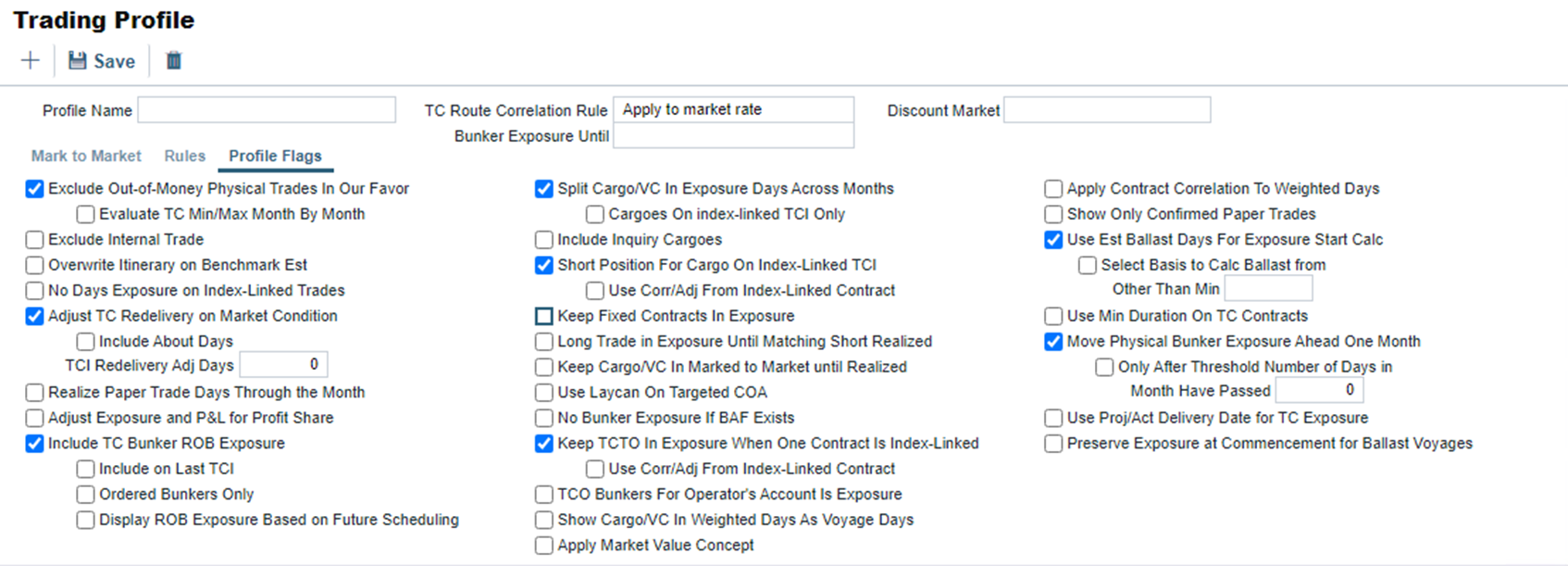

IMOS - Trading & Risk - Profile Flags

Navigate to Trading Profile

*Please note that some of these Profile Flags require a Configuration Flag setting(s) to be enabled by Veson and cross-checked for conflicting flag settings.

Profile Flags Tab

Exclude Out-of-Money Physical Trades In Our Favor

Prevents OTM Options from showing in the Trading P&L Summary

Evaluate TC Min/Max Month By Month

This will evaluate the TC Min/Max delivery option month by month instead of as a single option (entire period). Includes the exposure month for the redelivery bunkers on the TC contract.

This means if we have a trade that starts ITM then goes OTM, we will find the months that result in the largest ITM trade, and remove the rest from the Trading P&L Summary.

Exclude Internal Trade

Excludes trades/contracts marked as Internal from showing exposure.

This would exclude mirrored contracts from showing exposure.

Overwrite Itinerary on Benchmark Est

Using a benchmark estimate, will take the itinerary from the Cargo contract and overwrite the itinerary on the benchmark estimate to match the Cargo.

No Days Exposure of Index-Linked Trades

Checking this will show 0 Days exposure on Index-Linked Trades.

Adjust TC Redelivery on Market Condition

Similar to the “Exclude OTM physical trades in our favor”. This will adjust the TC Redelivery based on whether you are OTM or ITM.

Include About Days

Includes the period between the Min and Max period.

TCI Redelivery Adj Days

Number of days to be used in the following logic as X.

For TCI Contracts:

If the TCI Min/Max is OTM (Option Status is Out of The Money), exclude the TCI Min/Max and the Options. The total Exposure time is until the Min redelivery + X.

If the TCI Min/Max is ITM (Option Status is In The Money), but the Options are OTM, exclude the Options. The total Exposure time is until the Max redelivery + About Days - X.

If the TCI Min/Max and the Options are ITM, include both. The total Exposure time is until the last option's redelivery + About Days - X.

For TCO Contracts:

If the TCO Min/Max is ITM, exclude the TCO Min/Max and the Options. The total Exposure time is until the Min redelivery.

If the TCO Min/Max is OTM, but the Options are ITM, exclude the Options. The total Exposure time is until the Max redelivery + About Days.

If the TCO Min/Max and the Options are OTM, include both. The total Exposure time is until the last option's redelivery + About Days.

Realize Paper Trade Days Through the Month

This will Realize the P&L of your paper trades throughout the month (as each day passes).

Adjust Exposure and P&L for Profit Share

Takes Profit Share from the contract into account and applies it to Exposure and P&L

Include TC Bunker ROB Exposure

Select to have Exposure for bunkers that are planned to be remaining on board at the end of the current voyage for TCIs, or Redelivery Bunkers for TCOs

Include on Last TCI

Select to continue to calculate ROB exposure after the “Last TCI” is selected on the voyage.

“Last TCI” indicates the last voyage of the Time Charter contract.

Ordered Bunkers Only

This only include bunker inventory exposure when the bunkers have been ordered or lifted, and not when they are planned.

Display ROB Exposure Based on Future Scheduling

When a future voyage scheduled for a vessel is a TCTO:

The net of the preceding voyage’s ROBs and the delivery bunkers for the TC Out will be reflected in exposure.

Redelivery bunkers will be in exposure if the TCTO is the last scheduled voyage.

If there is a voyage scheduled after the TCTO voyage, then the redelivery bunkers will not be in exposure as they are considered covered by the next voyage.

Any voyages scheduled after the TCTO voyage will operate the same way, in that the bunker exposure will reflect the last ROBs from the final scheduled voyage and the redelivery bunkers for the TC In.

Split Cargo/VC In Exposure Days Across Months

This will split exposure days, tons, and P&L of a Cargo/VC In into months, starting from the Laycan From (or Exposure Basis Date if it is populated). P&L Calculations use forward rates of the first month and are allocated to months in proportion to the exposure days of each month. For a Cargo linked to a Benchmark estimate the voyage days = the exposure days.

If exposure days = 20 days and the voyage starts on June 15, you will show 15 days exposure for June and 5 days exposure for July.

Without this check-box checked, a cargo with 40 days exposure, scheduled for June 1, will show all 40 days of exposure in the month of June.

Include Inquiry Cargoes

Cargoes with a contract status of “Inquiry” will be included in the Trading P&L Summary

Short Position For Cargo On Index-Linked TCI

Scheduled cargoes on uncompleted TCOV voyages with an index-linked TCI will still show short days exposure equal to the minimum between the voyage days and the duration of today’s date to voyage completion date.

This flag enables the Cargo tied to the Index-linked TC In to remain in exposure, resulting in the Cargo exposure spread across more than 1 month. If the flag is unchecked, then the Cargo P&L sits in the first month.

The rationale for having this configuration option is that the Index-linked TC In is said to have “no Exposure to the market”, and therefore the Cargo’s position does not get flattened.

Keep Fixed Contracts In Exposure

Displays fixed physical conracts (Cargo, VC In, TC In, TC Out, and Head Fixtures) as if they are still in exposure. This is added to support some specific scenarios to use the Trading P&L in forecasting and budgeting.

Long Trade in Exposure Until Matching Short Realized

TCIs that are part of a TCTO voyage remain in exposure until the corresponding TCO is realized. TCIs that are part of a TCOV voyage remain in exposure until the cargo on the voyage has been realized, and VC Ins that are part of a RELT voyage remain in exposure until all cargoes have been realized.

Currently, when you schedule a cargo onto a vessel, the vessel will be removed from exposure and the cargo will remain in exposure until the voyage completes. This will allow you to keep the vessel in exposure until the cargo is realized.

Keep Cargo/VC In Marked to Market until Realized

Cargo/VC In stays M2M until fully realized (based on the Cargo P&L realization rule in the Profile Settings).

Use Laycan On Targeted COA

If you have a COA the liftings under that COA are always going to have exposure based on their specific laycan dates rather than prorated across the COA contract.

Exposes targeted COA liftings in the month of their Laycan From dates, instead of prorating the exposure of those liftings across the full timeline of the contract. If the Exposure Basis Month field is in use, that month will be used instead.

No Bunker Exposure If BAF Exists

Removes any trade with an Unpriced Component Bunker Adjustment Factor from bunker exposure.

The logic is that a BAF acts as an Owner’s hedge against market fluctuations.

As a Charterer, you may have bunker exposure against the BAF.

Keep TCTO In Exposure When One Contract Is Index-Linked

When selected, and there is a commenced TCTO voyage, then Exposure Days and Exposure Tons will reflect the remaining days in the voyage.

For a TCTO voyage with an index-linked TCI and a fixed-priced TCO, select to keep the TCO in exposure (or, with an index-linked TCO and a fixed price TCI, to keep the TCI in exposure).

TCO Bunkers For Operator’s Account Is Exposure

Bunkers that are in the "Paid by Operator" category on TCO contracts are added into the Bunker exposure for the TCO contract

Show Cargo/VC In Weighted Days As Voyage Days

For cargo contracts that utilize the Benchmark Estimate exposure method and are scheduled onto a voyage, the Weighted Days column will reflect the voyage days from the associated voyage instead of the Weighted Days.

When there are multiple contracts scheduled on one voyage, the Weighted Days column for each contract will display the Total Voyage Days / Number of Cargoes on the voyage.

For example, if there are 3 cargoes on a 21-day voyage each cargo will show 7 days in the Weighted Days field.

Start date reflects the Commencement Date of the voyage instead of the Cargo Laycan.

Apply Market Value Concept

Limited to the Trade Details List only: TCI becomes Short and TCO becomes long for the periods where Market Value Concept is applied

Changes the exposure associated with index-linked contracts so that the contract that is index-linked remains exposed against the Market Value rate captured at scheduling the voyage.

When an index-linked TC In contract shows as in exposure, when scheduled on a voyage, with the "Apply Market Value Concept" Trading Profile flag enabled, the TC In contract will have a Short/Long value of "Short" and will be included in the Short grouping when the "Short/Long" grouping is applied in the Trading P&L Summary.

Please note: this profile flag will not be visible unless the configuration flag CFGEnableVoyageMarketValue is set to "Y" in the Settings.

Apply Contract Correlation To Weighted Days

Applies weighted days, adjusted for the correlation value, to a P&L calculation.

Show Only Confirmed Paper Trades

Hides any paper trade with a “Pending” status from the Trade Details List and Trading P&L Summary.

Use Est Ballast Days For Exposure Start Calc

Adjusts the exposure of TC Out contracts to account for Ballast Days

When enabled, several new fields are added to the TC Out Contract's Exposure tab to capture the Net Daily TCE, Benchmark Estimate, Ballast Bunker Exposure and Ballast Days. When populated, these fields will update the exposure of the TC Out contract to account for the Ballast Days required to get to the delivery port. The new basis value becomes the Net Daily TCE and the Ballast Bunker Exposure is displayed either in addition to the delivery exposure or separately if the ballast period is different.

Use Min Duration On TC Contracts

When a TC Contract is in exposure and the duration basis is set to anything other than Min (Mid/Max/Custom/Etc) then enabling this flag will change the way that this contract is calculated. It will look at the contract as though the duration basis were still set to Min. This way the option will still be analyzed on the contracts.

The idea here is two ways to be able to view the contract, one in which you view the exposure up to the duration basis setting and then also be able to view what the contract exposure would be for the declared period (duration set to min) and the optional period (min to max).

Will treat the TC Contract as having a fixed window from delivery to the Min date, regardless the basis that is used on the TC contract. It means that the Min/Max period will always be treated as an optional period on the TC contract, so passing the Min period on the TC Contract would not remove the exposure completely with this set up, it would just move the exposure solely into the min/max window instead of having it as fixed TC Contract exposure.

We have a basis that can be used on the TC Contracts called "Min excl. Options" which would use a min duration basis for the contract in exposure and exclude any optional period for the contract. If you want to see exposure only showing up to the point of the Min duration and then have it fall off then we should leverage this duration basis on the contract instead of enabling the "Use Min Duration on TC Contracts“ flag, as this combination will still result in the min/max option shown.

Move Physical Exposure Ahead One Month

Physical bunkers that fall in exposure in the current month will be updated to be in exposure in the subsequent month.

Only After Threshold Number of Days in Month Have Passed

Specifies the number of days that have passed in the month before the bunker exposure moves to the next month. If the sub-flag is unchecked, all physical bunker exposure will move a month past the system exposure date. This profile flag does not impact Bunker Swap or Bunker Swap Options.

Use Proj/Act Delivery Date for TC Exposure

Uses the Projected/Actual Delivery date as the start of exposure for TC contracts by applying the "Use Proj/Act Delivery Date for TC Exposure“ profile flag. The Actual/Projected Delivery Date will populate on the contract instead of the Est. Delivery date.

Preserve Exposure at Commencement for Ballast Voyages

A vessel sailing on an **OV voyage without any cargoes assigned, will have a bunker exposure in the current period reflective of the initial bunkers at the start of the voyage plus any stemmed bunkers. The TC Exposure for the vessel will be based on an open date for the vessel equal to the commencement date of the voyage.

*Please note that some of these Profile Flags require a Configuration Flag setting(s) to be enabled by Veson and cross-checked for conflicting flag settings.