IMOS - Trading Profile

Home > Trading & Risk > Trading Profile

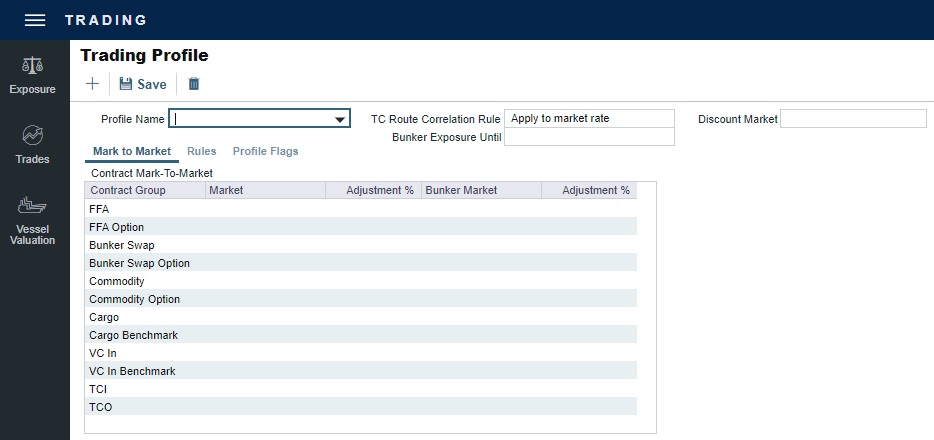

On the Trading Profile form, you can create different Trading Profiles, each with different adjustments of mark-to-market values, rules, and options.

To access it, on the Trading menu → click Trading Profile under Data.

To open an existing Trading Profile, you can select it from the Profile Name drop-down menu.

Creating a Trading Profile

To create a Trading Profile, do one of the following:

On the Trading menu → click the Trading Profile under Data → a blank Trading Profile appears.

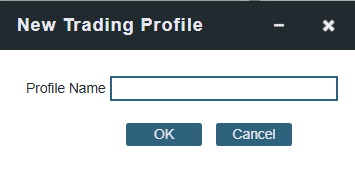

On the Trading Profile toolbar, click the + icon → the New Trading Profile window will appear → enter the new Profile Name → then click on the OK button.

New Trading Profile window

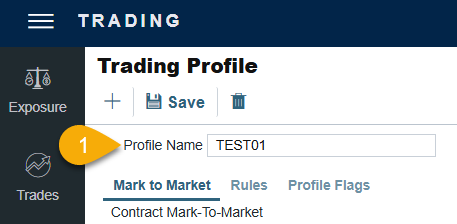

At the top of the Trading Profile form, you will need to select the specific Profile Name.

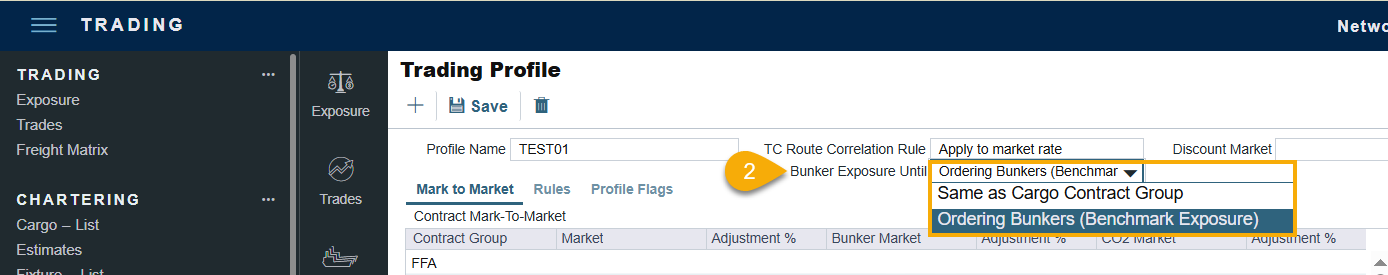

For the Bunker Exposure Until, select one of the following:

Same as Cargo Contract Group

Ordering Bunkers (Benchmark Exposure): Even if the Cargo is scheduled, Bunkers will remain in exposure based on the Bunker Exposure Breakdown grid on the Cargo Exposure tab until the order is placed. (Ordered Bunker Purchase or Invoiced) For those liftings, the lifting quantity is deducted from the remaining bunker exposure of that Fuel Type. When the total lifted quantity is higher than the total bunkers specified, or when the voyage is completed, those lots will go out of exposure.

Enter information on the Mark to Market, Rules, and Profile Flags tabs.

Save the form.

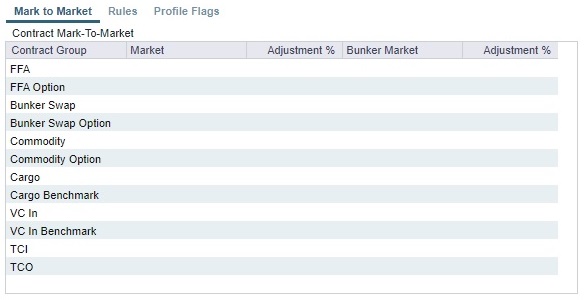

Mark to Market Tab

In the Contract Mark-To-Market grid, for each Contract Group, you can select a Market and a Bunker Market. You can also enter percentage values for adjustments. The Adjustment% is applied to the market rate, and the result is used in the exposure calculations.

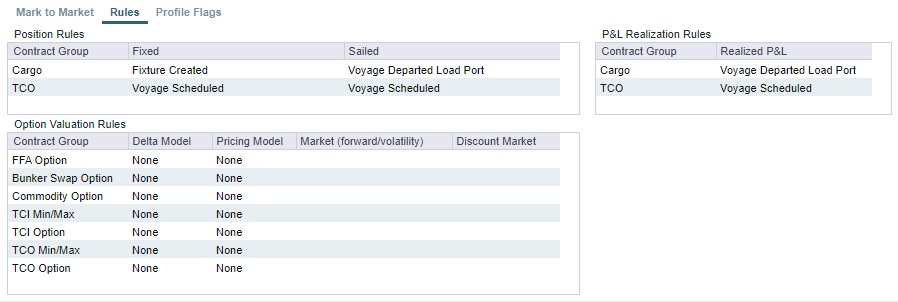

Rules Tab

The Rules tab enables you to set the following:

Option Valuation Rules: Specify what models should be applied for Delta and Pricing on the different option types. Available models are Black (1976) (not to be confused with the Black-Scholes model), Turnbull Wakeman (1991), or none. Should a custom model be used, the pricing can be imported into the system for trades to reference.

When None is selected for any of these models, the system keeps calculating the days/tons and net P&L values.

When Black (1976) or Turnbull Wakeman (1991) is selected for any of the Contract Groups for:

Delta Model: the Days/Tons value is adjusted based on the selected formula.

Pricing Model: the Net P&L value is adjusted based on the selected formula.

For more details about option formulas, visit the Option Valuation Formulas article.

Position Rules: Select when the trade status for Cargo and TC Out contracts changes from Confirmed to Fixed and from Fixed to Sailed.

P&L Realization Rules: Select when the P&L for Cargo and TC Out contracts changes from Unrealized to Realized.

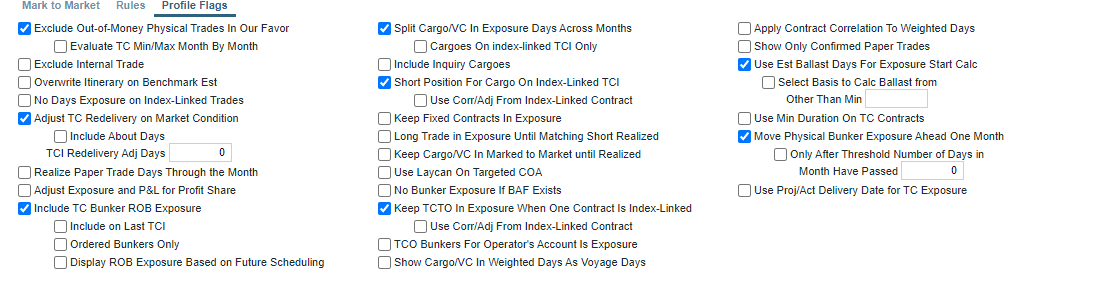

Profile Flags Tab

To see the definition of a profile flag option, hover over its label. Here are additional check box definitions:

Display ROB Exposure Based on Future Scheduling (when Include TC Bunker ROB Exposure is selected)

When a future voyage scheduled for a vessel is a TCTO:

The net of the preceding voyage’s ROBs and the delivery bunkers for the TC Out will be reflected in exposure.

Redelivery bunkers will be in exposure if the TCTO is the last scheduled voyage.

If there is a voyage scheduled after the TCTO voyage, then the redelivery bunkers will not be in exposure as they are considered covered by the next voyage.

Any voyages scheduled after the TCTO voyage will operate the same way, in that the bunker exposure will reflect the last ROBs from the final scheduled voyage and the redelivery bunkers for the TC In.

Short Position For Cargo On Index-Linked TCI

When selected, this flag enables the Cargo tied to the Index-linked TC In to remain in exposure, resulting in the Cargo exposure spread across more than 1 month. If the flag is unchecked, then the Cargo P&L sits in the first month.

The rationale for having this configuration option is that the Index-linked TC In is said to have no Exposure to the market, and therefore, the Cargo’s position does not get flattened.

Keep TCTO In Exposure When One Contract is Index-Linked

When selected and a TCTO voyage has commenced, Exposure Days and Exposure Tons will reflect the remaining days in the voyage.

Show Cargo/VC In Weighted Days as Voyage Days

When selected:

For cargo contracts that utilize the Benchmark Estimate exposure method and are scheduled onto a voyage, the Weighted Days column will reflect the voyage days from the associated voyage instead of the Weighted Days.

When there are multiple contracts scheduled on one voyage, the Weighted Days column for each contract will display the Total Voyage Days / Number of Cargoes on the voyage. For example, if there are 3 cargoes on a 21 day voyage each cargo will show 7 days in the Weighted Days field.

Start date reflects the Commencement Date of the voyage instead of the Cargo Laycan.

Apply Contract Correlation to Weighted Days: Select to apply weighted days, adjusted for the correlation value, to a P&L calculation.

Show Only Confirmed Paper Trades: Select to hide any paper trade with a Pending status from the Trade Details List and Trading P&L Summary.

TCI Redelivery Adj Days (appears when Adjust TC Redelivery On Market Condition is selected): Number of days to be used in the following logic as X.

For TCI Contracts:

If the TCI Min/Max is OTM (Option Status is Out of The Money), exclude the TCI Min/Max and the Options. The total Exposure time is until the Min redelivery + X.

If the TCI Min/Max is ITM (Option Status is In The Money), but the Options are OTM, exclude the Options. The total Exposure time is until the Max redelivery + About Days - X.

If the TCI Min/Max and the Options are ITM, include both. The total Exposure time is until the last option's redelivery + About Days - X.

For TCO Contracts:

If the TCO Min/Max is ITM, exclude the TCO Min/Max and the Options. The total Exposure time is until the Min redelivery.

If the TCO Min/Max is OTM, but the Options are ITM, exclude the Options. The total Exposure time is until the Max redelivery + About Days.

If the TCO Min/Max and the Options are OTM, include both. The total Exposure time is until the last option's redelivery + About Days.

Include TC Bunker ROB Exposure: Select to have the TC in ROB calculation account for TCTO voyage ballast legs until the TC out has been delivered.

When a TCTO voyage has a ballast leg before delivery to the TCO Charterer, the bunker tons in exposure will show the net amount calculated onboard the vessel at the time of delivery (ROB) and the delivery quantity from the TC Out Contract. When bunkers are pre-purchased for the Charterer prior to delivery of the vessel to them, the ROB calculation will account for this and include these bunkers as part of the delivery quantity.

The TC bunker exposure calculation can now handle TCTO voyages with reposition legs following redelivery. When the flag is enabled, bunkers ROB after the vessel has been redelivered and prior to voyage completion will now be included in the Trading P&L.

Move Physical Bunker Exposure Ahead One Month: Apply the “Move Physical Bunker Exposure Ahead One Month” profile flag in the Trading Profile to move bunker exposure forward into the following month. You can also apply a sub-flag to specify the number of days that have passed in the month before the bunker exposure moves to the next month. If the sub-flag is unchecked, all physical bunker exposure will move a month past the system exposure date. This profile flag does not impact Bunker Swap or Bunker Swap Options.

Use the Proj/Act Delivery Date for TC exposure: Use the Projected/Actual Delivery date as the start of exposure for TC contracts by applying the "Use Proj/Act Delivery Date for TC Exposure“ profile flag. The Actual/Projected Delivery Date will populate on the contract instead of the Est. Delivery date.

Deduct TC Unavailable Days from Exposure Days: Select to have the Trading P&L account for the available days on the Time Charter contract and deduct them from the Exposure Days in the period(s) they overlap.