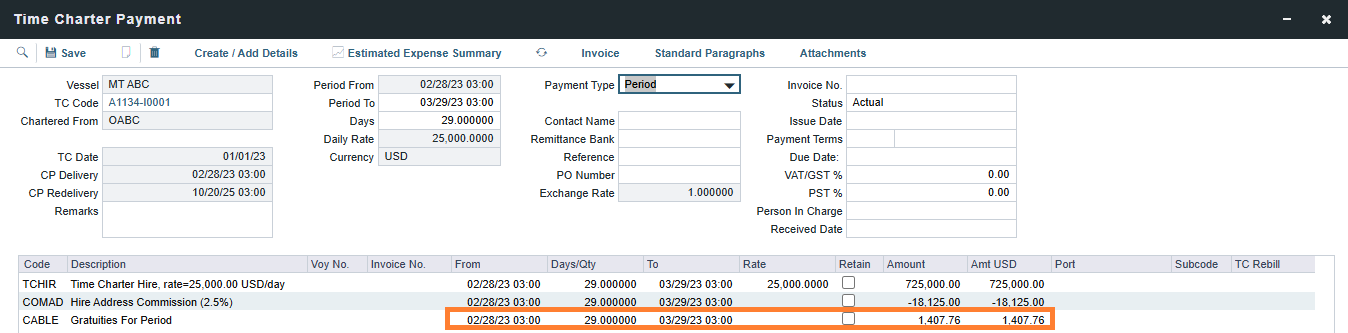

Case 1: Non-Leap Year (e.g., 2023)

Period:

28 Feb 2023, 03:00 GMT – 29 Mar 2023, 03:00 GMT(29 days)This duration is not treated as exactly one month, so the CVE amount will not be equals to 1,500 USD as per the monthly setting.

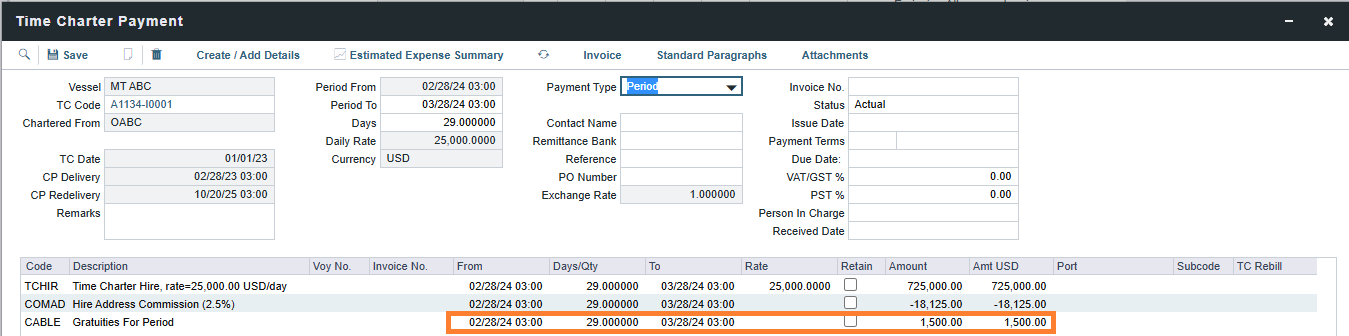

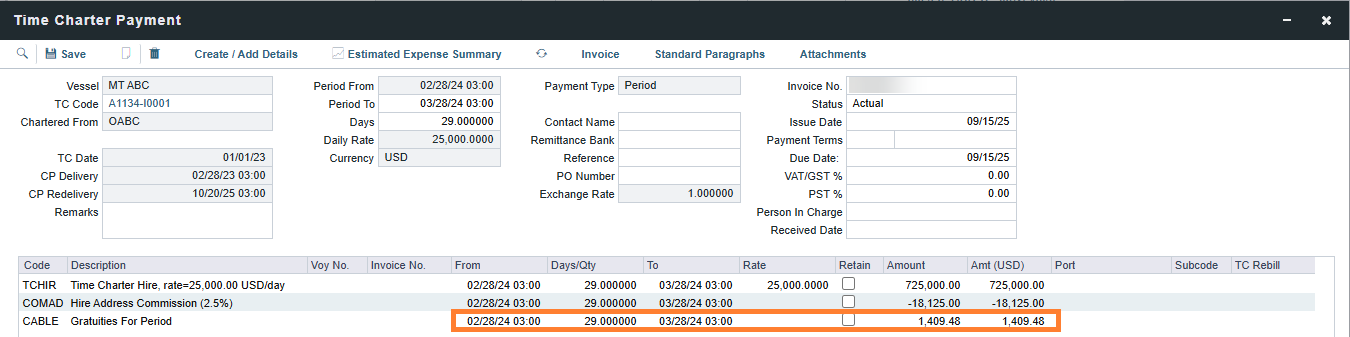

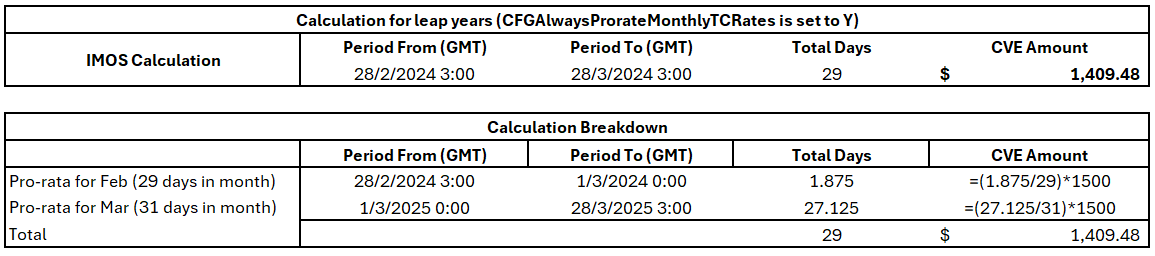

Case 2: Leap Year (e.g., 2024)

Period:

28 Feb 2024, 03:00 GMT – 28 Mar 2024, 03:00 GMT(29 days)This duration is treated as exactly one month if CFGAlwaysProrateMonthlyTCRates is set to N, so the CVE amount will be equals to 1,500 USD as per the monthly setting.

If CFGAlwaysProrateMonthlyTCRates is set to Y, the system will allocate the CVE amount according to the number of days from each month that fall within the invoice period.

Case 3: Non-Leap Year (e.g., 2025)

Period:

28 Feb 2025, 03:00 GMT – 29 Mar 2025, 03:00 GMT(29 days)Same as 2023, this duration is not treated as one month, and the CVE amount will not be equals to 1,500 USD.