IMOS - Trial Balance, Balance Sheet, Income Statement

Home > Financials > Trial Balance, Balance Sheet, Income Statement

After fully closing the month, you can use the Trial Balance, Balance Sheet, and Income Statement which are built-in Financial reports to help summarize your company’s financial performance. The three financial statements are typically used when IMOS is used as your main accounting system.

NOTE: Only posted transactions manually entered or imported into IMOS during integration populate in these reports.

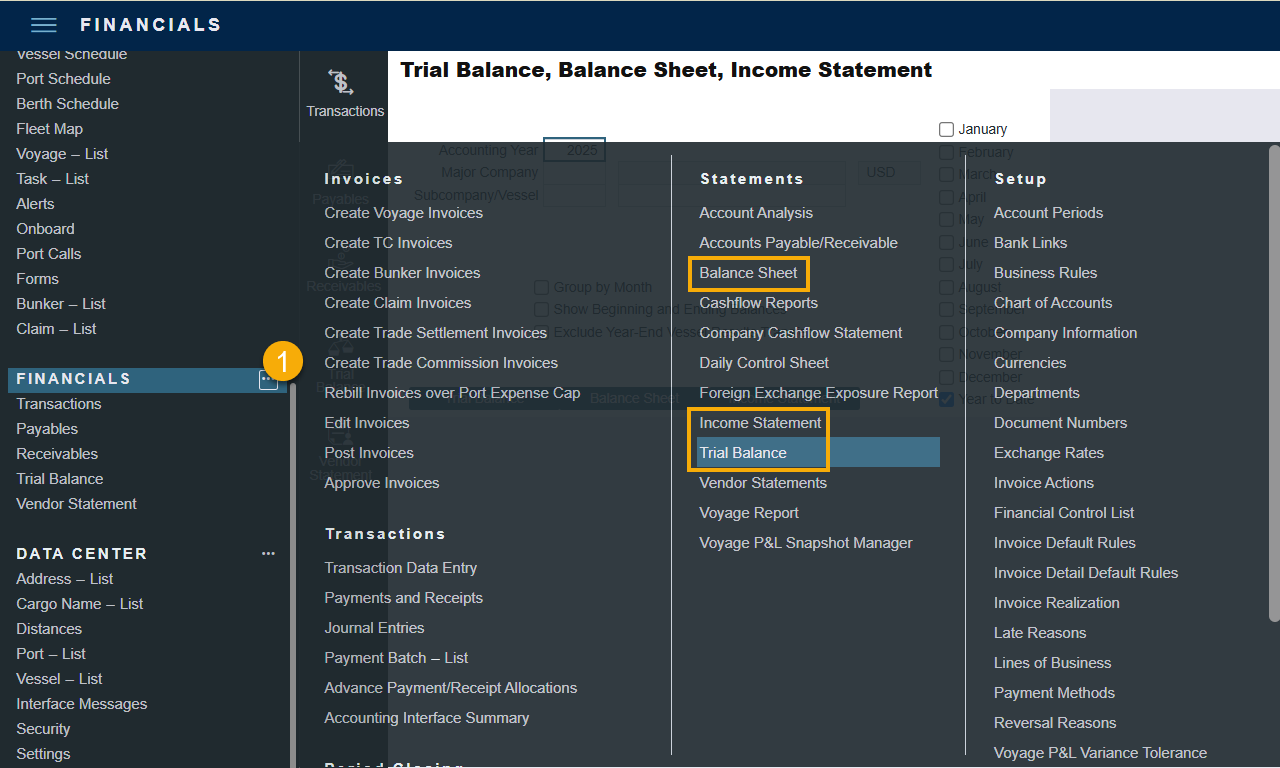

To access these reports please navigate to the Financials module.

Trial Balance: The purpose of the Trial Balance is to make sure a company’s general ledger is correctly balanced. This report provides the accounting departments information regarding the ending and starting balances for a given period for a specific company. It includes revenues, expenses, assets, and liability accounts summaries for the selected year and month(s), with totals for debits, credits, and the final balance.

Note: On the Account Periods form, if you do not enter a default Retained Earnings account, you may receive a large Unknown amount on your Trial Balance report. To rectify this, you will need to enter the default ledger code from the Chart of Accounts under the Retained Earnings field for the account period.

Balance Sheet: The Balance Sheet reports assets, liabilities, and equities for a IMOS company at a specific point in time. This report includes asset and liability accounts summaries for the selected month(s) and year (or year to date) with the total of debits, credits, and final balance. The beginning and ending balances for the selected period can be shown.

Income Statement: The Income Statement provides a summary of a company’s financial performance over a given period. This report includes revenue and expense accounts summaries for the selected year and month(s), with totals for debits, credits, and the final balance and profit (loss) for the specified period. The Income Statement report is run by users in IMOS to understand a company’s financial performance on an annual, quarterly, or monthly basis.

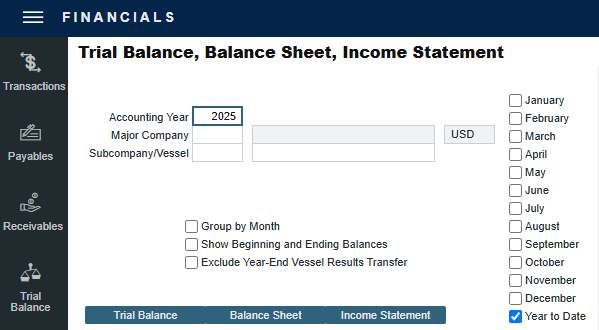

Report Options

Field Name | Mandatory/Optional | Description | Use When? |

|---|---|---|---|

Account Year | Mandatory | The Accounting Year for the Transactions to include based on the transaction Accounting Date. | Always. |

Major Company | Mandatory | A Type W company from the Address Book; this field will determine which transactions are included in the report. | Always. |

Subcompany/Vessel | Optional | A filter of Vessel Code or Subcompany Code. When the Company/Vessel Code is entered, the full name of the Vessel or Company populates in the field on the right. | When you want to view the report of transactions that are only related to a certain Vessel or Subcompany. |

Group by Month | Optional |

| When you want to view the balance of the GL account codes month by month |

Show Beginning and Ending Balance | Optional | Select to include two additional columns (Beginning Balance and Ending Balance) to show the beginning and ending balance of the GL accounts. | When you want to view the beginning and ending balances of the GL accounts |

Exclude Year-End Vessel Results Transfer | Optional | Select to exclude the year-end vessel results transfer from the report. | When you want to exclude the year-end vessel results transfer from the report |

Month selection check boxes | Optional | Select the particular month(s) or Year to Date as the reporting period. If none of these check boxes are selected, all transactions of the accounting year will be included in the report. | When you want to select particular months instead of the full accounting year to be reported |

Trial Balance | Optional | Button to generate Trial Balance upon the selected options. | When you want to generate a Trial Balance |

Balance Sheet | Optional | Button to generate Balance Sheet upon the selected options. | When you want to generate a Balance Sheet |

Income Statement | Optional | Button to generate Income Statement upon the selected options. | When you want to generate an Income Statement |