How do I troubleshoot bunker variances for Model B setup?

Allocating Period Costs to Voyages

With regards to Financials workflows in the Veson IMOS Platform (IMOS), there are two ways in which a company can allocate period cost to a voyage:

Model A: Invoices are considered prepayments and suspended in the balance sheet.

Model B: Invoices are considered expenses and immediately posted in the P&L.

For more information on these two workflows, see Allocating Period Cost to Voyages.

While both models are functional and require proper accounting procedures, Model B, in particular, will require you to be a little more meticulous in performing voyage/month-end closure in order to avoid variances in the P&L.

Below are some common reasons for bunker variances occurring and some quick checks which can be performed to troubleshoot the issue:

Quick Checks

Start by checking if:

If all of the above tasks are done, then some additional next steps are required to find out what is causing the variances. See Next Steps for further diagnosis.

Bunker Invoices Are Posted

In Model B, bunker liftings are recognized in the Voyage P&L. When bunker invoices are not posted, the P&L will register a variance even after the Voyage Period Journal (VPJ) is run.

The following are reasons why bunker invoices may not be posted:

A user may have forgotten to post them.

Paid By and For Account are not filled out properly for bunker liftings. For more information on this, see Bunker Liftings and Paid By/For Account Impacts.

Paid by: The party that is directly paying the bunker vendor.

For Account: The party that owns the bunkers, which may not necessarily be the party that pays for it. Filling out Paid By and For Account correctly enables the operator to claim/pay for bunkers through the TC.

When bunker invoices are posted and the P&L registers a variance before or after the Voyage Period Journal (VPJ) is run. The user may have entered the fuel price under the incorrect column i. e. "Other Prc“. To fix this issue, the fuel price needs to be entered in the correct column "Basic Prc“.

Time Charter Payment/Bill for Delivery/Redelivery Bunkers Are Raised

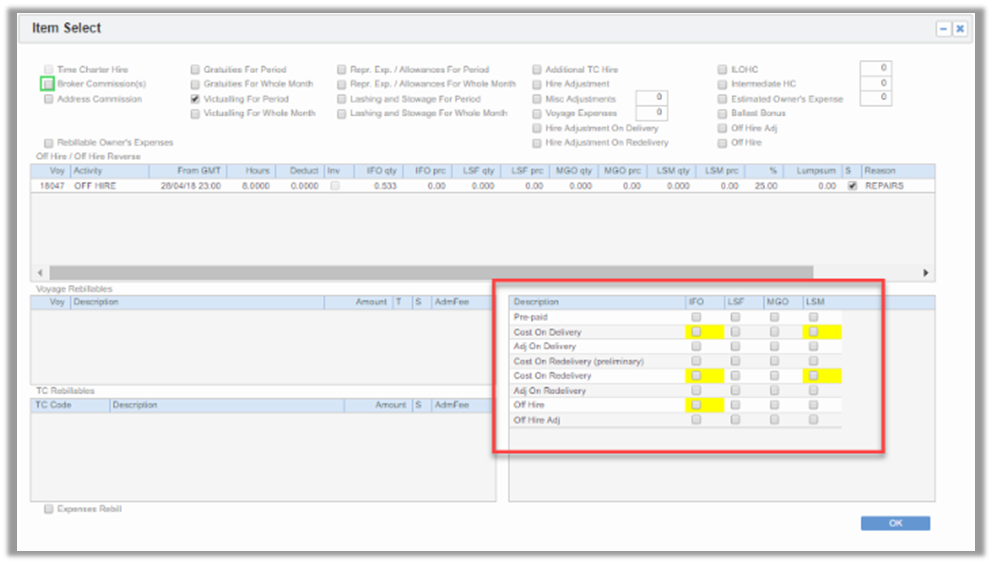

Operators may not have paid/billed for TC bunkers. When making a payment or issuing a bill, in the item select screen, IMOS will prompt the operator for any outstanding bunker payments/claims with yellow highlights as seen below.

Voyage Period Journal Has Been Run

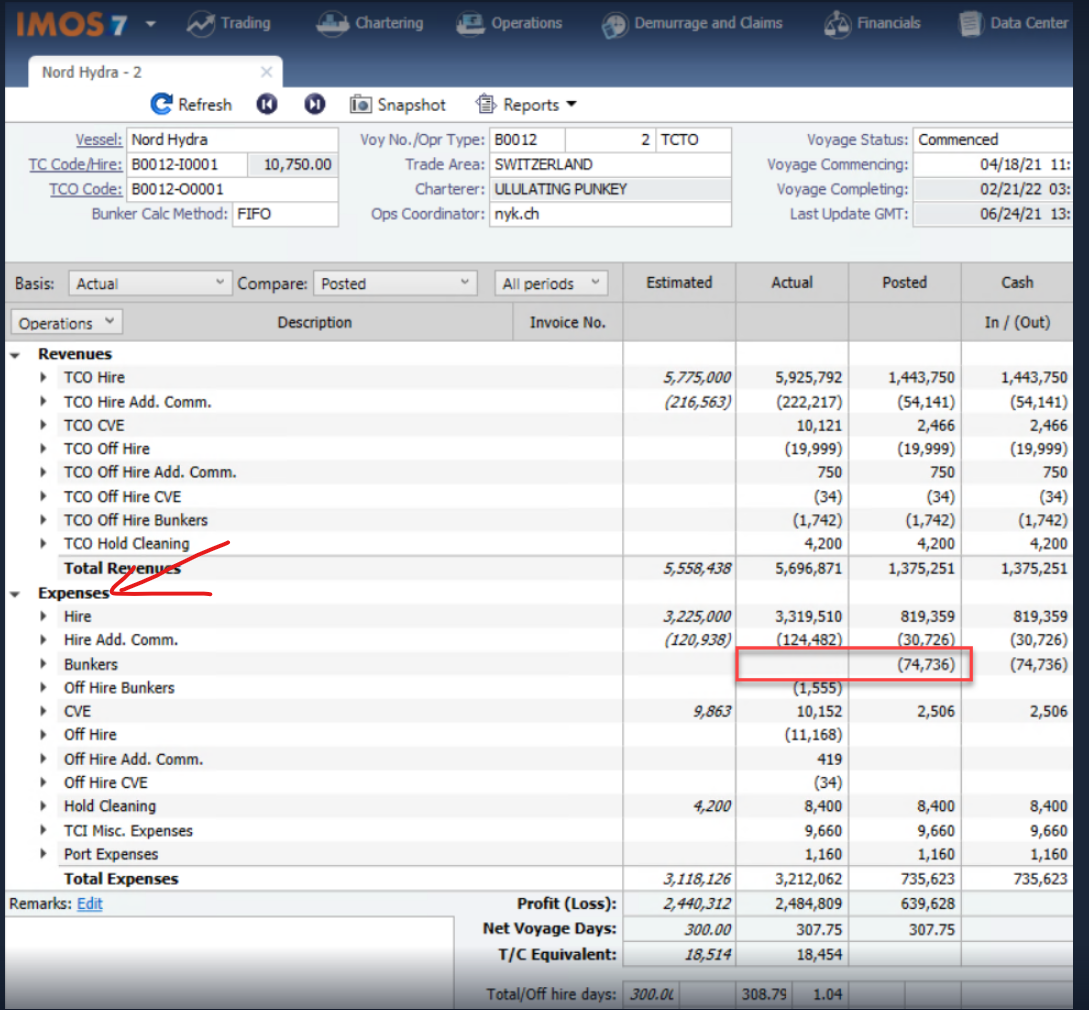

In Model B accounting, bunkers are consumables to be expensed and tracked in the Voyage P&L, unlike Model A where bunker inventories are capitalized as assets in the balance sheet. In this scenario, the VPJ needs to be run to move bunker inventory from the P&L of one voyage to another.

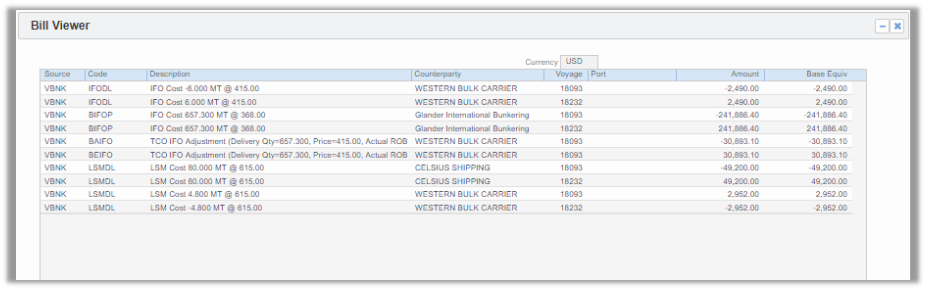

As seen in the image below, bunkers are credited from the current voyage expense and debited into the next voyage's P&L expenses:

If the voyage number in the Bill viewer of the VPJ shows the same number throughout then it could only be one of the two scenarios below:

The voyage is the last voyage or there is no consecutive voyage.

The Consecutive Voyage check box of the next voyage is not selected.

Next Steps

Analyze the P&L for Certain Patterns

The following patterns might indicate an issue that needs to be resolved:

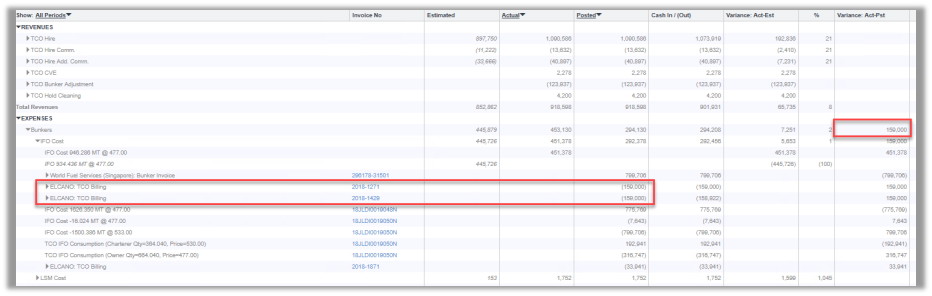

Variance amount tallies with a transaction

Check bunker adjustments. These adjustments usually appear when there is a price difference between Actual End ROB and Redelivery quantity or price. One of the common causes is the initial bunker (delivery bunker) quantity/price not tallying with the TC delivery bunker quantity/price. Confirm the correct quantity/price and amend it in the voyage/TC.

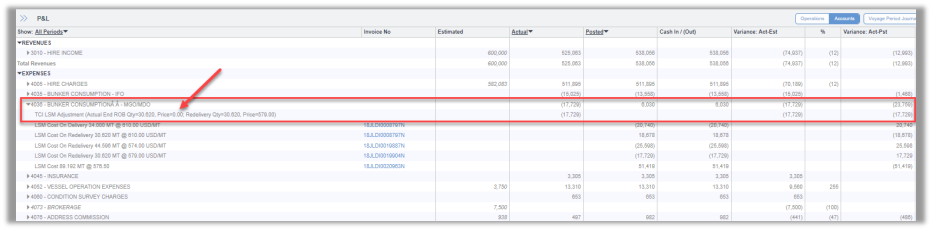

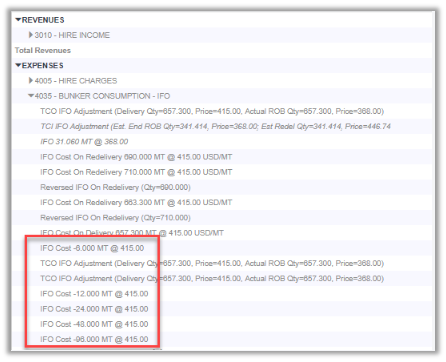

Odd, consistent patterns. For example, a bunker quantity doubling up in each transaction line such as that the image below.

Such patterns are likely to be caused by Bunkers on Consumption not being selected on the TC Out contract. When the VPJ is run, the amounts for the TC Out voyage will keep doubling up.

Other Reasons

Financial Adjustments to Bunkers

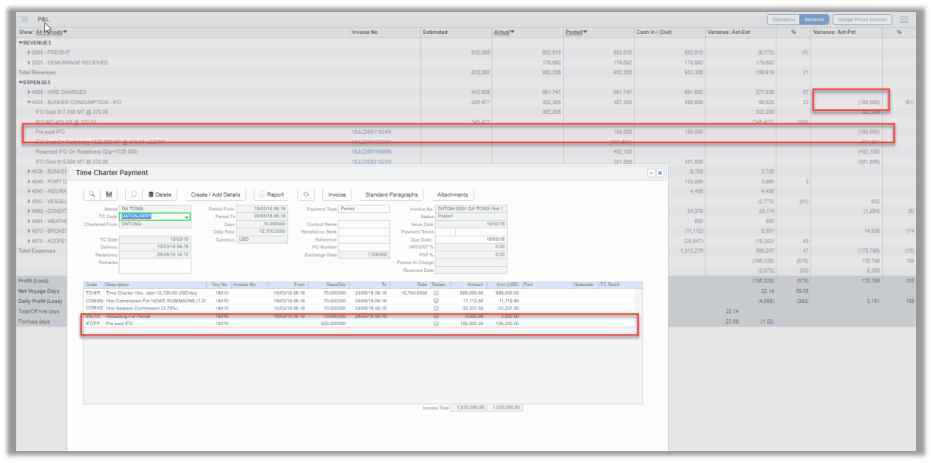

Running VPJ moves only the value of physical bunkers from one voyage to another. Financial adjustments to bunkers are not picked up by VPJ. IFOPP is one such example of a financial adjustment related to bunkers. The option used to create the IFOPP is prepaid bunker in the item select.

Time Charter Status

Another scenario for TC Out bunker adjustment variance that occurs is when the link of the TC is broken and the status of the TC is not updated.

Ensure that, when the OVTO/TCTO voyage is complete, the TC contract reflects Redelivered. The Veson IMOS Platform will then perform the necessary calculations to account for bunker adjustments.

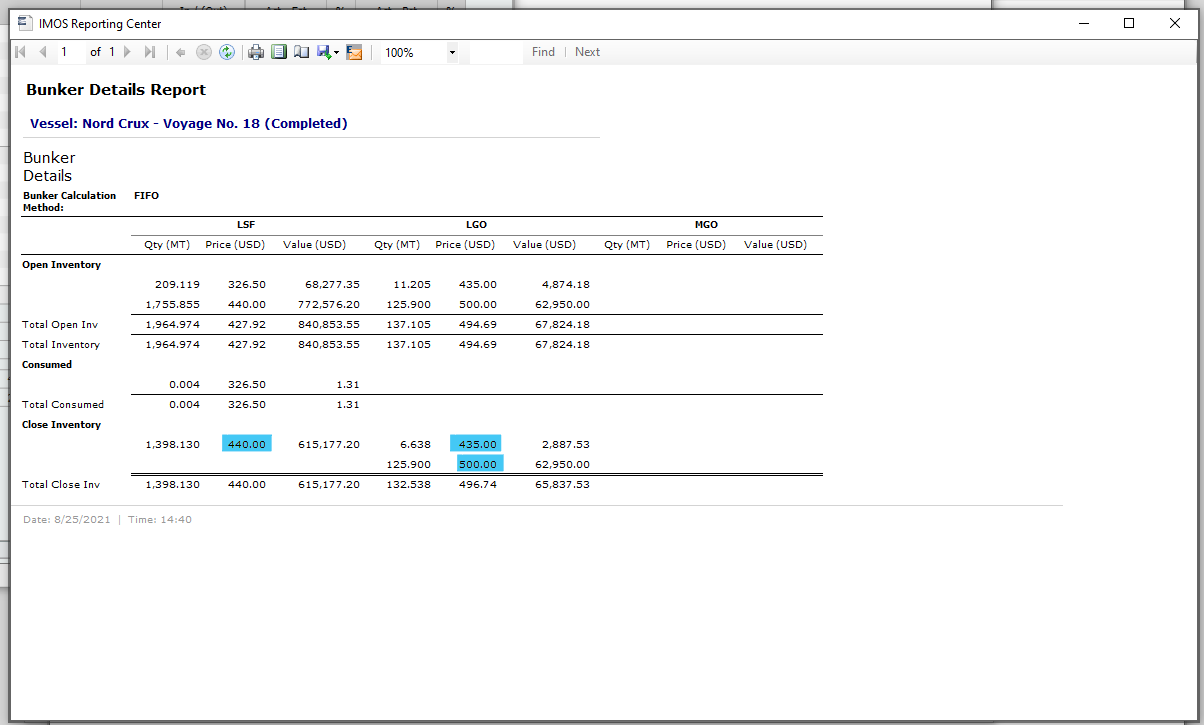

Where does the Posted P&L value for bunkers coming from?

Use Voyage → Pnl tab → Voyage Bunker Details report (on desktop) - or Voyage → Voyage Performance Report → Bunker Details check in the Veson IMOS Platform - to see the inventory on a previous voyage where the TCO is marked “Bunker on Consumption” - and thus we we preserve our FIFO during TCO and transfer closing inventory at our FIFO price (not at TCO contract price) - to see the closing inventory and its value ($681,014.73 in this case);

This value gets transferred to the next voyage as an opening inventory - then add the TCO delivery bunkers invoiced to it - and voila - that’s what you get in the Posted column for Bunkers on the next voyage.