IMOS - Time Charter Period Journals

Home > Financials > Time Charter Period Journals

Configuration flag CFGEnableTCLeaseAccounting must be enabled, and you must have the Time Charter Period Journals Module Right selected, under Period Closing in Financials.

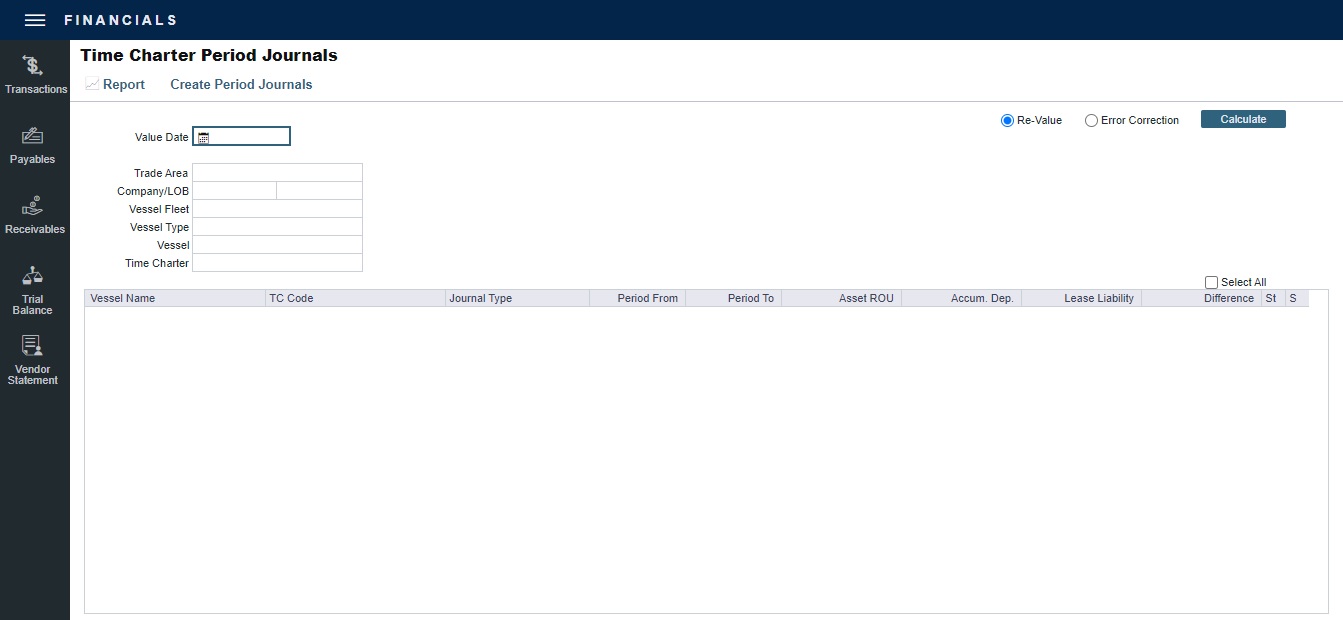

Expenses are incurred during a Time Charter that need to be transferred from the Balance Sheet. The Time Charter Period Journals form enables you to create Lease Transition Journals and Lease Cost Journals. When you then create Voyage Period Journals, lease line items are included.

For more information about the lease accounting workflow and IFRS 16, see Compliance with IFRS 15 and 16 Regulations.

Creating Time Charter Period Journals

Typically, Time Charter Period Journals are run when Time Charter redelivery is completed or at the end of the accounting period. For Time Charters that are in progress when the journals are run, journals will be overwritten the next time the journals are run.

Do one of the following:

On the Financials menu, under Period Closing, click Time Charter Period Journals.

Using the filters, you can create a list of journals that spans across multiple vessels/voyages. You can use multiple filters at the same time.

To filter by date, enter a Value Date. All Journal Types across all vessels appear, until that date.

Select a Trade Area, Company/LOB, Vessel Fleet, Vessel Type, Vessel, or Time Charter to further narrow the results.

Select Re-Value or Error Correction.

Click

Each Time Charter Period Journal has the following line items, either initial or incremental:

Source Code

Bill Code

Description

MLAJ

LIABILITY

Initial: A Credit entry of the journal; posted into a Liability-type ledger account.

Incremental: The value of change in Lease Liability as compared to initial journal.

ROU_ASSET

Initial: A Debit entry of the journal; posted into an Asset-type ledger account.

Incremental: The value of change in Right of Use Asset as compared to initial journal.

BSDIFF

Initial: A Debit entry of the journal; posted into a Retained Earning or Gain/Loss type ledger account.

Incremental: The value of change in BSDIFF, which should be zero.

ACCDEP

Initial: A Credit entry of the journal; posted into a Contra-Asset type ledger account.

Incremental: The value of change in Accumulated Depreciation, which should be zero.

ROU_REVERSAL

Reverses the previous period's ROU that was posted, regardless of whether or not there was a lease modification in the previous period.

To sort the columns, click the column headings.

On the context menu of each line item, you can:

Click Voyage Details to open the voyage in the Voyage Manager.

Click Preview Journal to open the Bill Viewer form. The Bill Viewer includes the details of the Journal.

Click Delete to delete all non-posted journal entries of a particular type that are linked to the voyage.

To select the records you want to post, select their check boxes in the S column, at the right, or select the Select All check box.

Click Create Period Journals. A message tells you that the journals have been generated and are ready to post.

To see a report with the details of all the Journal Entries to be generated in the calculation, click Report.

Posting Time Charter Period Journals

The Ready to Post Journals appear on the Voyage Manager Invoices list, Post Invoices list, and the Transaction Summary list with Counterparty name XJOURNAL.

To post the journals, see Post Invoices.