IMOS - Capitalization and Amortization Configuration and Calculation Details

Home > Financials > Compliance with IFRS 15 & 16 Regulations > IMOS - Capitalization and Amortization Configuration and Calculation Details

Overview

To meet the expense recognition requirements with certain interpretations of the IFRS 15 regulations, voyage costs incurred prior to the performing period of a voyage, and after a nomination date, will be capitalized and then amortized over the performing period as part of the month-end close process.

This page covers:

Required configuration and settings need to utilize the Capitalization and Amortization (Cap/Am) logic

Recommended P&L Calculation options

Details on how the calculations are performed when enabled

Key Terms:

Nomination Date - The date when a vessel is nominated to a cargo and used, along with voyage commencement, to determine the capitalization period

Performing Period - the timeframe from the Arrival at First Load Port to Departure from last Discharge

Required Configuration

Both CFGNominationDateOnFixtureAndVoyage and CFGShowPNLCalcOptions configuration flags need to be set to Y and CFGVoyaccAccrualType cannot be set to ‘Ops’ as Accrual by Account is required.

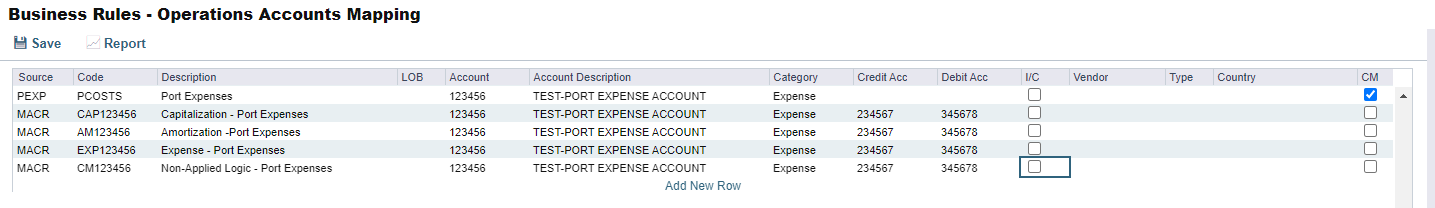

Business Rules

For the Cap/Am logic to apply to any cost category, the new ‘CM’ checkbox will need to be selected in the business rules for the matching Source:Code pair. Additionally, new MACR business rules are required with the following new prefixes:

CAP - to map those costs that are Capitalized based on the logic

Example: MACR: CAP123456, where 123456 is the account code

AM - to map those costs that are Amortized based on the logic

Example: MACR: AM234567, where 234567 is the account code

EXP - to map those costs that are expensed to the period based on the logic

Example: MACR: EXP345678, where 345678 is the account code

CM - To map all remaining journals that are generated by the accruals program when the Cap/Am flag is enabled, even though the logic does not apply to these items

Example: MACR: CM456789, where 456789 is the account code

Port Expenses Example:

PEXP: PCOSTS has CM checked indicating that the cost category is applicable for the Capitalization logic

MACR: CAP123456 is the matching capitalization rule

MACR: AM123456 is the matching amortization rule

MACR: EXP123456 is the matching expense rule

MACR: CM123456 is the rule for all other cost categories that match to the 123456 account code and do not have the CM checkbox selected

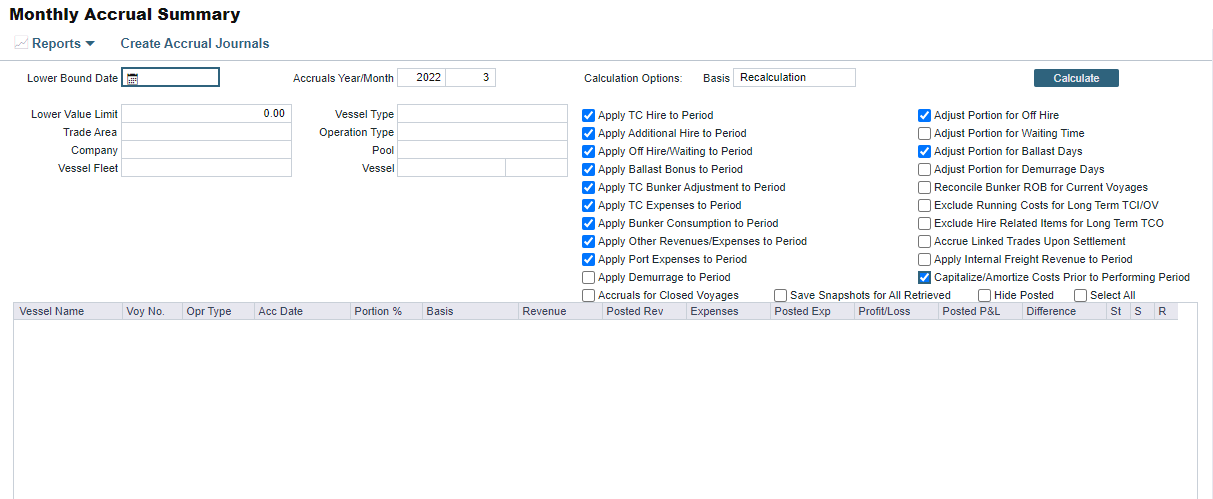

Minimum Recommended P&L Calculation Settings

Option | Impact on Logic |

|---|---|

Capitalize/Amortize Costs Prior to Performing Period | Will apply the capitalization logic to the expenses incurred between Nomination and Load on the voyage and then amortize those expenses over the performing period of the voyage |

Apply TC Hire to Period | It will ensure that TC Hire expenses incurred on a voyage prior to nomination will be expensed in the period. Additionally will ensure that TC Hire Expenses incurred during the performing period will also be expensed in the period. Leaving only the period from Nomination to Load to be Capitalized |

Apply Additional Hire to Period | It will ensure that additional TC Hire expenses incurred on a voyage prior to nomination will be expensed in the period. Additionally will ensure that additional TC Hire Expenses incurred during the performing period will also be expensed in the period. Leaving only the period from Nomination to Load to be Capitalized |

Apply Off Hire/Waiting to Period | It will ensure that Off Hire will be allocated to the actual period, that is, full deduction of Off Hire in the period when the Off Hire occurred. |

Apply Ballast Bonus to Period | It will ensure that any ballast bonus is allocated to the period of Voyage Commencement and therefore does not impact the Capitalization logic when nomination happens after commencement |

Apply TC Bunker Adjustment to Period | It will ensure that TC Bunker Adjustments incurred on a voyage prior to nomination will be expensed in the period. Additionally will ensure that TC Bunker Adjustments incurred during the performing period will also be expensed in the period. Leaving only the period from Nomination to Load to be Capitalized |

Apply TC Expenses to Period | It will ensure that any TC expenses incurred on a voyage prior to nomination will be expensed in the period. Additionally will ensure that any TC expenses incurred during the performing period will also be expensed in the period. Leaving only the period from Nomination to Load to be Capitalized |

Apply Bunker Consumption to Period | It will ensure that costs associated with Bunker Consumption incurred on a voyage prior to nomination will be expensed in the period. Additionally will ensure that costs associated with Bunker Consumption during the performing period will also be expensed in the period. Leaving only the period from Nomination to Load to be Capitalized |

Apply Other Revenues/Expenses to Period | It will ensure that Other Expenses incurred on a voyage prior to nomination will be expensed in the period. Additionally will ensure that Other Expenses incurred during the performing period will also be expensed in the period. Leaving only the period from Nomination to Load to be Capitalized |

Adjust Portion for Off Hire | Considers Off Hire when determining the percentage for the performing period in the amortization calculation |

Adjust Portion for Ballast Days | Applies Load-to-Discharge Revenue Recognition which is still required for IFRS15 compliance |

Apply Port Expenses to Period | It will ensure that Port Expenses incurred on a voyage prior to nomination will be expensed in the period. Additionally will ensure that Port Expenses incurred during the performing period will also be expensed in the period. Leaving only the period from Nomination to Load to be Capitalized |

Calculation Description and Example

When the Capitalize/Amortize Costs Prior to Performing Period P&L Calc option is enabled, the costs incurred between the nomination date and the start of the first load port will be capitalized and then amortized over the performing period as defined by the start of the first load to the end of last discharge on the voyage. The amortization will happen as a percentage of the performing period completed on the accrual date.

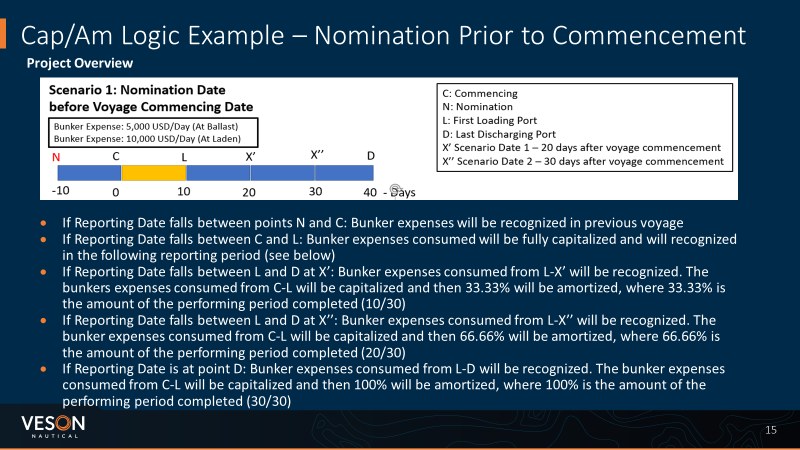

Example 1: Nomination prior to commencement date (most common)

This example uses bunker expenses but is applicable for all cost categories that have been set up with the ‘CM’ checkbox selected in the business rules.

The nomination date on the voyage is prior to the commencement date, indicating that this vessel was assigned to the cargo prior to the start of the voyage and that all ballast leg costs are to be capitalized and amortized over the cargo operations performing period.

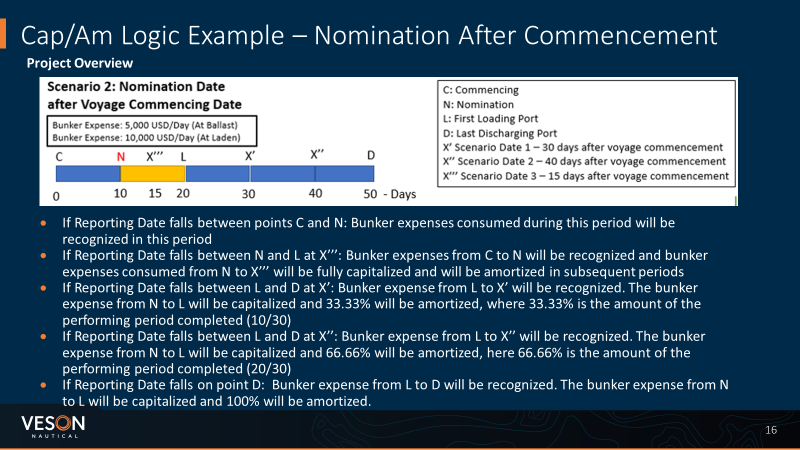

Example 2: Nomination after commencement date

This example uses bunker expenses but is applicable for all cost categories that have been set up with the ‘CM’ checkbox selected in the business rules.

The nomination date on the voyage is after the commencement date, indicating that the vessel was assigned the cargo after the start of the voyage and therefore incurred ballast leg costs that should not be capitalized and amortized over the cargo operations performing period.