IMOS - P&L - P&L Calculation Options

Home > Operations > P&L Calculation Options

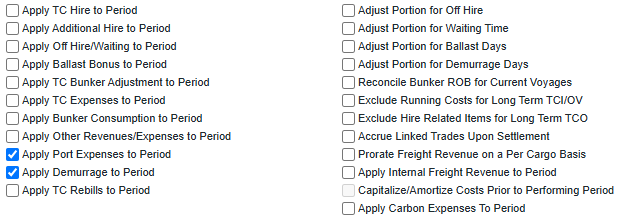

Monthly Accruals can be configured by configuration flags and each of these check boxes will impact the calculation of a certain type of P&L accounts. By selecting these options, you can modify certain areas of the P&L calculation, typically using a pro rata calculation or a more specific calculation for certain values. All of them can be selected by default through configuration flags so you do not need to select them every time you run the monthly accrual.

Setting up the P&L Calculation Options

CFGShowPNLCalcOptions must be enabled to use the P&L Calculation Options in Data Center > Settings.

Navigate to Data Center > Security > Select specific user > Click on Access Rights > Financials. Depending on your access right you or your IT admin will need to enable the following module rights:

Financials > Actions > Modify P&L Calculation Options.

With the Modify P&L Calculation Options Module Right selected under Financials Actions in Security, you can toggle the P&L calculation options on the Monthly Accruals, Voyage Period Journals, and Voyage P&L Summary Report forms. Without it, you can only use these forms with the P&L Options as set by the configuration flags beginning with Default P&L Calc.

Option Descriptions

Each of the following options has one or more possible configurations; for more information, see Related Configuration Flags on this page. These flags can be used to set the default states of the checkboxes.

If no P&L calculation options are changed from their defaults, all P&L items will be calculated according to configuration flag settings. Off Hire will be included in voyage duration and thus reflected in the Portion %.

Option | Description |

|---|---|

Apply TC Hire to Period | TC Hire will not be prorated; instead, TC Hire will be calculated based on the hire rate and actual voyage days in the period. CVE and commissions will be applied only to the period in which they occur. In Monthly Accruals, TC Commission will be applied to period when set as a percentage of the Hire in the contract. |

Apply Additional Hire to Period | For Time Charter voyages, 100% of an XHIRE (additional hire) amount is allocated to period based on TCIP (Time Charter In Payment) or TCOB (Time Charter Out Bill) Invoice Date. |

Apply Off Hire/Waiting to Period | Off Hire will be allocated to the actual period, that is, full deduction of Off Hire in the period when the Off Hire occurred. |

Apply Ballast Bonus to Period | Ballast Bonus and Ballast Bonus Commission for TCI and TCO will be allocated to period of voyage commencement. The P&L Period Range will begin before the voyage commences. |

Apply TC Bunker Adjustment to Period | For Time Charter voyages, 100% of a Bunker Adjustment amount is allocated to period based on operations ETA for delivery (TCO) or redelivery (TCI). For Time Charter Out Voyages, if the TCO Contract is set to Bunkers on Consumption, the Bunker Adjustment will be allocated to the period containing the departure from the Z port. |

Apply TC Expenses to Period | For TCIP and TCOB INTHC (Intermediate Hold Cleaning), ILOHC (In Lieu of Hold Cleaning), and VOYEX (Voyage Expenses), 100% of the line item amount is allocated to period based on the Invoice Date of the invoice in which it is included. Items included on incremental invoices will still be allocated based on their original invoice's date. |

Apply Bunker Consumption to Period | Bunker expense will not be prorated but calculated based on the actual consumed amount in the period. |

Apply Other Revenues/Expenses to Period | For invoice types VEXP (Voyage Other Expense, Lumpsum) and VREV (Voyage Other Revenue, Lumpsum), 100% of the invoice amount, including linked non-freight rebills, is allocated to period based on a specific date, determined by configuration. |

Apply Port Expenses to Period | 100% of a Port Expense amount, including linked non-freight rebills, is allocated to period based on a specific date, determined by configuration. |

Apply Demurrage to Period | When this option appears on a form, its effect depends on the values of configuration flags CFGDefaultPnlCalcApplyDemurrage and CFGDefaultPnlCalcAdjustForDemurrageDays; for more information, see Compliance with IFRS 15 & 16 Regulations. |

Apply TC Rebills to Period | When this flag is enabled, any TC Rebill line items will be recognized in the month of the accounting date of the original expense item when that expense is posted. When the original expense is not yet posted, the TC Rebill item will be recognized in the month of the invoice date of the original expense item. |

Adjust Portion for Demurrage Days | The portion percentage for other P&L items is adjusted based on the demurrage days in the period. |

Adjust Portion for Off Hire | Off-hire time is considered when determining the percentage. For example, if you have a 2-month voyage, and it is off-hire for the entire first month, the voyage will be considered 0% complete after the first month and 100% after the second month. If the check box is cleared, the system will consider the voyage 50% complete after the first month and 100% complete after the second month. |

Adjust Portion for Waiting Time | Waiting Time is considered when determining the percentage. For example, if you have a 2-month voyage, and it is waiting for the entire first month, the voyage will be considered 0% complete after the first month and 100% after the second month. If the check box is cleared, the system will consider the voyage 50% complete after the first month and 100% complete after the second month. |

Adjust Portion for Ballast Days | Load-to-discharge or delivery-to-redelivery is used as P&L recognition basis when the check box is selected. Otherwise, the full voyage duration is used as the basis. Voyage revenues and expenses will be allocated within the L/D period (for voyage charters) or Y/Z period (for TC Out voyages). Note that this does not impact revenues/expenses that are applied to the period; these will still be allocated to the period in which they were incurred. The change impacts any revenues and expenses that are prorated only. For more information, see Compliance with IFRS 15 & 16 Regulations. |

Reconcile Bunker ROB for Current Voyages | Accrual includes ROB rows up until the accrual period with new bill codes of the format ROB_FuelType in current voyages. The accrual basis is based on the ROB from the most current Activity Report in the accrual period rather than based on bunker planning estimation. For consecutive voyages, when no commenced voyage exists for the vessel, the most recently completed voyage is considered current. For non-consecutive voyages, all (except closed voyages) are considered as current. When running the Monthly Accruals for a TCTO with this option selected, only the net ROB (ROB minus the TCO delivery quantity) will be displayed. |

Exclude Running Costs for Long Term TCI/OV | There will be no accrual for Running Cost on OV vessels and vessels on Long Term TCI contract. |

Exclude Hire Related Items for Long Term TCO | For long-term Time Charter Out contracts (which is something that can only be defined via inter-company mirroring), exclude hire-related items, such as Hire, Off Hire, CVE, Hire Commissions, Off Hire Commissions, and Off Hire CVE, from P&L calculations. |

Accrue Linked Trades Upon Settlement | Only settled periods of trades linked to the Voyage P&L will be included in Monthly Accruals; exposed periods will be excluded. |

Prorate Freight Revenue on a Per Cargo Basis | When selected, the accruals program will use the BL Date for the individual cargo(s) and the BL qty for the cargo to calculate the accrual percentage and amount to accrue for freight when there are multiple cargoes on the voyage. |

Apply Internal Freight Revenue to Period | When selected, freight revenue with an internal counterparty on the voyage, excluding demurrage, will be 100% allocated to the period based on the BL Date for the contract. Demurrage will still be allocated according to the Apply Demurrage to Period option. When Adjust Portion for Ballast Days is also selected, its setting will take precedence. |

Accruals for Closed Voyages | When selected, the system will run accruals only for voyages that are marked as Closed during the specified Accrual Month. |

Capitalize/Amortize Costs Prior to Performing Period | When selected, the costs incurred between the Nomination Date and the Start of the First Load port will be capitalized and then amortized over the performing period as defined by the Start of First Load to the end of Last Discharge on the voyage. The amortization will happen as a percentage of the performing period completed on the accrual date. Costs incurred during the performing period will not be affected by this option. Requires CFGNominationDateonFixtureandVoyage to be enabled and specific business rules configuration. For more information, see Capitalization and Amortization Configuration and Calculation Details. |

Apply Carbon Expenses to Period | When selected, this will look at the actualized emissions recorded on the voyage based on the bunker consumption details actualized on the voyage and accrue based on that information instead of prorating across the voyage. When enabled along with the Capitalize / Amortize Costs Prior to the Performing Period profile flag on the accruals form, the emissions during the N-L window of the voyage will be capitalized and then amortized over the performing (L-D) period. Requires business rules to be created to support the new expense type. |

Option Availability

These options are available in several areas where P&L calculation is performed but may not be valid in all areas. This table shows where the check box will have an effect if used.

Table Legend

✓ = Option is applied to calculation/report

X = Option is not applied to calculation/report

Option | Period-Based Voyage P&L | Monthly Accruals | Voyage Period Journals | Voyage P&L Summary Report |

|---|---|---|---|---|

Apply TC Hire to Period | ✓ | ✓ | ✓ | ✓ |

Apply Additional Hire to Period | ✓ | ✓ | ✓ | ✓ |

Apply Off Hire/Waiting to Period | ✓ | ✓ | ✓ | ✓ |

Apply Ballast Bonus to Period | ✓ | ✓ | ✓ | ✓ |

Apply TC Bunker Adjustment to Period | ✓ | ✓ | ✓ | ✓ |

Apply TC Rebills to Period | ✓ | ✓ | ✓ | ✓ |

Apply TC Expenses to Period | ✓ | ✓ | X | ✓ |

Apply Bunker Consumption to Period | ✓ | ✓ | ✓ | ✓ |

Apply Other Revenues/Expenses to Period | ✓ | ✓ | X | ✓ |

Apply Port Expenses to Period | ✓ | ✓ | X | ✓ |

Apply Demurrage to Period | ✓ | ✓ | X | ✓ |

Adjust Portion for Demurrage Days | ✓ | ✓ | X | ✓ |

Adjust Portion for Off Hire | ✓ | ✓ | ✓ | ✓ |

Adjust Portion for Waiting Time | ✓ | ✓ | ✓ | ✓ |

Adjust Portion for Ballast Days | ✓ | ✓ | ✓ | ✓ |

Reconcile Bunker ROB for Current Voyages | ✓ | ✓ | X | ✓ |

Exclude Running Costs for Long Term TCI/OV | ✓ | ✓ | ✓ | ✓ |

Exclude Hire Related Items for Long Term TCO | ✓ | ✓ | X | ✓ |

Accrue Linked Trades Upon Settlement | ✓ | ✓ | X | ✓ |

Prorate Freight Revenue on a Per Cargo Basis | ✓ | ✓ | ✓ | ✓ |

Apply Internal Freight Revenue to Period | ✓ | ✓ | X | ✓ |

Accruals for Closed Voyages | ✓ | ✓ | X | X |