IMOS - Accrual Business Rules

Home > Financials > Accrual Business Rules

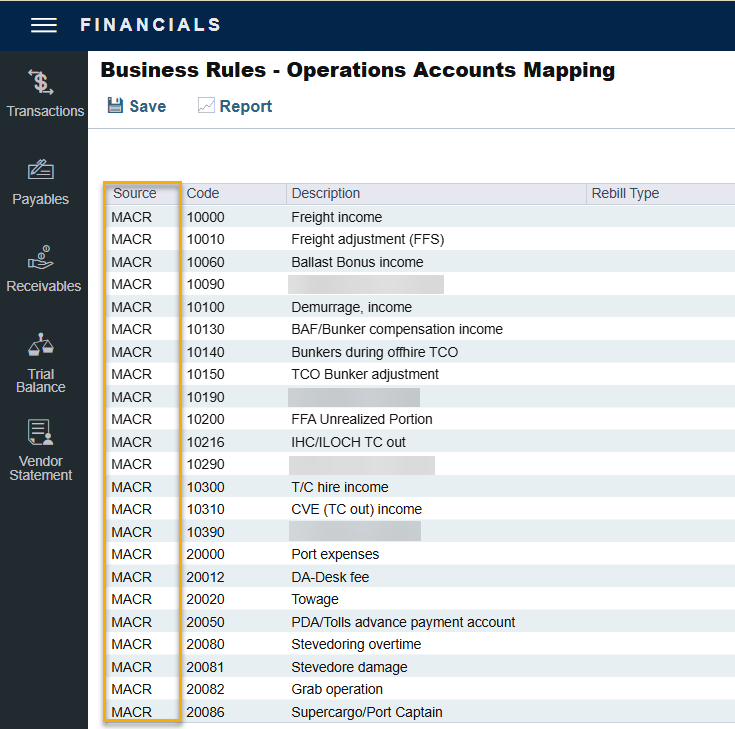

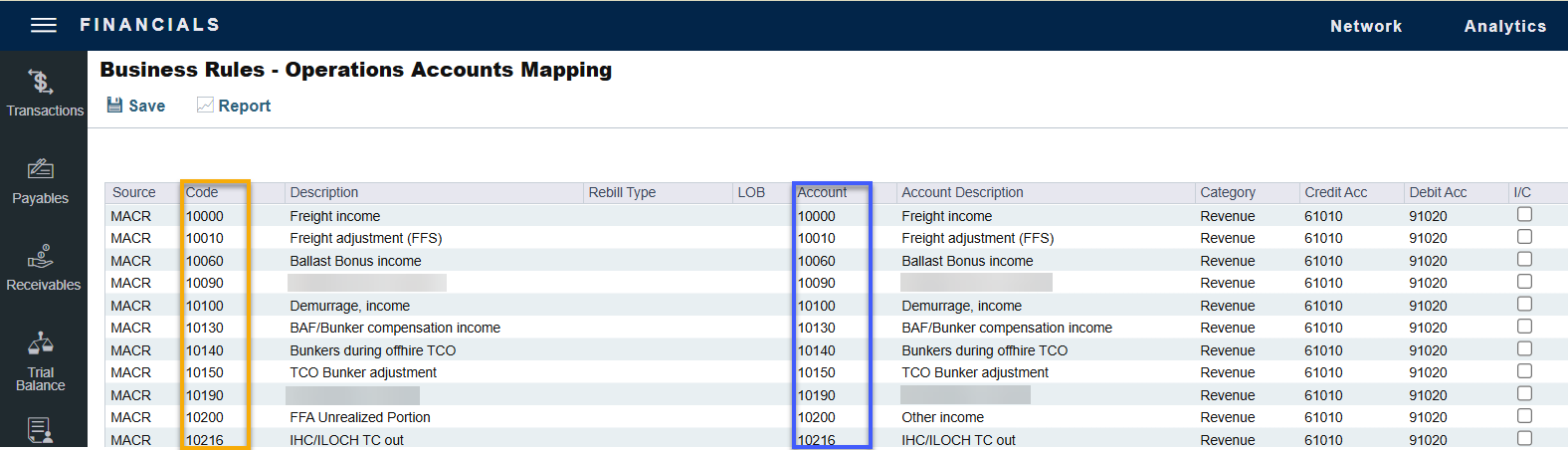

Similar to invoice transactions the posting of Monthly Accruals is also governed by the Business Rules with the Source code MACR.

Source code with MACR are connected to accruals.

The code column is based on the voyage accrual type setup in CFGVoyaccAccrualType which enables an option to control the type of accrual items using Business Rules.

Here are the five possible values:

Ops (default): No change in behavior for accruals. When set, IMOS generates accrual journal entries (and reversals) for each operations ledger code setup in IMOS.

.png?inst-v=74aee63d-9500-4008-8b5a-8a52f7ee185b)

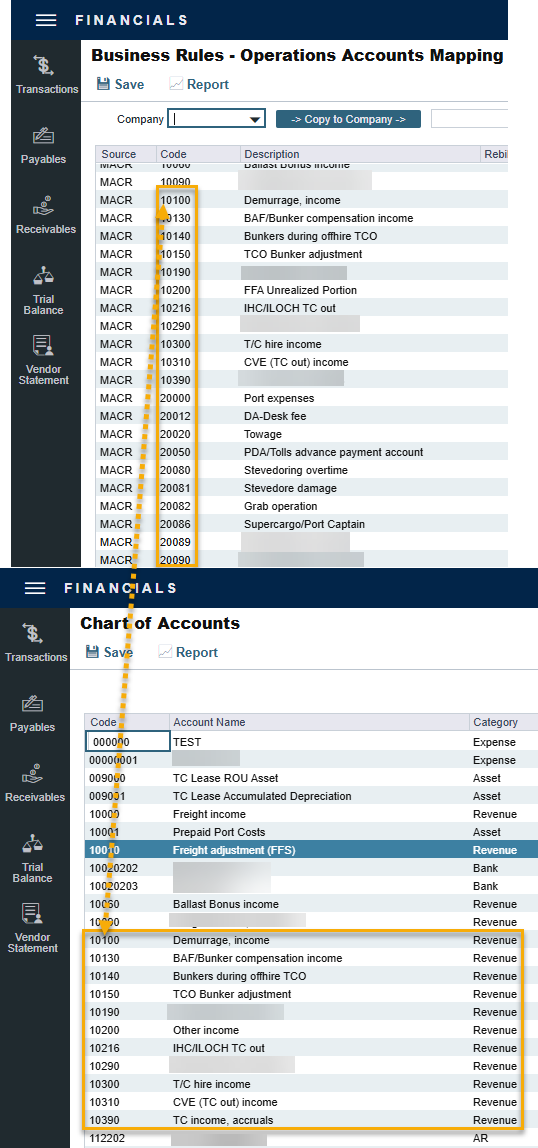

Act: Accrual based on financial accounts. With this setup, IMOS generates one accrual journal entry (and reversal) for each P&L account from the Chart of Accounts. The items are grouped per their corresponding P&L accounts in the Business Rules (Accruals by Account) and is generated automatically upon opening the Business Rules form.

ActCounterparty: Same as Act, but the accruals are also itemized per vendor.

ActCounterpartyPort: Port expenses will be accrued on a separate line-item for each port and each counterparty, and all other items will be accrued per account and counterparty.

ActPort: Port expenses will be accrued on a separate line-item for each port and all other items will be accrued per account.

Notes:

When CFGVoyaccAccrualType is set to a nondefault value, a check box column appears on the Bill Viewer form; to exclude a row from Monthly Accruals, clear its check box.

When Accruals by Account is enabled:

If the accruals figures appear in red, that means that a Business Rule is missing an account.

For more details please refer to this article: IMOS - Understanding Errors in Accruals.

Incremental accruals can be run. If accruals are run and then an adjustment is made that would warrant running accruals for a second time, the accrual journals do not have to be reversed to do so. The accruals can be run again, and the difference between the original accrual amount and the new accrual amount will be the resulting Journal Entry. Accrual journals that have been run but not posted will be overwritten. Only accounts that have been updated since the last run of accruals will have a Journal Entry created for them.

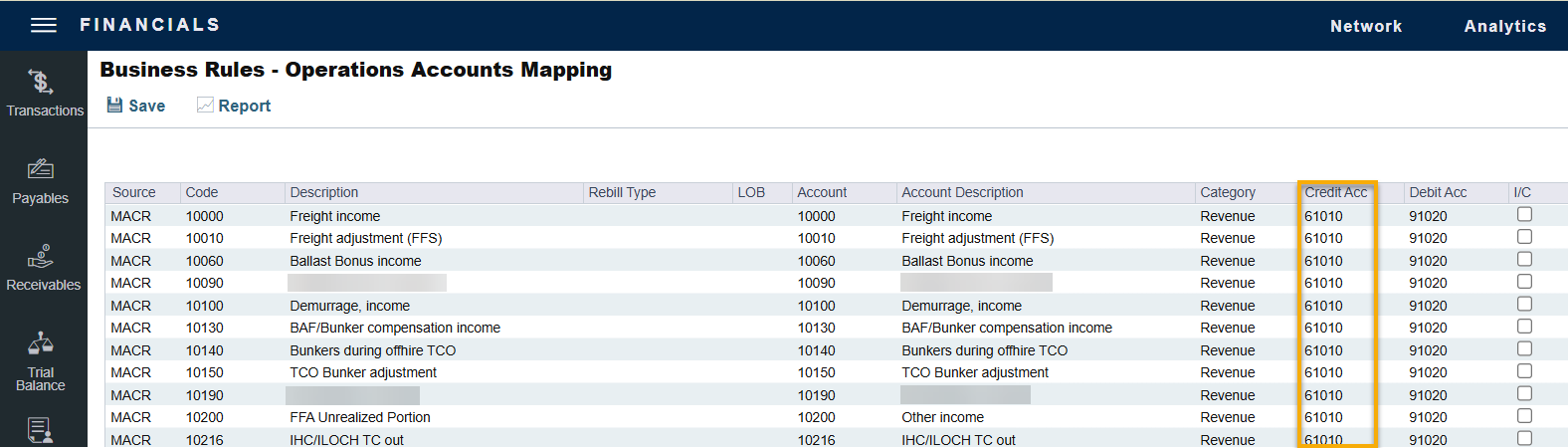

Functionality of the Credit Acc Column:

The Credit Acc column account has two purposes for accruals:

Accrued Expenses: An expense that needs to be recognized in the P&L will be posted in the Balance Sheet under the account specified in this column.

Deferred Revenues: A revenue that was posted and needs to be removed from the P&L will be posted in the Balance Sheet under the account specified in this column.

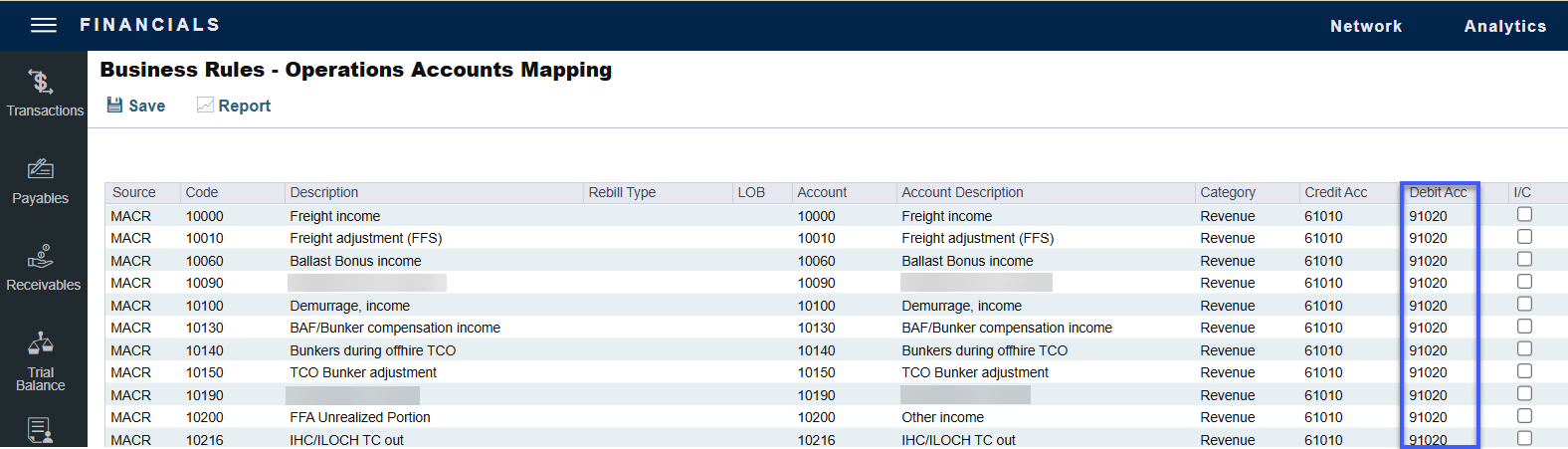

Functionality of the Debit Acc Column:

The Debit Acc column account has two purposes for accrual:

Accrued Revenues: A revenue that needs to be recognized in the P&L will be posted in the Balance Sheet under the account specified in this column.

Deferred Expenses: An expense that was posted and needs to be removed from P&L will be posted under the account specified in this column.

Creating Accounting Ledgers per Vendor for Posted Invoices and Accruals

To configure the Veson IMOS Platform to allocate transactions to specific vendors:

Scenario

Commission On Freight (FCOM)

Internal Broker

External Brokers

Internal Broker A posting on account: 550

External Brokers B posting on account: 555

Create Accruals with separate accrual accounts similar to posted transactions

Financial Account Configuration

Create unique Account Codes for internal broker and external brokers in the Chart of Accounts and add their equivalent Accrual Accounts.

Create new Business Rules for both accounts using the same code (FCOMM), and link the Internal Broker in Vendor column. The internal broker will thereby be posted, separated from the other external brokers.

Associate the new Business Rules with their accrual account by creating a new MACR rule:

In the Code column, enter the unique account code for the internal/external broker.

In the Account column, enter the accrual account code.

Enter the applicable accounts:

The Account column refers to the correct posting on the Income Statement.

The Credit Acc column refers to the correct posting on the Balance Sheet.

Checking the Configuration

To check that internal/external commissions are posted to the correct account:

To check if the new Freight Commission accounts are configured correctly (posting to the correct Account Codes), create and post a new Commission Invoice. On the Transaction Data Entry form, the correct Account Number should appear.

To check that accruals are separating internal/external brokers:

Run accruals and note that the separation is done per accrual account set for the respective internal and external brokers.