IMOS - Emissions Expense Settlement Workflow

Introduction

With the addition of the Maritime industry into the European Union Emissions Trading Schema (EU ETS) starting the first of January 2024, any voyages that include cargo operations in an EU port will have an associated emissions expense. To best ensure that the industry follows the polluter-pays principle, where the party that is directing the vessel into the EU covers the cost of emissions, contracts are being amended to include clauses to recoup these costs.

These clauses are being added to the Time Charter In and Time Charter Out contracts as well as to the Cargo and VC In contracts. This page covers how IMOS has been updated to handle these contract changes, the workflow used to track these changes, and the impact they will have on the Voyage P&L.

Emissions Expense

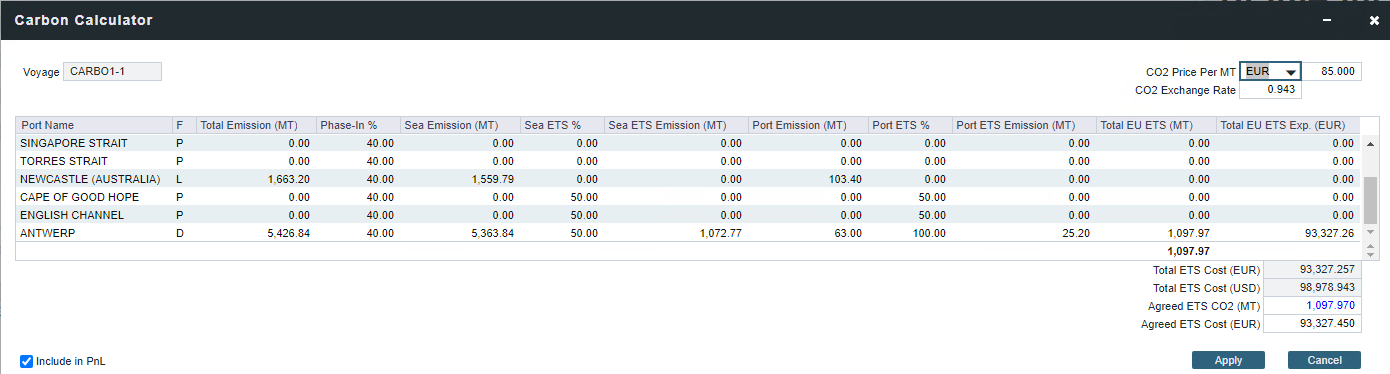

Whether it is running a Voyage Estimate calc or performing operations in the Voyage Manager, the Carbon Calculator can be utilized to determine the applicable emissions expense based on the routing and timeframe. The Carbon Calculator utilizes the logic from the regulation to determine what emissions from the vessel will be applicable. It looks at legs that go into and out of the EU and takes 50% of those emissions and then takes 100% of the emissions from the legs that are intra-EU. It also applies the phase-in logic for 2024 (40%), 2025 (70%), and 2026 onwards (100%) to determine the quantity of emissions for a given time period that should be included in the expense. Using a per-ton cost for CO2, it calculates the expense and applies it to the P&L.

When estimating, this gives a more accurate picture of the expected voyage result, and in the voyage itself, it determines the actual cost that is to be incurred for a given movement.

The emissions expense on the voyage will be included in the accounting process during monthly accruals and also in reporting on the Voyage P&L. How the expense will be realized on the voyage will depend on how the contract(s) are structured

Time Charter Contracts

When the Enable TC Emissions Allocation flag (CFGEnableTCEmissionsAllocation) is enabled in an IMOS environment, a new Emissions tab will become visible on the Time Charter In and Time Charter Out contracts. This tab is to be used to capture the contractual details that were agreed to with the counterparty on the contract for how emissions expenses will be settled over the life of the contract. Clicking on this Emissions tab on a Time Charter Contract will show the following three fields:

Settlement Type - Defines how the contract is structured to settle emissions expenses.

Options are N/A (default), CASH, ALLOWANCES and HYBRID

Billing Period - Defines the period frequency that the emissions expense will be invoiced, which can be different from the billing period for hire

Payment Terms - Defines the terms for how the invoices are to be paid/settled following receipt or delivery

Uses the Payment Terms as they are defined in the Data Center

Cash Settlement

The Settlement Type of CASH is to be used when the agreement with the counterparty is to invoice for the emissions expense that the vessel incurs and settle those invoices with cash. In the instance of a Time Charter In contract, this is an invoice that will be received from the TCI Owner and will be a payable item that will be settled in a cash payment. In the instance of a Time Charter Out contract, this is an invoice that will be sent to the TCO Charterer and will be a receivable item that will be settled in a cash receipt.

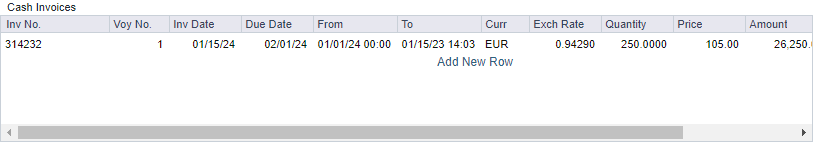

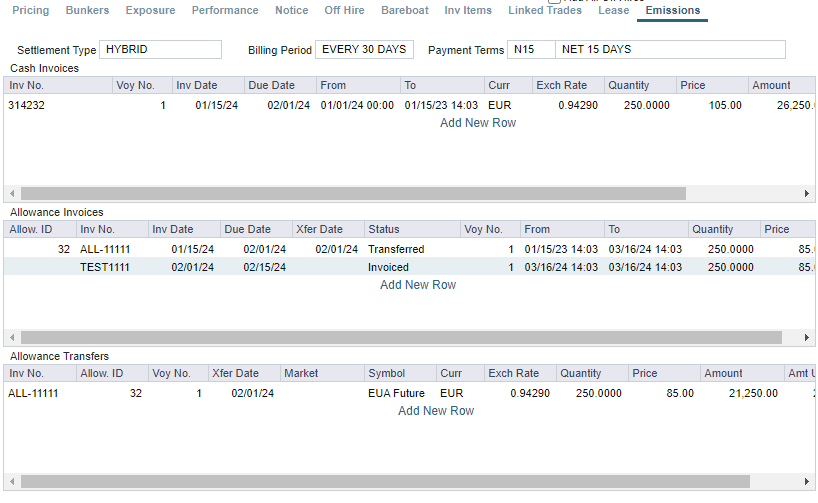

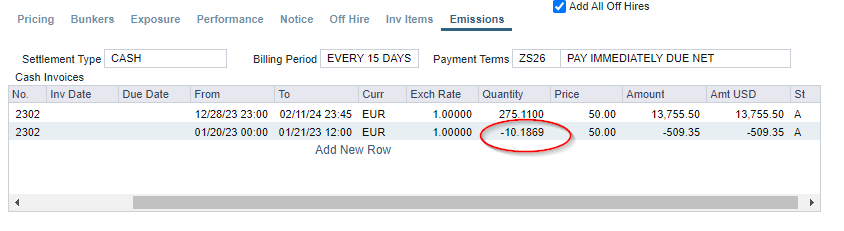

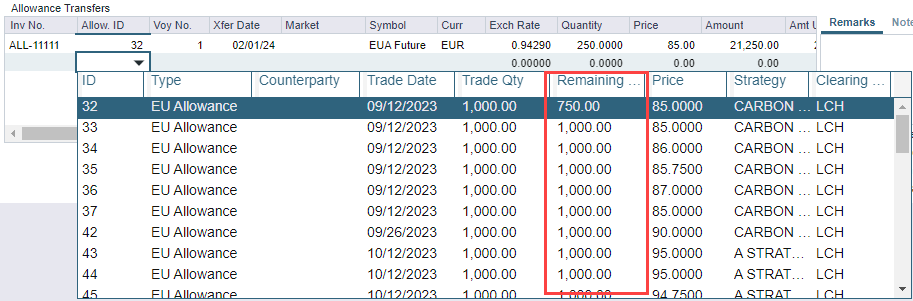

When CASH is selected, the Cash Invoices table becomes visible, where all of the Emissions Cash Invoices for the contract will be recorded and visible.

Recording a new Cash Invoice

Click Add New Row

Fill in the Invoice No (for a payable, or leave blank for a receivable as it will auto-generate)

Select the Voyage(s) that the invoice period covers

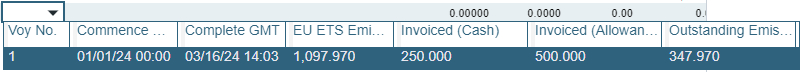

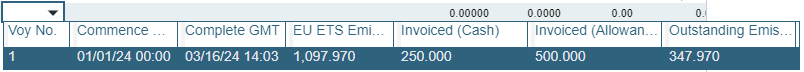

In the Voy No dropdown, you will see helpful information from the voyage, including the Commence/Complete dates and the Outstanding Emissions (ie, those calculated emissions that have not been invoiced for yet)

Record the Invoice Date, Due Date, From and To dates for the period covered, Curr, Quantity and Price

To be completed:

Defaulting the Due Date from the Inv Date and Payment Terms

Default the From and To dates using the Billing Period

Mark the Invoice as A - Actual

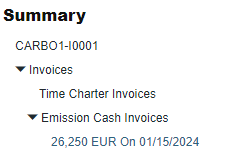

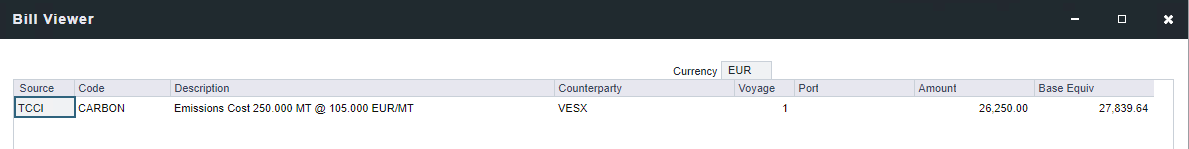

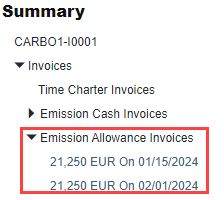

When the line item has been added and the contract saved, you will see a new record in the Summary tree on the contract under Invoices > Emission Cash Invoices. When clicked on, the Bill Viewer for the transaction will open:

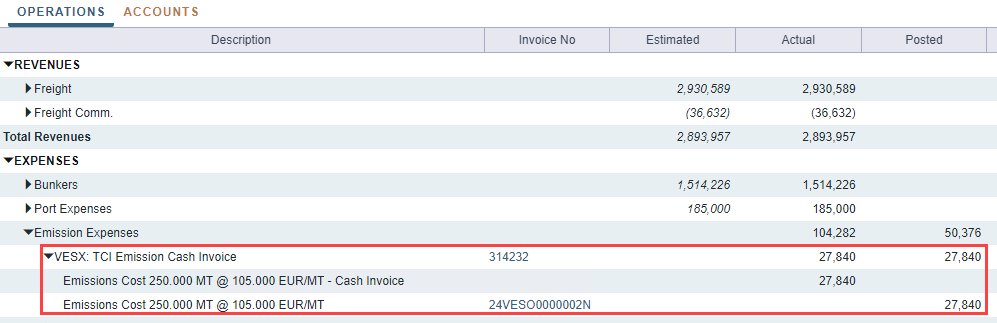

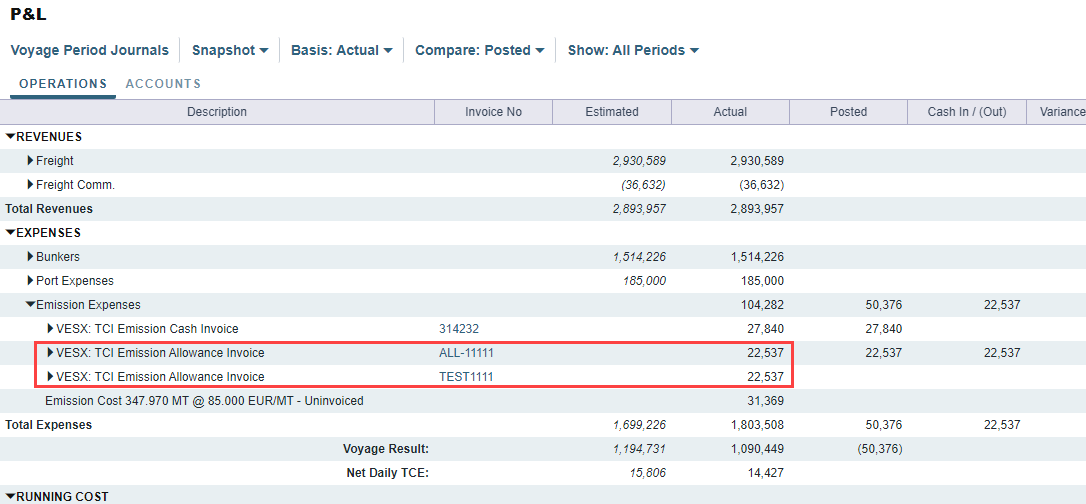

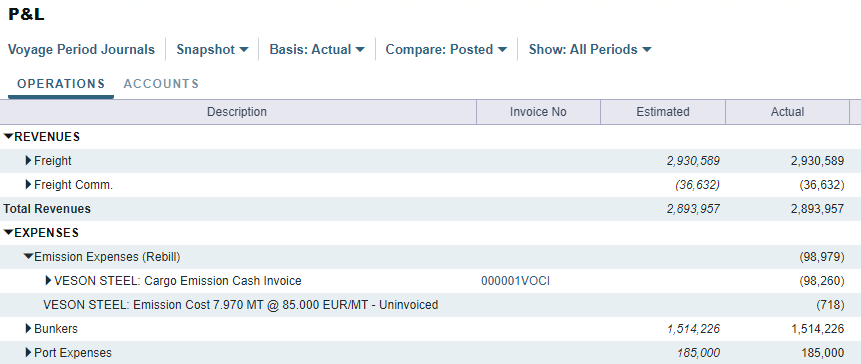

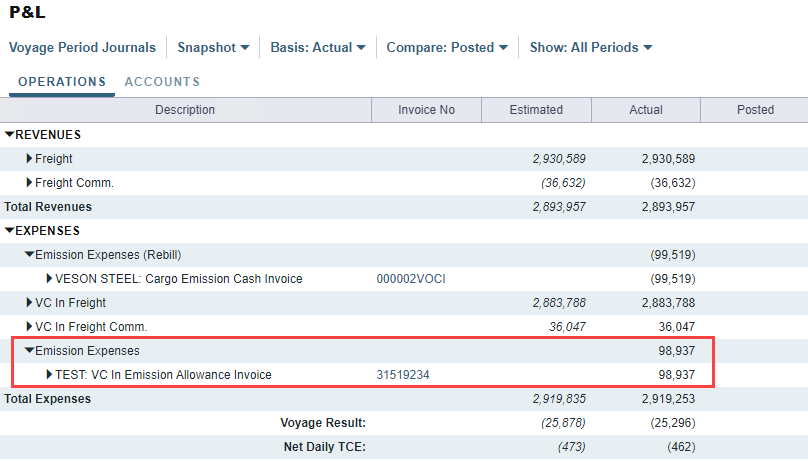

Opening the voyage for the Time Charter In contract will show a new line in the Emissions Expenses category. If the invoice period does not cover the whole voyage, then the system will calculate the remaining emissions quantity and expense so that the total Emissions Expense is correctly reflected on the voyage.

NOTE: It will do this through multiple different methods depending on the information captured on the voyage, such as noon reports, arrival/departure reports, or proration. It will also look at the Agreed Amount in the Carbon Calculator when used to override the calculated amount.

If the period does cover the end of the voyage, then the Emissions Expenses on the voyage will be fully realized and will stop accruing.

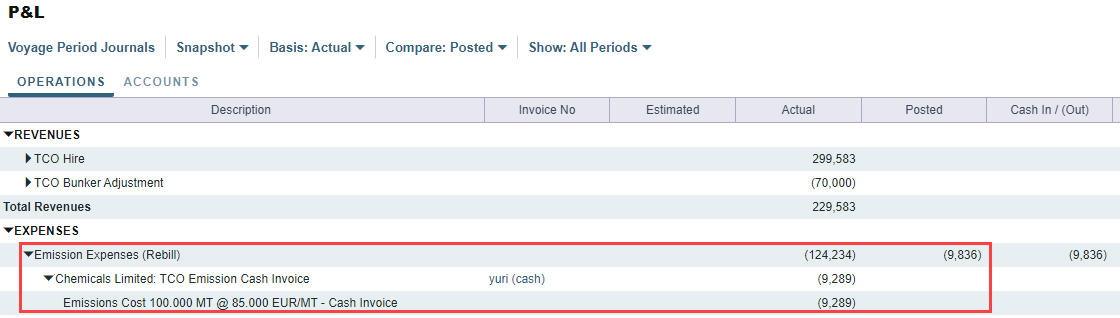

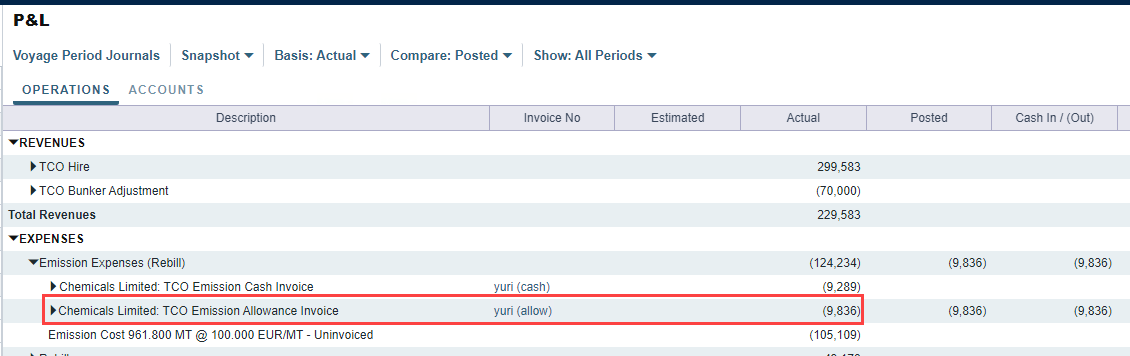

If the invoice was for a Time Charter Out contract, then it will show under the Emissions Expenses (Rebill) category under Expenses. This will net out on TCTO voyages when the contracts that have emissions expenses passed through but will have a delta if there are differences in the agreements between the TCI Owner and TCO Charterer.

Posting Emissions Cash Invoices

The new type, Emissions Cash Invoice, can be approved and posted through the Approve Invoices List or the Voyage Invoices List. They will follow the standard invoicing process and rules in the system around approvals. It will require proper business rules to be set up, which can be found below. Given that these are cash settlements, there will be an outstanding cash amount visible in the financial lists and reports until a payment or receipt is recorded.

Generate a Cash Invoice on the contract

Requires the configuration flags CFGEnableCargoEmissionsAllocation flag for Cargo and VC In Contracts and the CFGEnableTCEmissionsAllocation flag for Time Charter (In/Out) Contracts and Head Fixture Contracts. Requires a schema version of 44.5 and above.

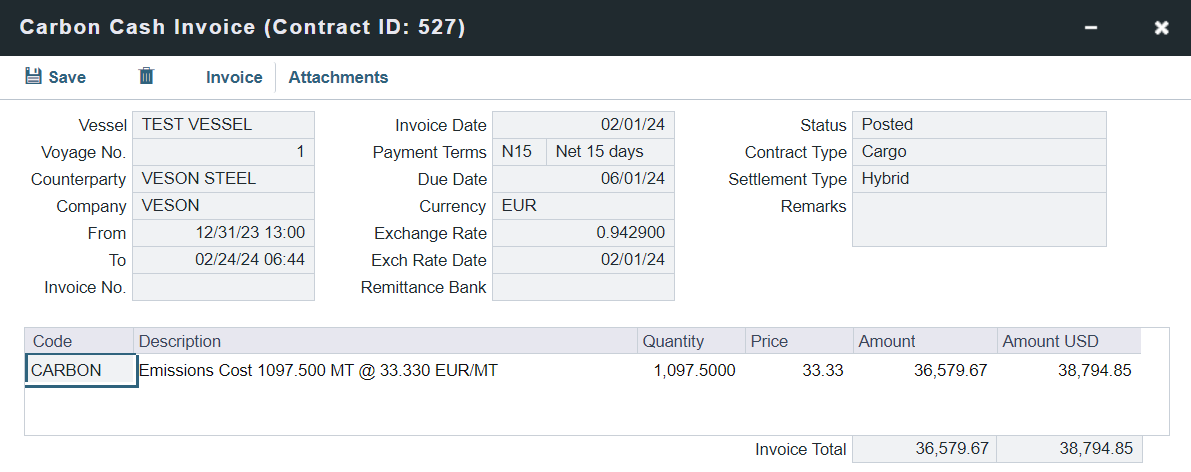

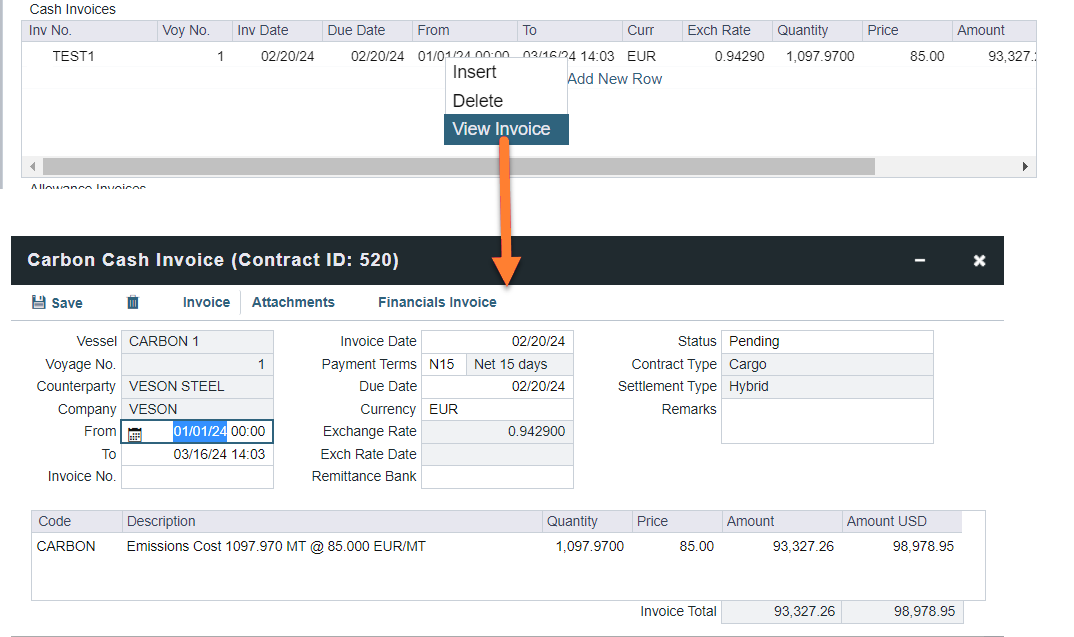

To create a Cash Invoice directly from the contract screen, right-click the desired line item in the Cash Invoices grid and select Invoice. The Carbon Cash Invoice form in the following image displays all the data in the invoice created in the Emissions tab.

Carbon Cash Invoice

Like other invoice forms in the IMOS Platform, you can access the invoice by selecting the link to the invoice on the Summary tree under Invoices or selecting the link in the Type column on the Voyage Invoice List. The form contains business logic that will update relevant fields as you change information in the form. For example, you can change the Payment Terms and the due date updates accordingly.

If another invoice exists for this line item, the existing invoice opens. To open or modify an existing invoice, right-click the line item in the Emissions tab rows.

Allowance Settlement

The Settlement Type of ALLOWANCE is to be used when the agreement with the counterparty is to invoice for the emissions expense the vessel incurs and settle those invoices with EU Allowances. In the instance of a Time Charter In contract, this invoice will be received from the TCI Owner and will be a payable item that will be settled with a transfer of allowances to them through the EU Registry. In the instance of a Time Charter Out contract, this invoice will be sent to the TCO Charterer and will be a receivable item that will be settled with a transfer of allowance from them to the company account in the EU Registry.

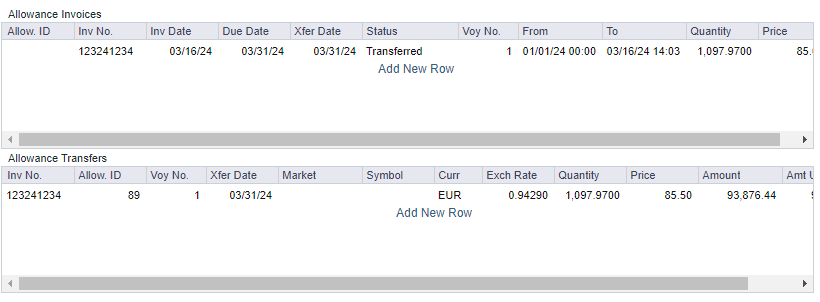

When ALLOWANCE is selected, the Allowance Invoices and Allowance Transfers tables become visible where all of the Emissions Allowance invoices for the contract will be recorded and visible, as well as the corresponding allowances that have been transferred to settle those invoices.

Recording a new Allowance Invoice

Click Add New Row

Fill in the Invoice No (for a payable, or leave blank for a receivable as it will auto-generate)

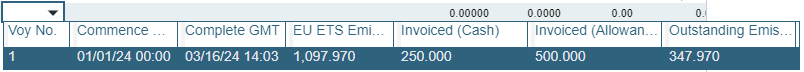

Select the Voyage(s) that the invoice period covers

In the Voy No dropdown, you will see helpful information from the voyage, including the Commence/Complete dates and the Outstanding Emissions (ie, those calculated emissions that have not been invoiced for yet)

Record the Invoice Date, Due Date, From and To dates for the period covered, Curr, Quantity and Price

To be completed:

Defaulting the Due Date from the Inv Date and Payment Terms

Default the From and To dates using the Billing Period

Set the Status value to ‘Invoiced’

The default Status value of ‘Pending’ will not show up on the Voyage P&L, but ‘Invoiced’ and all others following that will

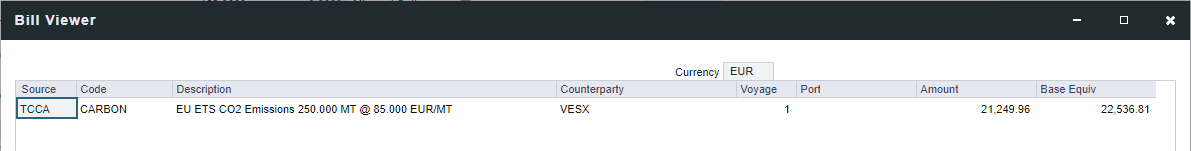

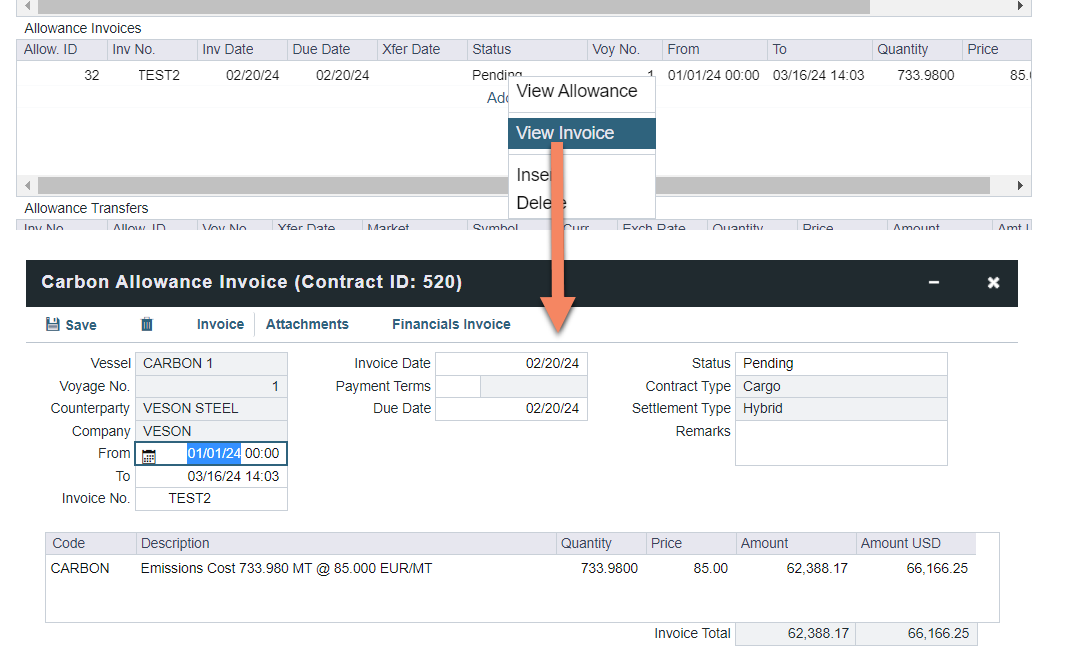

When the line item has been added and the contract saved, you will see a new record in the Summary tree on the contract under Invoices > Emission Allowance Invoices. When clicked on, the Bill Viewer for the journal will open:

Similar to the Emissions Cash Invoice, you will now see the line item captured in the Voyage P&L under the category Emissions Expenses, and the same actualization process will be followed as it is in the cash invoice workflow.

If it is a TCO then it will show up under the Emissions Expense (Rebill) category

Posting Emissions Allowance Invoices

The new type, Emissions Allowance Invoice, can be approved and posted through the Approve Invoices List or the Voyage Invoices List. This will create a journal in the system to capture the new liability that exists on the balance sheet. The journal will follow the standard invoicing process and rules in the system around approvals. It will require proper business rules to be set up, which can be found below. Once posted, allowances transfers can now be recorded to close the outstanding balance.

Create an Allowance Invoice on the contract

Requires the configuration flags CFGEnableCargoEmissionsAllocation flag for Cargo and VC In Contracts and the CFGEnableTCEmissionsAllocation flag for Time Charter (In/Out) Contracts and Head Fixture Contracts. Requires a schema version of 44.5 and above.

To create an Allowance Invoice directly from the contract screen, right-click the desired line item in the Allowance Invoices grid and select Invoice.

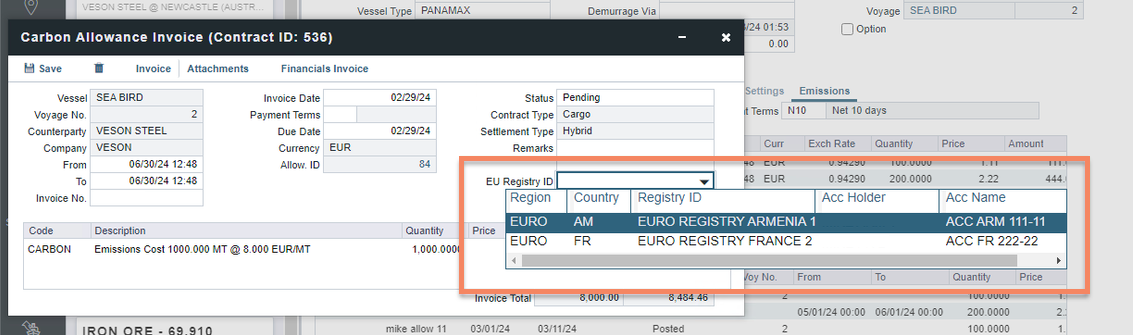

You can use the EU Registry ID field to select which EU Registry Account applies to this invoice from your Address Book, as shown in the following image.

EU Registry ID on Carbon Allowance Invoice form

Like other invoice forms in the IMOS Platform, you can access the invoice by selecting the link to the invoice on the Summary tree under Invoices or selecting the link in the Type column on the Voyage Invoice List. The form contains business logic that will update relevant fields as you change information in the form. For example, you can change the Payment Terms and the due date updates accordingly.

If another invoice exists for this line item, the existing invoice opens. To open or modify an existing invoice, right-click the line item in the Emissions tab rows.

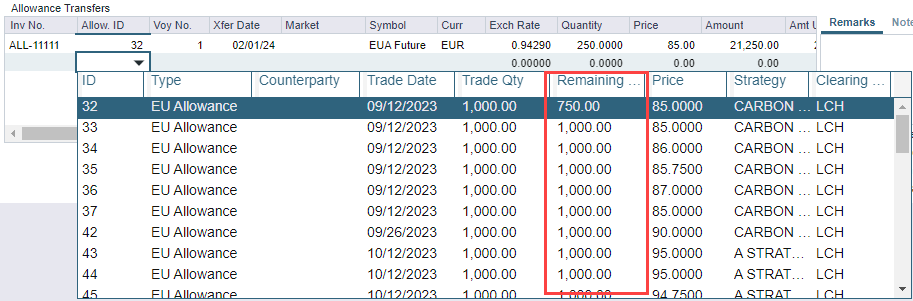

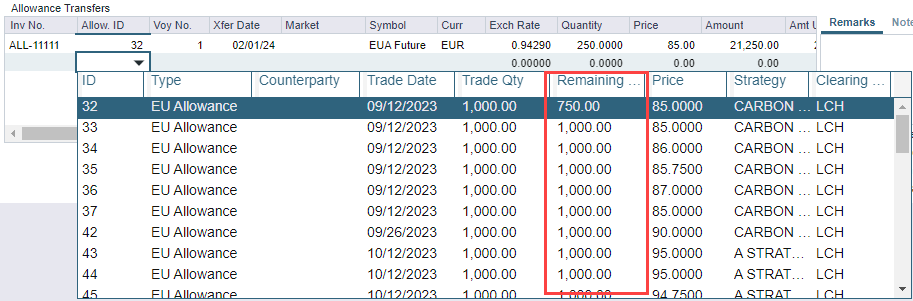

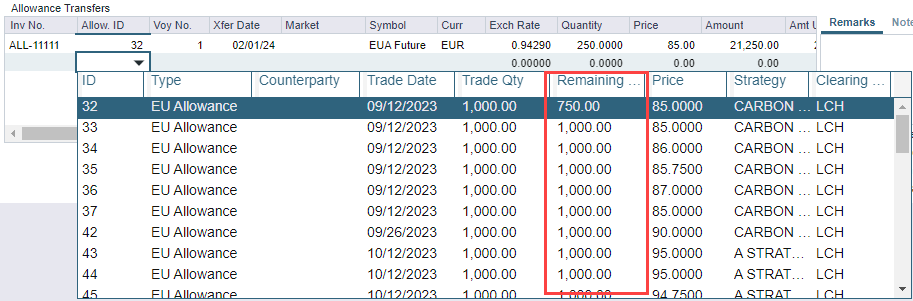

Allowance Transfers

Once an Emissions Allowance Invoice is Posted, allowances can be allocated to settle the outstanding balances. In the Allowance Transfers table on the contract on the Time Charter In contract:

Click to Add New Row

In the Inv No. column, select the invoice that the allowances will be transferred against. Only those line items in the Allowance Invoices table that are Posted or Transferred / Partially Partially will be available in this dropdown.

In the dropdown, you will see the remaining outstanding balance for a given invoice as well as the invoiced quantity

In the Allow. ID. column, select the Carbon Allowance record that you want to transfer from

In the dropdown, you will see helpful information about the allowances and, most importantly, the remaining balance of a given allowance that can be chosen from. Allowances cannot be over-transferred.

In the Xfer Date column, record the date the allowances are being transferred, which should reflect the time in the EU Registry account that they have been transferred to the counterparty.

The remaining fields will be populated from information on the invoice and the allowance (quantity, price, currency)

If the quantity or the price needs to be adjusted, this can be done now. The price used in this row and the resulting amount is what will show up on the Voyage P&L

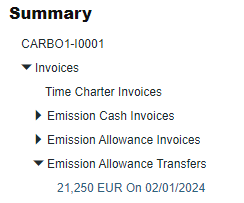

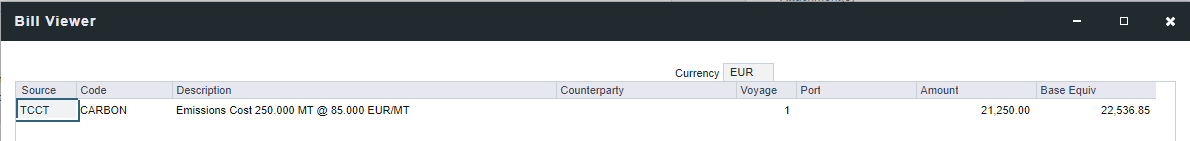

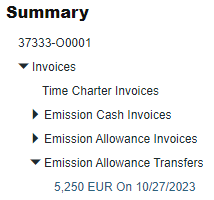

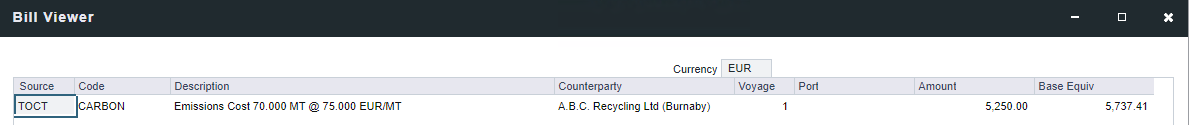

When the line item has been added and the contract saved, you will see a new record in the Summary tree on the contract under Invoices > Emission Allowance Transfers. When clicked on, the Bill Viewer for the journal will open:

The available quantity on the Allowance will be updated to reflect the amount transferred out, and this remaining balance will be used in the exposure calculations (see below).

For the Time Charter Out contract, the process is the same, with the primary difference being that the allowances are being transferred into the balance sheet and inventory, and therefore, a specific allowance is not being deducted from:

Click to Add New Row

In the Inv No. column, select the invoice that the allowances will be transferred against. Only those line items in the Allowance Invoices table that are Posted or Transferred / Partially Partially will be available in this dropdown.

In the dropdown, you will see the remaining outstanding balance for a given invoice, as well as the invoiced quantity

In the Allow. ID. column select the Carbon Allowance that reflects the quantity that was transferred to you from the counterparty

In the dropdown, you will see helpful information about the allowances, such as the date, quantity, and strategy, which will help to ensure you are picking the correct ID.

In the Xfer Date column, record the date that the allowances are being transferred, which should reflect the time in the EU Registry account that they have been transferred from the counterparty and will be aligned with the Trade Date on the Carbon Allowance trade in most cases

The remaining fields will be populated from information on the invoice and the allowance (quantity, price, currency)

If the quantity or the price needs to be adjusted, this can be done now. The price used in this row and the resulting amount is what will show up on the Voyage P&L

When the line item has been added and the contract saved, you will see a new record in the Summary tree on the contract under Invoices > Emission Allowance Transfers. When clicked on, the Bill Viewer for the journal will open:

Posting Emissions Allowance Transfers

The new type, Emissions Allowance Transfer journal, can be approved and posted through the Approve Invoices List or the Voyage Invoices List. This will create a journal in the system to capture the reduction in the liability on the balance sheet. The journal will follow the standard invoicing process and rules in the system around approvals. It will require proper business rules to be set up, which can be found below. Once posted, allowances transfers can now be recorded to close the outstanding balance

Hybrid Settlement

The Settlement Type of HYBRID is to be used when the agreement with the counterparty is to invoice for the emissions expense that the vessel incurs and settle those invoices with both CASH and EU Allowances. In the instance of a Time Charter In contract, these are invoices that will be received from the TCI Owner and are payable items that will be settled with either cash or a transfer of allowances to them through the EU Registry. In the instance of a Time Charter Out contract, these are invoices that will be sent to the TCO Charterer and are receivable items that will be settled with either cash or a transfer of allowance from them to the company account in the EU Registry.

When HYBRID is selected, all three tables, Cash invoices, Allowance Invoices, and Allowance Transfers tables, become visible where all of the Emissions Invoices for the contract will be recorded and visible as well as any corresponding allowances that have been transferred to settle those invoices.

The process followed here will be the same as above for the respective invoice types. Periods can overlap between the Cash Invoice and Allowance Invoice line items if there is a true hybrid invoice for a given period.

Handling of Off hire

At the time of writing (11/30/2023), there has been no specific workflow established to take an off-hire, even calculate the emissions costs occurring in that off-hire period and apply it to the TC contract. This is widely due to no industry consensus on whose costs these are and how to handle them. Right now, the off-hire emissions can be amended by adding a second row to the emissions management tab in the TC contract. The emissions costs for the off-hire will need to be calculated manually.

Owned Vessels (Head Fixture Contracts)

Tracking the transfers for owned vessels will follow the same process laid out for Time Charter contracts, which will be done through the Head Fixture contract. Instead of tracking the allowances being transferred to a counterparty based on voyage emissions, the transfers can transfer allowance balances to the vessels for surrendering in the reporting period. The allowance balances will be removed from the available quantity to prevent over-allocation.

Cargo/VC In Contracts

When the Enable Cargo Emissions Allocation flag (CFGEnableCargoEmissionsAllocation) is enabled in an IMOS environment, a new Emissions tab will become visible on the Cargo and VC In contracts. This tab is to be used to capture the contractual details that were agreed to with the counterparty on the contract for how emissions expenses will be settled over the life of the contract. Clicking on this Emissions tab on a Cargo Contract will show the following three fields:

Settlement Type - Defines how the contract is structured to settle emissions expenses.

Options are N/A (default), CASH, ALLOWANCES and HYBRID

Billing Period - Defines the period frequency that the emissions expense will be invoiced

Payment Terms - Defines the terms for how the invoices are to be paid/settled following receipt or delivery

Uses the Payment Terms as they are defined in the Data Center

Cash Settlement

The Settlement Type of CASH is to be used when the agreement with the counterparty is to invoice for the emissions expense that the vessel incurs and settle those invoices with cash. In the instance of a Cargo contract, this invoice will be sent to the Charterer and will be a receivable item settled in a cash receipt. In the instance of a VC In contract, this invoice will be sent to the Owner and will be a payable item settled in a cash payment.

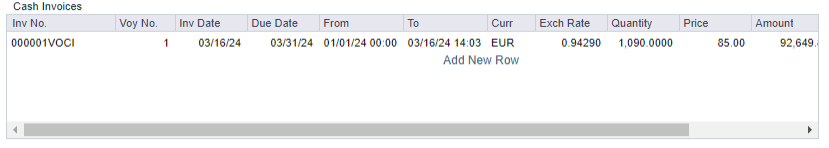

When CASH is selected, the Cash Invoices table becomes visible, where all of the Emissions Cash Invoices for the contract will be recorded and visible.

Recording a new Cash Invoice

Click Add New Row

Fill in the Invoice No (for a payable, or leave blank for a receivable as it will auto-generate)

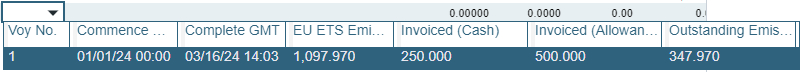

Select the Voyage for the freight contract

In the Voy No dropdown, you will see helpful information from the voyage, including the Commence/Complete dates and the Outstanding Emissions (ie, those calculated emissions that have not been invoiced for yet)

Record the Invoice Date, Due Date, From and To dates for the period covered, Curr, Quantity and Price

To be completed:

Defaulting the Due Date from the Inv Date and Payment Terms

Default the From and To dates using the Billing Period

Mark the Invoice as A - Actual

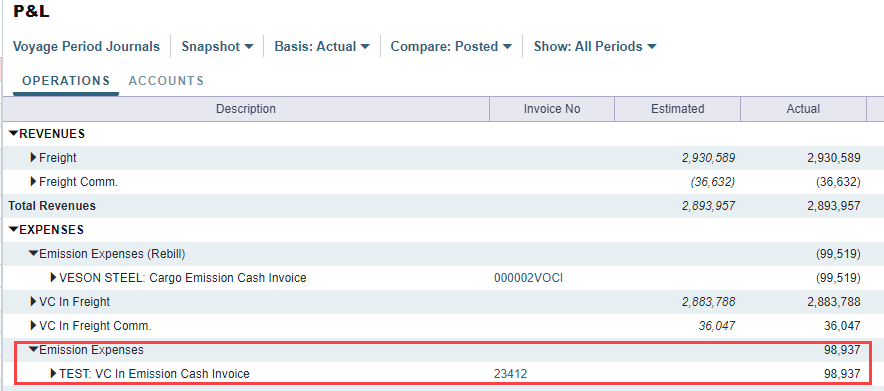

Opening the voyage for the VC In contract will show a new line in the Emissions Expenses category. If the invoice period does not cover the whole voyage, then the system will calculate the remaining emissions quantity and expense so that the total Emissions Expense is correctly reflected on the voyage.

NOTE: It will do this through multiple different methods depending on the information captured on the voyage, such as noon reports, arrival/departure reports, or proration. It will also look at the Agreed Amount in the Carbon Calculator when used to override the calculated amount.

If the period does cover the end of the voyage, then the Emissions Expenses on the voyage will be fully realized and will stop accruing.

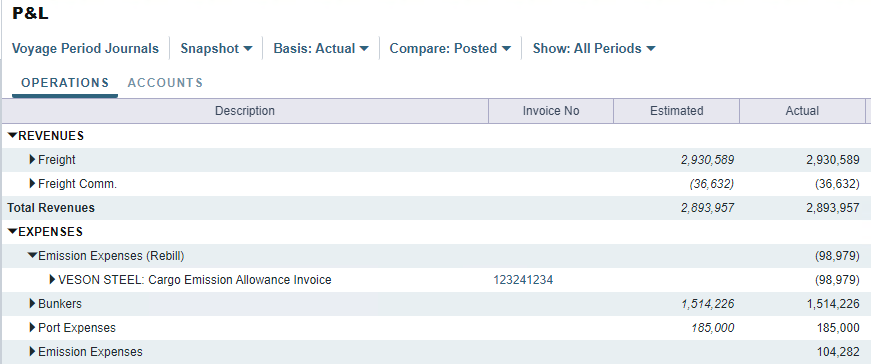

If the invoice was for a Cargo contract, then it will show under the Emissions Expenses (Rebill) category under Expenses. This will net out on RELT voyages when the contracts that have emissions expenses passed through but will have a delta if there are differences in the agreements between the Cargo Charterer and VC In Owner.

Posting Emissions Cash Invoices

The new type, Emissions Cash Invoice, can be approved and posted through the Approve Invoices List or the Voyage Invoices List. They will follow the standard invoicing process and rules in the system around approvals. It will require proper business rules to be set up, which can be found below. Given that these are cash settlements, there will be an outstanding cash amount visible in the financial lists and reports until a payment or receipt is recorded.

Allowance Settlement

The Settlement Type of ALLOWANCE is to be used when the agreement with the counterparty is to invoice for the emissions expense the vessel incurs and settle those invoices with EU Allowances. In the instance of a VC In contract, this invoice will be received from the Owner and will be a payable item that will be settled with a transfer of allowances to them through the EU Registry. In the instance of a Cargo contract, this invoice will be sent to the Charterer and will be a receivable item that will be settled with a transfer of allowance from them to the company account in the EU Registry.

When ALLOWANCE is selected, the Allowance Invoices and Allowance Transfers tables become visible where all of the Emissions Allowance invoices for the contract will be recorded and visible, as well as the corresponding allowances that have been transferred to settle those invoices.

Recording a new Allowance Invoice

Click Add New Row

Fill in the Invoice No (for a payable, or leave blank for a receivable as it will auto-generate)

Select the Voyage that the invoice period covers

In the Voy No dropdown, you will see helpful information from the voyage, including the Commence/Complete dates and the Outstanding Emissions (ie, those calculated emissions that have not been invoiced for yet)

Record the Invoice Date, Due Date, From and To dates for the period covered, Curr, Quantity and Price

To be completed:

Defaulting the Due Date from the Inv Date and Payment Terms

Default the From and To dates using the Billing Period

Set the Status value to ‘Invoiced’

The default Status value of ‘Pending’ will not show up on the Voyage P&L, but ‘Invoiced’ and all others following that will

Similar to the Emissions Cash Invoice, you will now see the line item captured in the Voyage P&L under the category Emissions Expenses, and the same actualization process will be followed as it is in the cash invoice workflow.

If it is a Cargo then it will show up under the Emissions Expense (Rebill) category

Posting Emissions Allowance Invoices

The new type, Emissions Allowance Invoice, can be approved and posted through the Approve Invoices List or the Voyage Invoices List. This will create a journal in the system to capture the new liability that exists on the balance sheet. The journal will follow the standard invoicing process and rules in the system around approvals. It will require proper business rules to be set up, which can be found below. Once posted, allowances transfers can now be recorded to close the outstanding balance

Allowance Transfers

Once an Emissions Allowance Invoice is Posted, allowances can be allocated to settle the outstanding balances. In the Allowance Transfers table on the contract on the VC In contract:

Click to Add New Row

In the Inv No. column, select the invoice that the allowances will be transferred against. Only those line items in the Allowance Invoices table that are Posted or Transferred / Partially Partially will be available in this dropdown.

In the dropdown, you will see the remaining outstanding balance for a given invoice as well as the invoiced quantity

In the Allow. ID. column, select the Carbon Allowance record that you want to transfer from

In the dropdown, you will see helpful information about the allowances and, most importantly, the remaining balance of a given allowance that can be chosen from. Allowances cannot be over-transferred.

In the Xfer Date column, record the date the allowances are being transferred, which should reflect the time in the EU Registry account that they have been transferred to the counterparty.

The remaining fields will be populated from information on the invoice and the allowance (quantity, price, currency)

If the quantity or the price needs to be adjusted, this can be done now. The price used in this row and the resulting amount is what will show up on the Voyage P&L

The available quantity on the Allowance will be updated to reflect the amount transferred out, and this remaining balance will be used in the exposure calculations (see below).

For the Cargo contract, the process is the same, with the primary difference being that the allowances are being transferred into the balance sheet and inventory, and therefore, a specific allowance is not being deducted from:

Click to Add New Row

In the Inv No. column, select the invoice that the allowances will be transferred against. Only those line items in the Allowance Invoices table that are Posted or Transferred / Partially Partially will be available in this dropdown.

In the dropdown, you will see the remaining outstanding balance for a given invoice, as well as the invoiced quantity

In the Allow. ID. column select the Carbon Allowance that reflects the quantity that was transferred to you from the counterparty

In the dropdown, you will see helpful information about the allowances, such as the date, quantity, and strategy, which will help to ensure you are picking the correct ID.

In the Xfer Date column, record the date that the allowances are being transferred, which should reflect the time in the EU Registry account that they have been transferred from the counterparty and will be aligned with the Trade Date on the Carbon Allowance trade in most cases

The remaining fields will be populated from information on the invoice and the allowance (quantity, price, currency)

If the quantity or the price needs to be adjusted, this can be done now. The price used in this row and the resulting amount is what will show up on the Voyage P&L

Posting Emissions Allowance Transfers

The new type, Emissions Allowance Transfer journal, can be approved and posted through the Approve Invoices List or the Voyage Invoices List. This will create a journal in the system to capture the reduction in the liability on the balance sheet. The journal will follow the standard invoicing process and rules in the system around approvals. It will require proper business rules to be set up, which can be found below. Once posted, allowances transfers can now be recorded to close the outstanding balance

Hybrid Settlement

The Settlement Type of HYBRID is to be used when the agreement with the counterparty is to invoice for the emissions expense that the vessel incurs and settle those invoices with both CASH and EU Allowances. In the instance of a VC In contract, these invoices will be received from the Owner and are payable items that will be settled with either cash or a transfer of allowances to them through the EU Registry. In the instance of a Cargo contract, these invoices will be sent to the Charterer and are receivable items that will be settled with either cash or a transfer of allowance from them to the company account in the EU Registry.

When HYBRID is selected, all three tables, Cash invoices, Allowance Invoices, and Allowance Transfers tables, become visible where all of the Emissions Invoices for the contract will be recorded and visible as well as any corresponding allowances that have been transferred to settle those invoices.

The process followed here will be the same as above for the respective invoice types. Periods can overlap between the Cash Invoice and Allowance Invoice line items if there is a true hybrid invoice for a given period.

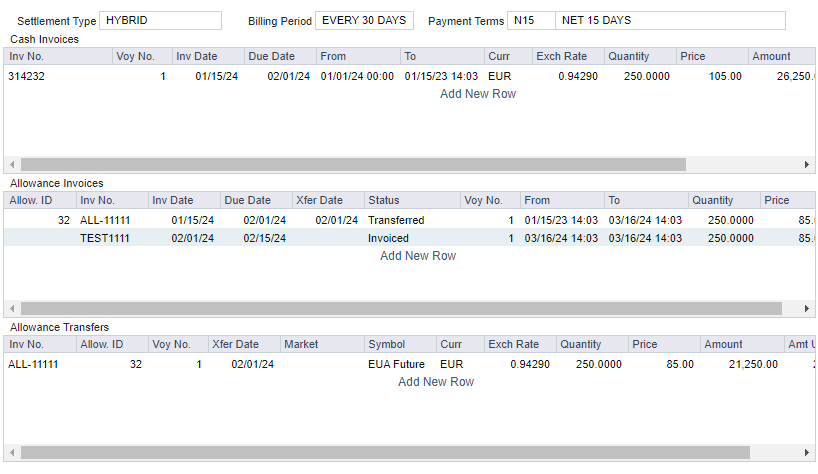

Carbon Allowance Contracts

To track the transfer of allowances out of the inventory and to counterparties, a table is visible on the Carbon Allowance contract that will show all allocations made from the specific contract. This will show both full transfers, ones completed through the EU Registry to cover an open balance with a counterparty, as well as pre-allocated quantities.

In addition to the table, there is a total Pre-Allocated Qty, Transferred Qty, and Remaining Qty visible on the Carbon Allowance form. The Remaining Qty is the difference between the initial Trade Qty and the combination of the Transferred and Remaining quantities. The Remaining Qty will show in the Trading P&L Summary and Trade Details list as in exposure. This is also the quantity remaining in inventory on the balance sheet.

These additional fields, as well as the table, are all read-only and are for informational purposes for the time being.

Business Rules

The following business rules will need to be set up to support the posting for the new invoice and journal types that have been created as part of the Emissions Expense Settlement workflow:

Note that the EMSx Sources in the table below are for Month-end Accruals of the un-invoiced Emissions Expense / Emisisons Expense (Rebill) line items on the Voyage P&L.

When running accrual by accounts (CFGVoyaccAccrualType = Act*), the EMSx:CARBON rule will drive the MACR rule. These rules require the MACR rules for each account associated to EMSx.

When accrual by ops (CFGVoyaccAccrualType = Ops) then rule will be MACR:CARBONEXPENSES for expenses and MACR:CARBONEXPENSESREBILL for expense rebills.

For Allowance Trading settlements, an additional set of Source Codes are utilized IMOS - Trading-Related Bill Codes .

Source | Code | Description | Account Type | Credit Acc Type |

|---|---|---|---|---|

TCCA | CARBON | TCI Emissions Allowance Invoice | Expense | Liability |

TCCI | CARBON | TCI Emissions Cash Invoice | Expense | |

TCCT | CARBON | TCI Emissions Allowance Transfer | Liability | Asset |

TOCA | CARBON | TCO Emissions Allowance Invoice | Expense | Liability |

TOCI | CARBON | TCO Emissions Cash Invoice | Expense | |

TOCT | CARBON | TCO Emissions Allowance Transfer | Asset | Liability |

OVCA | CARBON | OV Emissions Allowance Invoice | Expense | Liability |

OVCI | CARBON | OV Emissions Cash Invoice | Expense | |

OVCT | CARBON | OV Emissions Allowance Transfer | Liability | Asset |

VOCA | CARBON | Cargo Emissions Allowance Invoice | Expense | Liability |

VOCI | CARBON | Cargo Emissions Cash Invoice | Expense | |

VOCT | CARBON | Cargo Emissions Allowance Transfer | Asset | Liability |

VICA | CARBON | VC In Emissions Allowance Invoice | Expense | Liability |

VICI | CARBON | VC In Emissions Cash Invoice | Expense | |

VICT | CARBON | VC In Emissions Allowance Transfer | Liability | Asset |

EMSN | CARBON | TCI Emissions Expense | Expense | |

EMSO | CARBON | OV Emissions Expense | Expense | |

EMSI | CARBON | VC In Emissions Expense | Expense | |

EMSR | CARBON | TC Out Carbon Expense Rebill | Expense | |

EMSC | CARBON | Cargo Carbon Expense Rebill | Expense |

If CFGApplyAllowancePriceDiffToPnL is set to Y, TCCT: CARBDIFFERENCE, OVCT:CARBDIFFERENCE and VOCT: CARBDIFFERENCE business rules are also to be set up with an Expense account.

Invoice Import XML for EU ETS settlements

Requires database schema version 45.2 and higher. CFGEnableCargoEmissionsAllocation and CFGEnableTCEmissionsAllocation configuration flags have to be set accordingly.

You can import all pertinent data about your EU ETS settlements in interface messages to third-party financial systems and have it exported from IMOS in invoice-type notification XML.

Cargo and TC Emissions invoices can import the EU Registry setting through the interface. The elements "registryAccCompNo" and "registryAccCompSeq" are added to the "invoice" interface message schema.

For more information about interface messages, visit IMOS - Interface Message List.