How to set up Lease Accounting Business rules for different scenarios

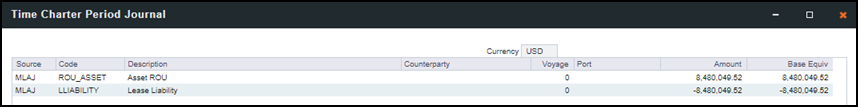

Initial Time Charter Period Journal

When running the Time Charter Period Journal for the first time, the future cash flow for the Time Charter is capitalized to the balance sheet.

You will need to set up the following Business Rules:

Source Code | Bill Code | Description |

|---|---|---|

MLAJ | ROU_ASSET | This is to debit the ROU asset account with the entire lease value. |

LLIABILITY | This is to credit the lease liability account. |

Initial Time charter Period Journal with Transition

When running the Time Charter Period Journal for a TC starts before 1/1/2019 (or any value according to the flag CFGTCDefaultLeaseTransitionDate), and the capitalization should happen only after 1/1/2019. We call it a “Transition”.

You will need to set up the following business rules:

Source Code | Bill Code | Description |

|---|---|---|

MLAJ | ROU_ASSET | This is to debit the ROU asset account with the entire lease value. |

ACCDEP | This is to debit the Accumulated Depreciation account from the beginning of the TC till 1/1/2019 (or any value according to the flag CFGTCDefaultLeaseTransitionDate). | |

LLIABILITY | This is to credit the lease liability account with the lease value after 1/1/2019,

| |

BSDIFF | This is to credit the retained earning account with the difference between the Book value of the Asset on 1/1/2019 and the lease liability.

|

Lease Modification

When there is a modification to the lease period, discount rate or hire rate, the Time Charter Period Journal will need to be rerun to get a new ROU_Asset value. The date on which the change happens is called the Modification date

Modification date:

The Modification Date refers to the Time Charter Period Journal Value Date.

The Forward Periods refer to lease periods starting from the Modification Date.

Ie. Time Charter Period Journal Value Date field should be populated with the date when modification happens.

You will need to set up the following business rules:

Source Code | Bill Code | Description |

|---|---|---|

MLAJ | ROU_REVERSAL | This business rule should use the ROU asset account.

|

ROU_ASSET | This business rule should use ROU asset account.

| |

LLIABILITY | This business rule should use lease liability account

| |

ROU_MOD | This business rule should use either ROU asset or ROU accumulated depreciation account.

| |

LL_MOD | This business rule should use a Liability account.

|

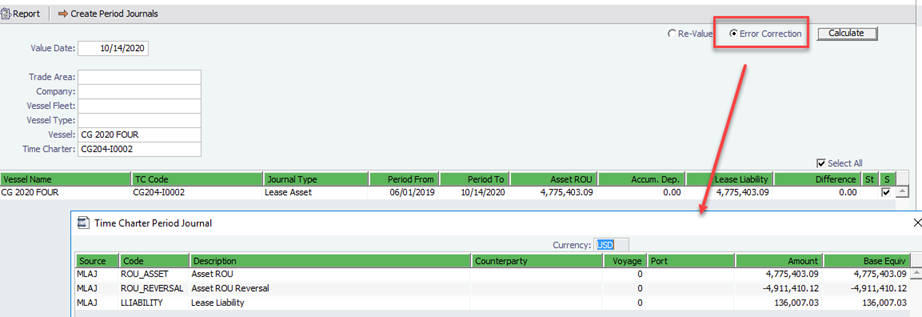

Error Correction

The Error Correction function can be used to correct any errors when a wrong parameter (interest rate, hire rate, service fee etc.) is entered for the last Time Charter Period Journal.

It will recalculate the last Time Charter Period Journal based on the new parameters

You will need to set up the following business rules:

Source Code | Bill Code | Description |

|---|---|---|

MLAJ | ROU_ASSET | This is to debit the ROU asset account with the new value (after the error correction) of the ROU_ASSET. |

ROU_REVERSAL | This is to credit the ROU asset account with the old value (before the error correction) of the ROU asset | |

LLIABILITY | This business rule should use lease liability account

|