IMOS - Compliance with IFRS 15 & 16 Regulations

Home > Financials > Compliance with IFRS 15 & 16 Regulations

The following workflows and features support compliance with the following regulations:

IFRS 15

IFRS 15 (or ASC 606), Revenue from Contracts with Customers, affects the allocation and recognition of revenue. Under this regulation, the voyage operating entity is only allowed to recognize revenue when it satisfies a performance obligation of performing the voyage. Voyage expenses continue to be allowed to be capitalized and recognized on the same basis as revenue, following a revenue-expense matching principle.

Effective Date: IFRS 15 is effective for annual periods beginning on or after January 1, 2018.

Recognize Voyage Revenue Basis Load-to-Discharge or Delivery-to-Redelivery

For some clients and their auditors, IFRS 15 is interpreted that the voyage operating entity is not allowed to recognize revenue during the positioning of the ship into the load port. Instead of the discharge-to-discharge or redelivery-to-redelivery (or voyage completion percentage) recognition, the entity is expected to recognize basis load-to-discharge or delivery-to-redelivery.

When running Monthly Accruals or Voyage Period Journals, select P&L calculation option Adjust Portion for Ballast Days. Load-to-discharge or delivery-to-redelivery is used as P&L recognition basis when the check box is selected, otherwise, the full voyage duration is used as the basis. Voyage revenues and expenses will be allocated within the L/D period (for voyage charters) or Y/Z period (for TC Out voyages). Note that this does not have any impact on revenues/expenses that are applied to period; these will still be allocated to the period in which they were incurred. The change impacts any revenues and expenses that are prorated only.

To select Adjust Portion for Ballast Days by default, enable configuration flag CFGDefaultPnlCalcAdjustForBallastDays.

Note: Enabling this flag will also default this calculation option in advanced P&L reports in the Report Designer.

Recognize Demurrage Basis Demurrage Days

Under IFRS 15, demurrage must be recognized as a variable consideration. Under this regulation, future (estimated) demurrage cannot be accrued or deferred to future periods after the vessel has gone on demurrage. Demurrage must be allocated to the period in which it is realized.

When running Monthly Accruals or Voyage Period Journals, select the P&L calculation option Apply Demurrage to Period. The behavior of this check box depends on the following configuration flags:

CFGDefaultPnlCalcApplyDemurrage: There are three possible values:

PRORATE (default): Demurrage is prorated based on voyage proration logic: Voyage Days in Period / Total Voyage Days. The Apply Demurrage to Period check box is cleared by default; if the check box is selected, the calculation logic for BYDAYS is applied.

FULL: The Apply Demurrage to Period check box is selected by default, and 100% of a demurrage amount is applied to the P&L reporting period. (for this functionality to be applied, the following flag must also be enabled :

CFGLaytimeEnablePeriodAllocation )

BYDAYS: The Apply Demurrage to Period check box is selected by default, and the amount of demurrage in the P&L reporting period is prorated. The prorata portion is calculated by the following logic: For each port call, Prorated Demurrage Amount = (Number of Days at Port within Period / Total Number of Days in Port in Voyage) × Demurrage Amount.

CFGDefaultPnlCalcAdjustForDemurrageDays: When enabled, the portion percentage for other P&L items are adjusted based on the demurrage days in the period by default.

To quickly view demurrage period allocation details for a Laytime Calculation, open the Period Allocation form (configuration flag CFGLaytimeEnablePeriodAllocation must be enabled).

Capitalizing Expenses Between Nomination and Start of Loading and then Amortizing those Expenses over the Load to Discharge Performing Period

Certain interpretations of IFRS 15 require that expenses incurred following a nomination date of a vessel to a voyage and prior to the start of a performing period are to be capitalized to a balance sheet account and then amortized over the life of the performing period. In this interpretation the nomination date is a specific date when a vessel is nominated to perform a cargo operation and the performing period is from the Start of First Load activity to the completion of Last Discharge activity.

When running Monthly Accruals, select the P&L calculation option Capitalize/Amortize Costs Prior to Performing Period. The behavior of this checkbox depends on the configuration of other P&L calculation options and requires the CFGNominationDateOnFixtureAndVoyage configuration flag to be enabled.

More information on the recommended P&L calculation option configuration and the calculation logic that will be applied can be found in the sub-article here.

Creating Simulated Notifications for Management Reporting

In some organizations, it is required to calculate accruals both for compliance with IFRS 15 and for Management Reporting purposes using different configurations. This requires being able to have one set of accrual journals calculated, created and posted, while having another set just calculated but not posted. This second set that is not posted still needs to be sent downstream to a reporting system or separate General Ledger application.

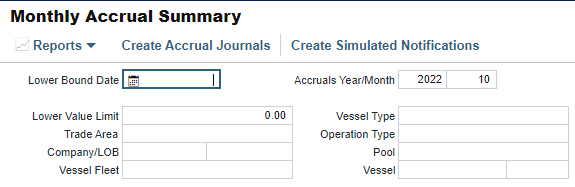

When the CFGCreateSimulatedAccrualNotifications flag is set to Y, a Create Simulated Notifications button will be present on the Accruals form. Clicking this button instead of the Create Accrual Journals will generate invoice messages to be sent do a downstream system without actually creating the journal in the Veson IMOS Platform.

Requires notificationsIncludeList to have ‘invoice’ included.

IFRS 16

Note: Configuration flag CFGEnableTCLeaseAccounting must be enabled.

Under IFRS 16 (or ASC 842), Leases, Time Charter contracts are categorized as leases. For leases of more than 12 months, IFRS 16 requires companies to recognize the total value (service cost, interest, and depreciation) of the leased asset (vessel) on the balance sheet of their books.

Effective Date: IFRS 16 is effective for annual reporting periods beginning on or after January 1, 2019, with earlier application permitted (as long as IFRS 15 is also applied). Configuration Flag CFGTCDefaultLeaseTransitionDate must be defined, in the format: yyyy-MM-ddThh:mm (for example, 2019-01-01T00:00).

Lease Accounting Business Rules

With the help of a Veson Nautical consultant, set up Business Rules for the following journal types.

Time Charter Period Journals

To transfer lease costs to your balance sheet, you can create Time Charter Period Journals. Each Time Charter Period Journal has the following line items, either initial or incremental:

Source Code | Bill Code | Description |

|---|---|---|

MLAJ | LIABILITY |

|

ROU_ASSET |

| |

BSDIFF |

| |

ACCDEP |

| |

ROU_REVERSAL | Reverses the previous period's ROU that was posted, regardless of whether or not there was a lease modification in the previous period. |

Lease Cost Journals

When you create Voyage Period Journals, lease line items are included:

Source Code | Bill Code | Description |

|---|---|---|

LCST | COHAD_REVERSAL | A reversal of the Address Commission for Off Hire Amount. |

COMAD_REVERSAL | A reversal of the TC Address Commission Amount. | |

OFFHI_REVERSAL | A reversal of the Running Cost Off Hire Amount. | |

TCHIR_REVERSAL | A reversal of the Running Cost Hire Amount. | |

LEASE_SERVICE | The value of the lease Service component. | |

LEASE INTEREST | The value of the lease interest expenses. | |

LEASE_DEPRECIATION | The value of the lease depreciation. |

Time Charter Lease Tab

On the TC In or TC Out Lease tab, you can set up lease accounting for the contract.

Lease Costs on the Voyage P&L

On the Voyage P&L, Lease Costs appear in a separate section with the following line items:

Hire Reversal: Reverses running cost hire line items, with Hire Reversal, Hire Add Comm Reversal, Off Hire Reversal, and Off Hire Add Comm Reversal subsections.

Service: Based on the Service Fee column on the TC Lease tab.

Interest: Based on the Interest Rate % column on the TC Lease tab.

Depreciation: The asset depreciation expense over time.

Lease Reporting

To report on leases, in the Report Designer, create a report that includes the Time Charter > Time Charter Lease and/or Time Charter Lease Service Schedule tables.