IMOS - Monthly Accruals

Home > Financials > Monthly Accruals

🔑 This is a Key Topic, with high value for all users.

The purpose of closing accruals is to keep as accurate as possible a picture of the revenues and expenses of open voyages in the same accounting period. Accrual functionality allows you to allocate revenues and expenses over the period of the voyage and accruals handle deferrals of revenues and expenses over financial periods.

With Monthly Accruals, you can compute the posted-actual for every vessel voyage that is still open and calculate accruals based on the result.

Required Setup

Before running monthly accruals, the following setup is required to achieve accurate results:

Complete your Chart of Accounts.

Determine if you will be using Accrual By Ops or Accrual By Act.

Complete your Accrual Business Rules.

Set your accrual basis: always prorate or using an operations basis date (CFGVoyaccAccrualDate).

Running the Monthly Accruals

Note: Before preparing for the Monthly Accruals, please have your Operations team ensure that all invoices for the month are properly posted.

Step 1:

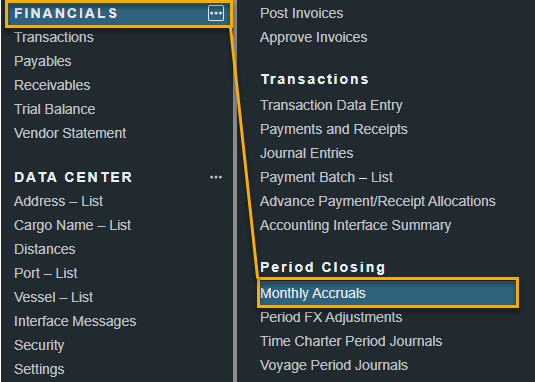

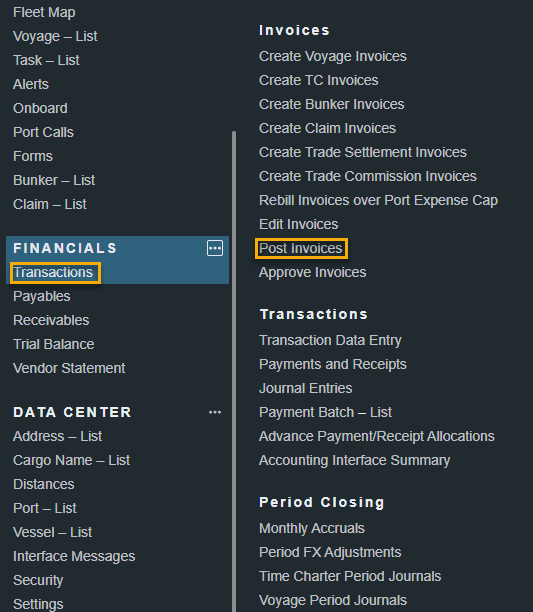

On the Financials menu … > under Period Closing > click Monthly Accruals.

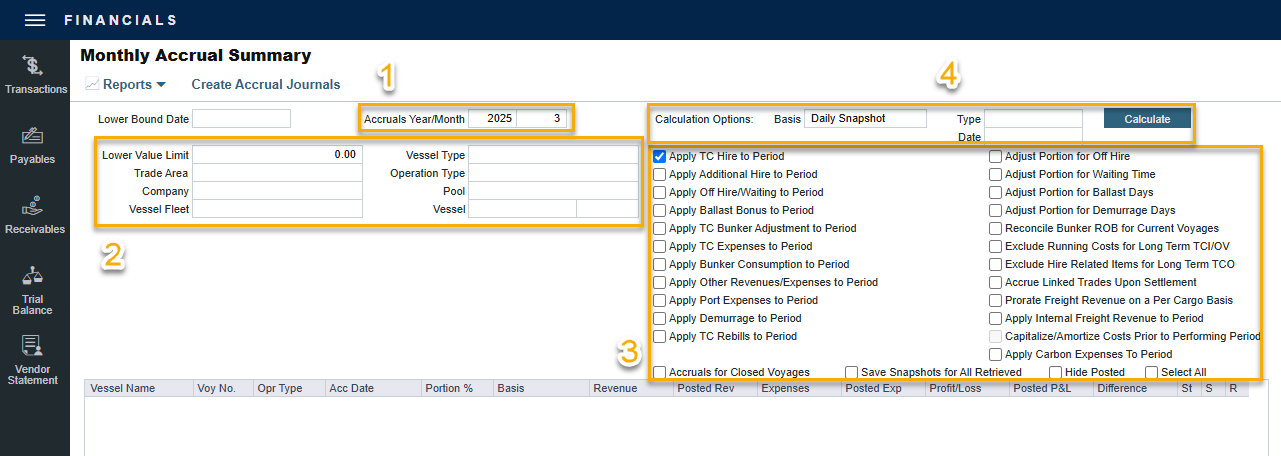

Step 2: Select Filters, P&L Calculation Options, & Basis

When it comes to the filters, they can be set through the configuration flags to ensure that each time the Monthly Accrual is run, it is expected to apply the specific filters consistently for each month.

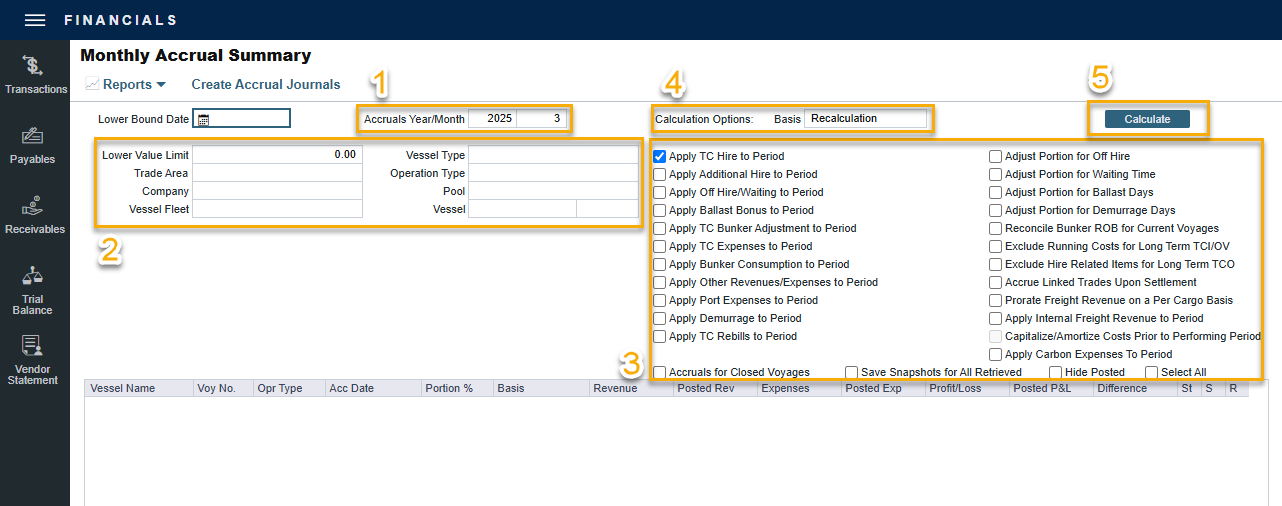

Accruals Year/Month: Enter the month and year for the calculation.

IMOS allows accounting periods on a monthly and yearly basis. When a period is closed, for example, the month of January 2025, transactions with an accounting date of January 31, 2025 or before cannot be posted.

Filter Options: Select filters to limit accruals by Trade Area, Company/LOB, Vessel Fleet, Vessel Type, Operation Type, or Pool, or select a specific Vessel and Voyage No.

In the case of a Head Company and Subcompany organizational structure, closing periods can also be set up basis a specific Company code.

For organizations with a few fleets, it may not be necessary to set these filters options.

For organizations with large fleets, it is recommended to use these filter options such as Company/LOB, to improve the performance of the run time.

Note: If all filters are blank, the calculator will calculate accruals for all opened voyages. When a voyage is in Completed status, data and existing transactions can be modified. Hence, security rights exist to ensure that a Closed voyage can only be opened by the appropriate user. Once Closed, no data can be modified.

Hence, its recommended to set the voyage status to Closed once all invoicing is complete to reduce the amount of voyages run in month end accruals.

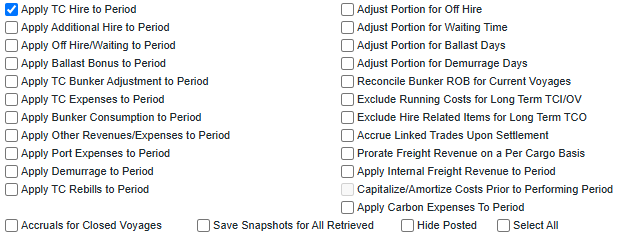

Select P&L Calculation Options: To apply P&L calculation options, select the appropriate check boxes. Please refer to IMOS - P&L - P&L Calculation Options for further details.

Select the Calculation Basis: You can calculate based on either Recalculation or based on saved Daily Snapshots.

Monthly Accrual Calculation Basis - Daily Snapshots:

Specify the snapshot Type and, for noncurrent snapshots, specify the Date. For journals created using this method, the Invoice Date and Accounting Date are the same as the Accruals Year/Month on this form.

Accruals snapshots appear in the Snapshot and Period Comparison selection lists on the Voyage P&L.

To accurately account for these items based on your company's policies, the following Calculation Options can be used with accruals-based snapshots created with IMOS v7.10 or later: Apply Additional Hire to Period, Apply TC Bunker Adjustment to Period, Apply TC Expenses to Period, Apply Other Revenues/Expenses to Period, Apply Port Expenses to Period.

To take and save a P&L snapshot for every result line, regardless of whether there are accrual items, select the Save Snapshots for All check box.

Click the

button to calculate the Monthly Accrual.

button to calculate the Monthly Accrual.

Further Details on Filters:

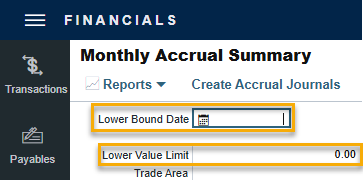

Lower Bound Date is applied to determine the earliest date to look at for generating the Accrual journals. The system will provide results only from that date forward.

Lower Value Limit is applied on individual items and is only applied upon saving. Anything greater than the lower value limit will still appear in the Preview but it won't be saved as part of the monthly journals. As a result, Accrual journals that have been created should not display the Monthly Closing Accruals amount with values under the Lower Value Limit.

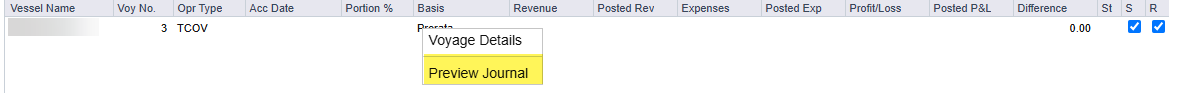

Step 3: Validate the Monthly Accrual Result

To view a record in the Bill Viewer, including the details to be included in the Journal, right-click its line item and then click Preview Journal.

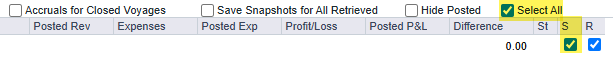

To select the records you want to post, select the check box in the S column, at the right, or select the Select All check box.

To select the records for which you do not want to create a reversal of the accrual, clear their check boxes in the R column.

Step 4: Create the Monthly Accrual Journals

Click the Create Accrual Journals button to do the following three things:

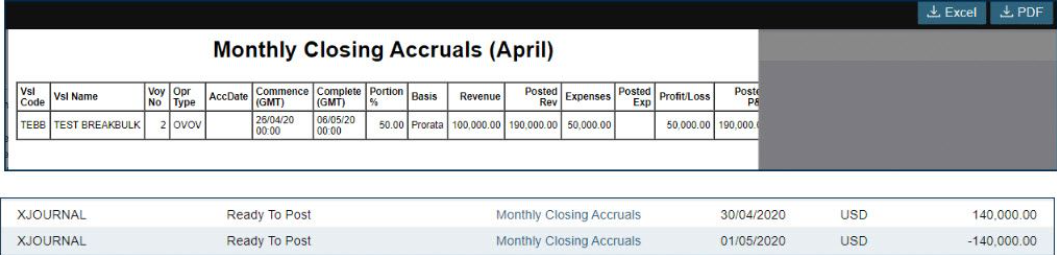

The Monthly Closing Accruals report will open which can be downloaded as a PDF and saved for auditing purposes.

Creates both Monthly Accrual journals and Monthly Accrual reversal journals.

Take notes about the accounting dates and the amounts. A Monthly Accrual journal has an accounting date of the last day of the month, and a Monthly Accrual reversal journal has an accounting date of the first date of the next month; the amounts are net-off each other.

Note: If a record's S check box is selected, a Journal Entry is generated with two lines, one for accrued revenue, and one for accrued expense. The accrual transaction is generated on the last date of the accounting period (typically the end of the month).

If a record's R check box is selected, a reversal of the accrual is generated for the first day of the next month.

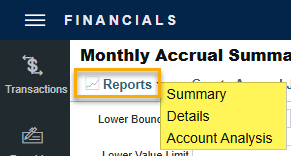

To view Summary, Details, or Account Analysis reports, click Report.

Step 5: Approve and Post the Monthly Accrual Journals

After you have calculated and created the Accrual journals, it is still necessary to approve and post the journals. Accrual journals will follow your security settings for approving and posting but also have some convenient functionality:

When posting the journal for the end of the accrual period, you will be prompted to post the additional reversal accrual journal for the next day.

When reversing an accrual journal, you will be prompted if you want to reverse the reversal journal as well.

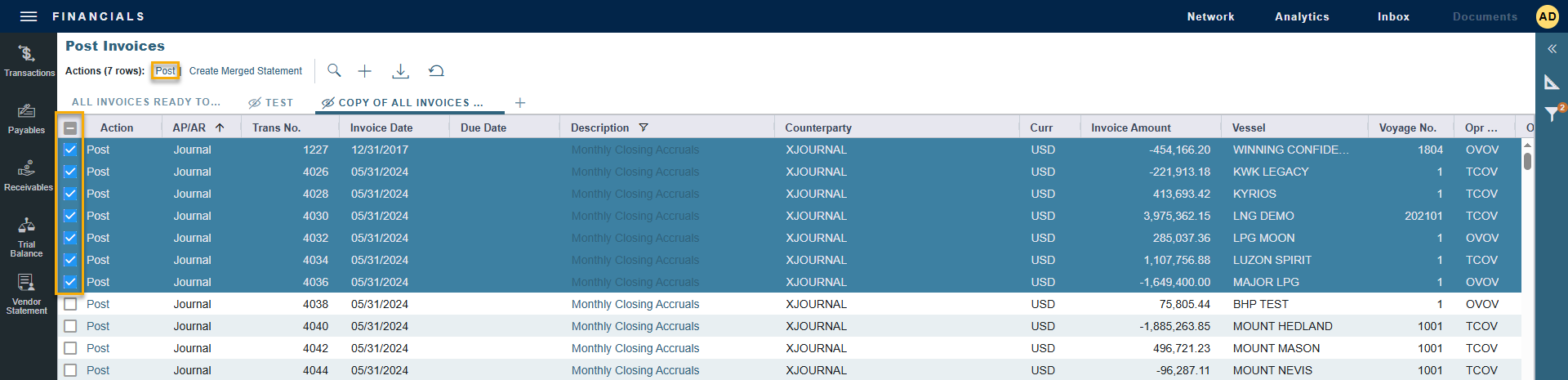

Use the check box on the Post Invoices List to approve and post accrual journals in bulk.

You can find the created journals in the Transactions Summary or the Post Invoices list under the Financials module.

In these lists, you can bulk post the journals, or individually post them.

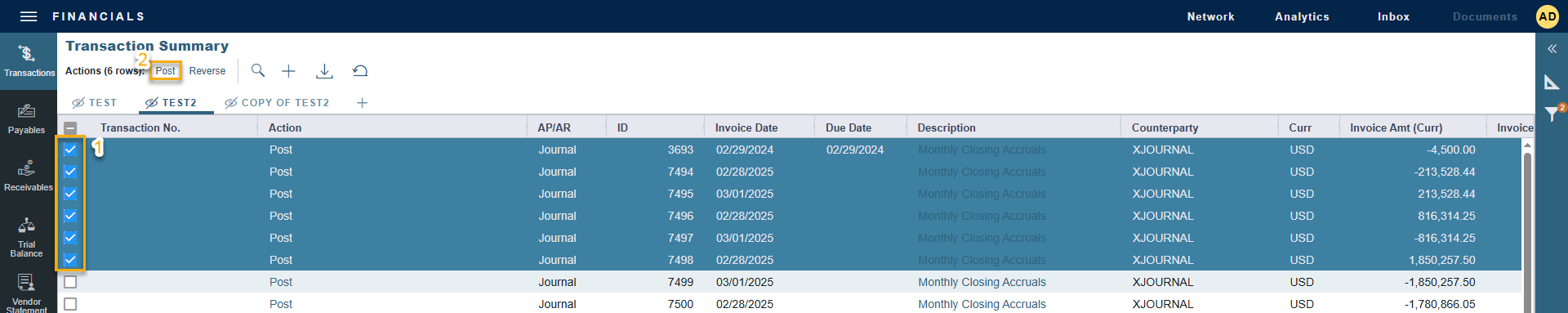

Bulk Posting via Transaction Summary

Bulk Posting via Post Invoices

Once both journals and reversals are posted, you are done with the Monthly Accrual process.

Calculation Method for Accruals (Revenue and Costs)

Accrual journals are generated on a per vessel, per voyage basis. The system calculates month-end results.

With configuration flag CFGActAccrualBreakdown set to:

Y: The calculation is per P&L category.

N: P&L categories are consolidated into revenues and expenses.

With configuration flag CFGVoyaccAlwaysProrate set to:

Y: P&L results are prorated according to the number of voyage days in the month.

N: Revenues and expenses are recognized in the month in which they occur.

Prorating Voyages

Depending on your configuration, your accrual calculation may be prorated. The prorating of a voyage P&L is basis the voyage days before the end of the month. For example, if a 40-day voyage takes 15 days in April and 25 days in May, we would recognize 15/40 = 37.5% of all expenses and revenues for the end of April, as 15 days were past. For this same voyage, running accruals for May 31, we would recognize 100% of all expenses and revenues, as the voyage was 100% completed before this date.

TCO Voyages

Time Charter Out voyages are all treated the same, regardless of system configuration. Time Charter Out voyages will by default always be prorated. This can be overridden using the Apply TC Hire To Period calculation option on the Accrual form. Additionally, TCO voyages are not accrued until they have commenced.

Uninvoiced Bunker Liftings

When running Monthly Accruals for voyages with Bunker Liftings that are not bound to invoices, the Veson IMOS Platform (IMOS) will only accrue the costs of the Bunker Liftings if they have been consumed.