How is the field Total Tax calculated in Port Advance/DA?

There are three fields in the Total Tax Row (from left to right):

Total of all tax estimates, in invoice currency.

Total of all actual taxes, in invoice currency.

Total of all differences between estimated and actual taxes,

Estimate

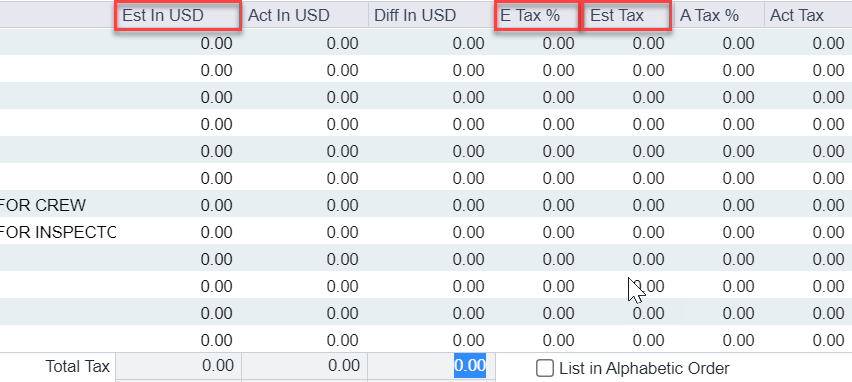

The Total of all tax estimates, in invoice currency field is calculated by using three columns Estimate of the Port Expense (in the Advance Currency), Estimated Tax Rate, and the Estimated Tax Amount. These have been highlighted in the picture below:

Therefore, the total is contingent on what the total of the estimated Tax amount is. The formula for this is:

Port Expense Estimate * Estimated Tax rate = Estimated Tax amount (column total)

Actual

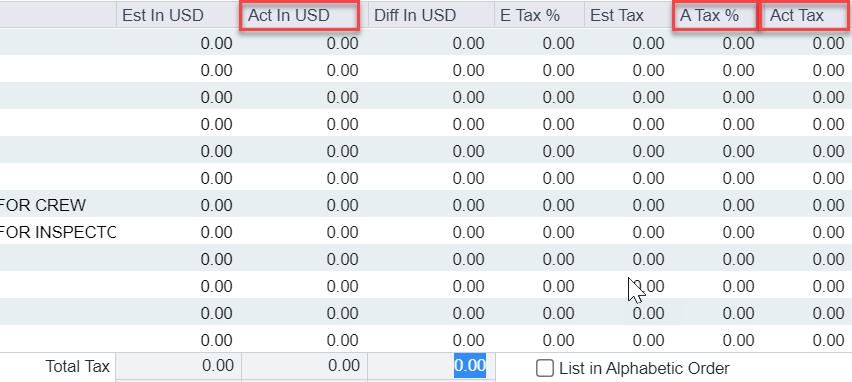

The Total of all actual taxes, in invoice currency field is calculated by using three columns, Actual amount disbursed (in the disbursement currency), Actual Tax Rate, Actual Tax Amount. These have been highlighted in the picture below:

Therefore, the total is contingent on what the total of the actual Tax amount is. The formula for this is:

Actual Amount Disbursed*Actual Tax Rate=Actual Tax Amount (column total)

Difference

This field is calculated by finding the difference between Estimated Tax Amount and Actual Tax Amount.