IMOS - Pooling Distribution Calculation Details

Home > Pooling > Pooling Distribution Calculation Details

The Pooling Distribution form shows the final result; this page describes how those numbers are calculated. The calculations on this page are based on using configuration flag CFGUsePostedInPooling.

Example Scenario

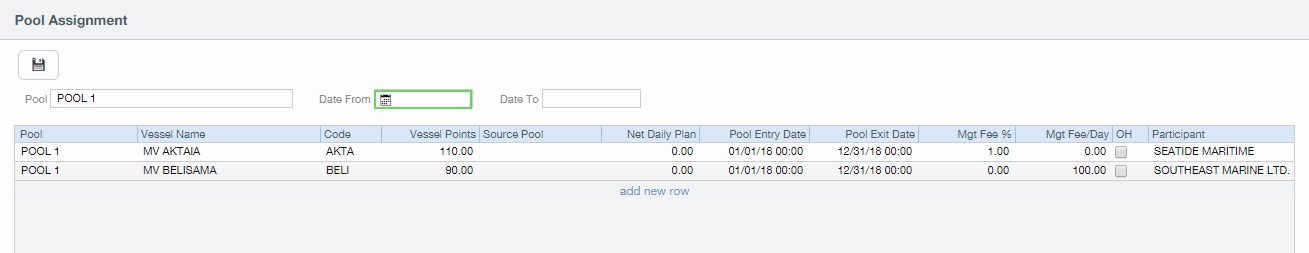

Number of pool Participants: 2 vessels

Management Fee: $100 per day

How the Income Before Pooling is Derived

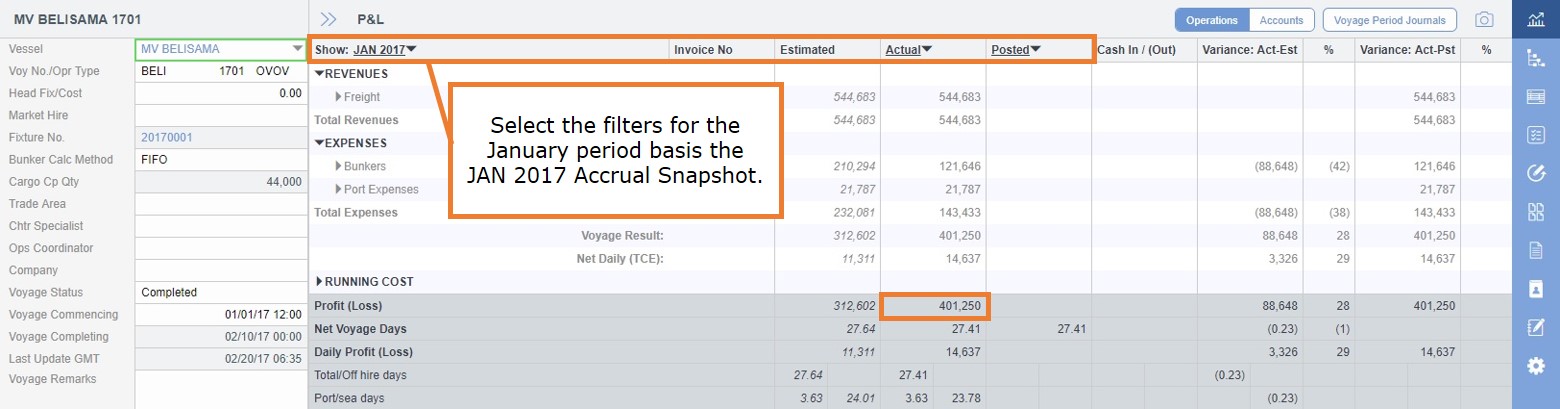

The Income Before Pooling (Income BP) is derived from the Monthly Accrual Snapshot.

If After Profit Share is selected for a Pool, its Income BP = Net Voy Profit = Voyage Result – Profit Share.

For the two vessels in the example pool:

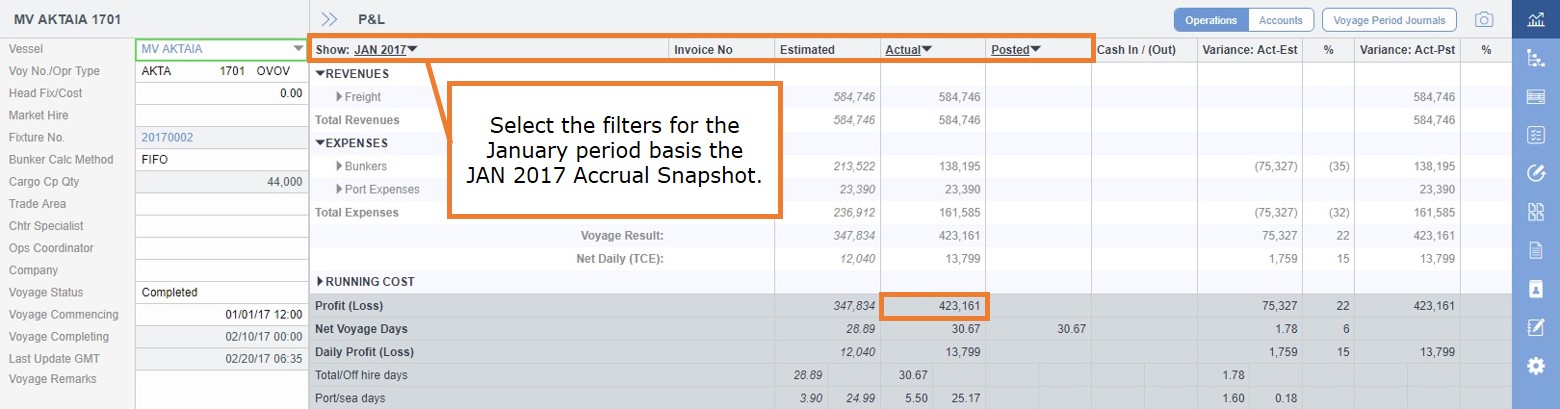

MV AKTAIA:

Income from January on the Jan 2017 Snapshot = $423,161

On-hire days = 30.6667 days

Vessel Points = 110

MV BELISAMA:

Income from January on the Jan 2017 Snapshot = $401,250

On-hire days = 27.4132 days

Vessel Points = 90

Formulas for Income After Pooling and On-Hire Days

The example pool has one Pooling Distribution period, for which:

Y = Total Income BP

X = Number of pool vessels

The formula to calculate the Income After Pooling (Income AP) for one participant is: (Y * on-hire days of the Participant's vessel * Vessel Points of the Participant's vessel) / (X * on-hire days * Vessel Points)

On-hire days are calculated as: voyage days – off-hire days

How the Income After Pooling is Derived

This formula is used to calculate Income AP based on Income BP:

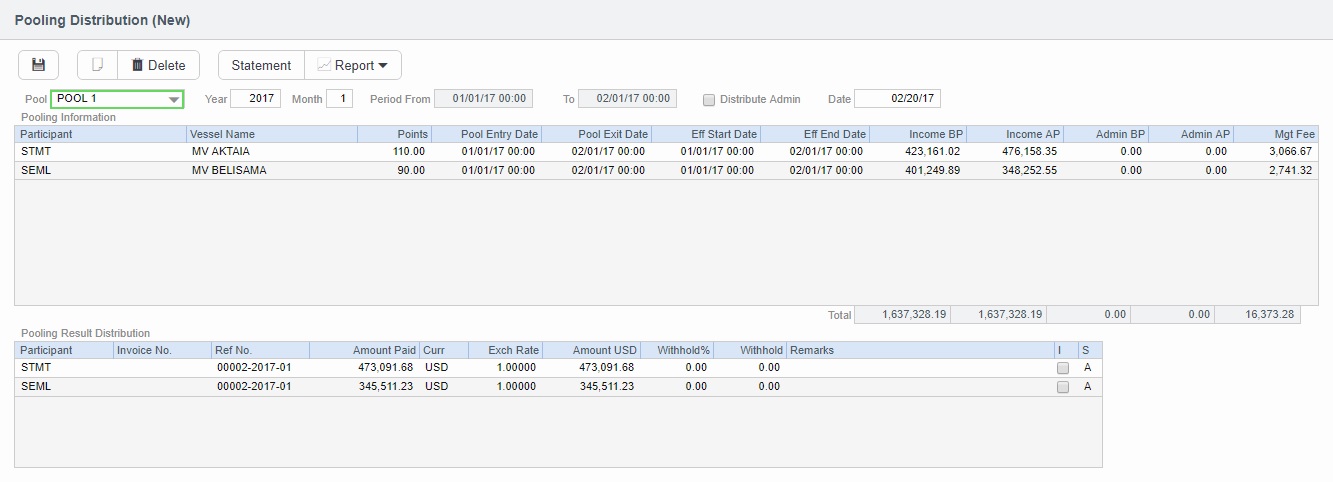

For MV AKTAIA: Income AP = ($423,161.02 + $401,249.89) * (30.66667 days * 110) / (30.6667 days * 110 + 27.4132 days * 90) = $476,158.35

For MV BELISAMA: Income AP = ($423,161.02 + $401,249.89) * (27.4132 days * 90) / (30.6667 days * 110 + 27.4132 days * 90) = $348,252.55

MV AKTAIA | MV BELISAMA | ||||

|---|---|---|---|---|---|

Data source | Voyage Period | Income BP | Income AP | Income BP | Income AP |

Pooling Distribution, as calculated in January | JAN | $423,161.02 | $476,158.35 | $401,249.89 | $348,252.55 |

The same information is displayed in Pooling Distribution for January 2017:

Note: Eff Start Date and Eff End Date fields have been added to the Pooling Distribution form.

How the Previous Month Adjustments are Incurred and Calculated

The Voyage P&L is dynamic when the vessel is still at sea. The Voyage P&L could be distributed in a past distribution period according to the Voyage P&L accrual snapshot in that particular period, but some voyage expenses and revenues are only incurred and posted in a later distribution period. Under this circumstance, Pooling Distribution captures this change and adds previous month adjustment components into the Pooling Distribution.

If the Vessel Points are revised for previous periods, or if off-hire days are entered for previous periods, the Pooling Distribution form also captures these changes and calculates the new Income AP for that period minus the old Income AP for that period as the previous period adjustments.

In summary, any changes to the Income BP, Vessel Points, and on-hire days of a vessel to the past period are captured. The new Income AP is then calculated for that period, basis the latest information, and the difference between the new Income AP and the old Income AP is shown as previous period adjustments.

In the following example, where the Income BP changes for a pool vessel MV AKTAIA, you can see how the previous adjustments are calculated.

Example of Previous Month Adjustments Due to Change in Income BP

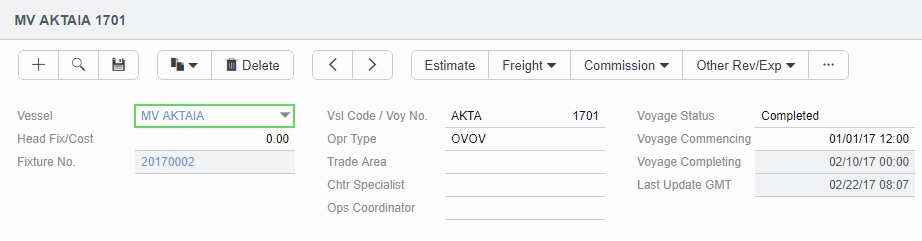

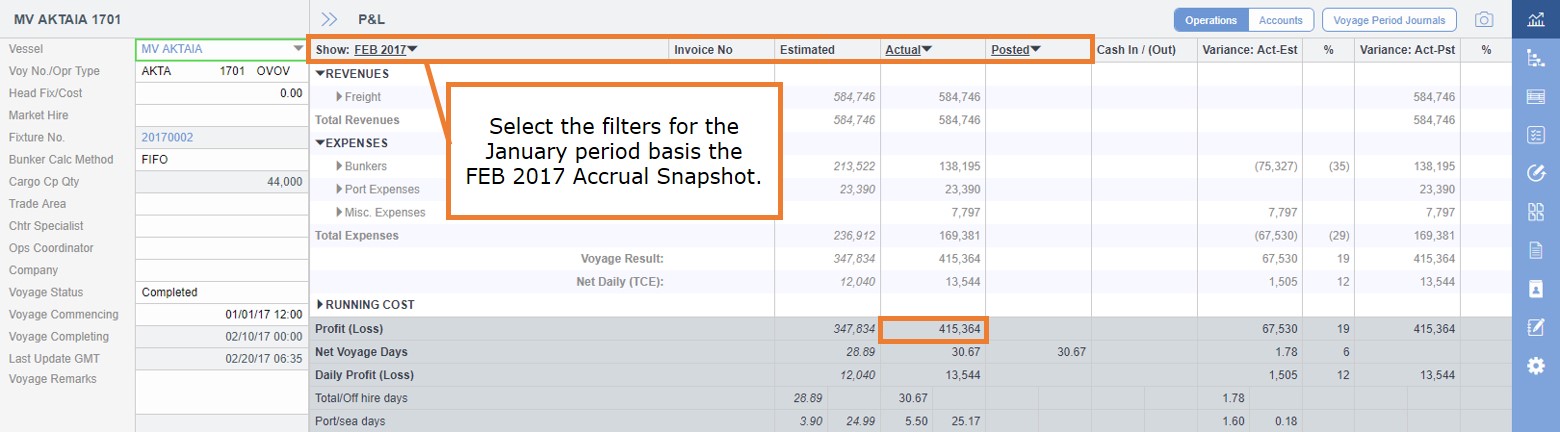

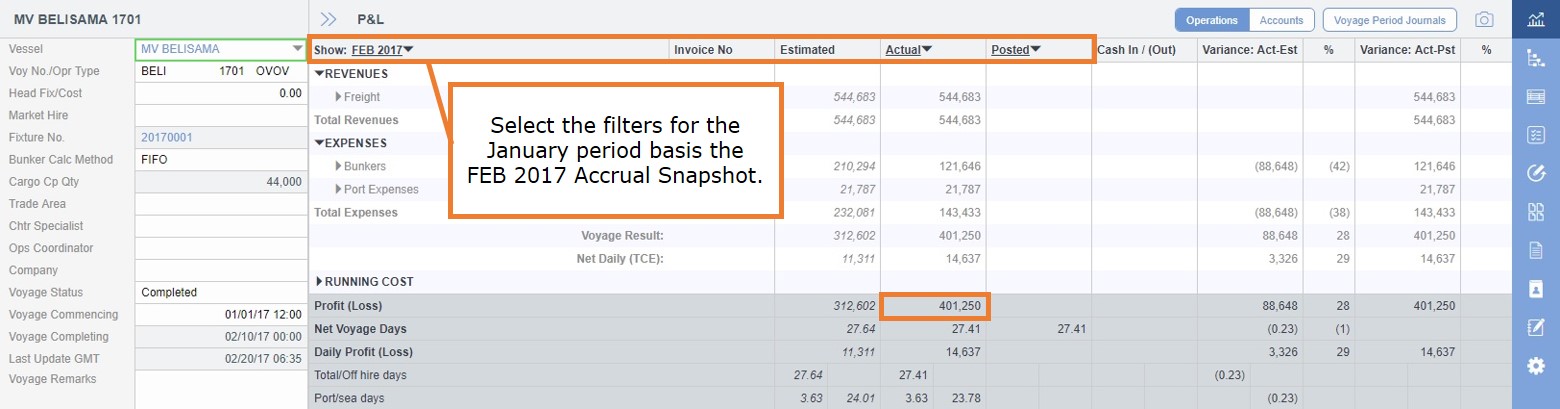

The voyage MV AKTAIA 1701 commences in January and completes in February:

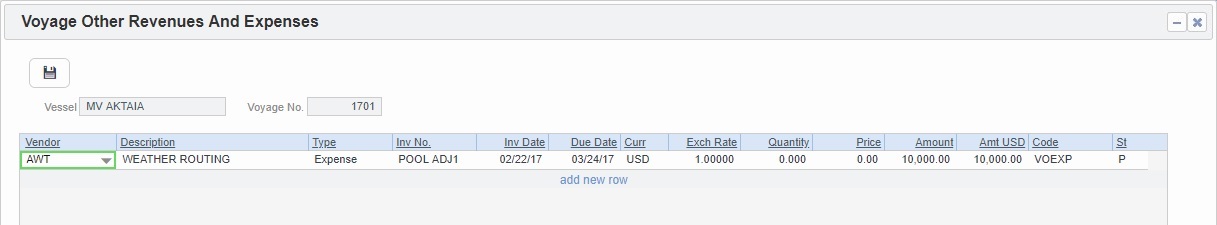

There is one WEATHER ROUTING expense of $10,000 that was not posted before the Pooling Distribution in January was running, so it is not captured in January’s result and distribution.

Later in February, this expense was posted, so the Feb Pooling Distribution captures this change, and there are no other changes.

Income BP changes for Jan period in Feb: –$10,000

To determine the voyage result of January when looking from February, in the Voyage P&L, check the snapshots for Feb 2017 Accruals during the period Jan 2017:

The following is a recap of the calculation of January’s distribution, performed above:

MV AKTAIA | MV BELISAMA | ||||

|---|---|---|---|---|---|

Data source | Voyage Period | Income BP | Income AP | Income BP | Income AP |

Pooling Distribution, as calculated in January | JAN | $423,161.02 | $476,158.35 | $401,249.89 | $348,252.55 |

With the adjusted figure for January’s distribution, and taking in the new P&L number from February’s accrual snapshot, the calculation changes to:

For MV AKTAIA: Income AP = ($415,364.09 + $401,249.89) * (30.66667 days * 110) / (30.6667 days * 110 + 27.4132 days * 90) = $471,655.23

For MV BELISAMA: Income AP = ($415,364.09 + $401,249.89) * (27.4132 days * 90) / (30.6667 days * 110 + 27.4132 days * 90) = $344,959.10

MV AKTAIA | MV BELISAMA | ||||

|---|---|---|---|---|---|

Data source | Voyage Period | Income BP | Income AP | Income BP | Income AP |

Pooling Distribution, as calculated in January | JAN | $423,161.02 | $476,158.35 | $401,249.89 | $348,252.55 |

February Monthly Accrual Snapshot | JAN | $415,364.00 | $471,655.23 | $401,249.89 | $344,959.10 |

The adjustment amount for January, in the Pooling Distribution period February, is:

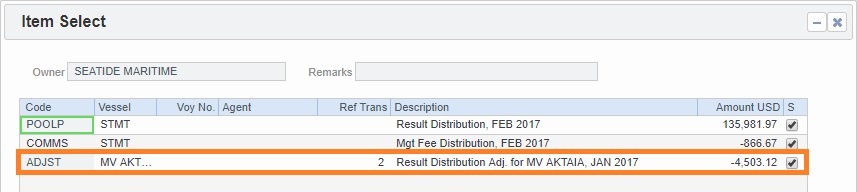

For MV AKTAIA: $471,655.23 – $476,158.35 = –$4,503.12

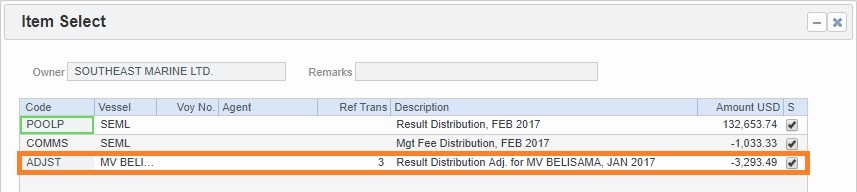

For MV BELISAMA: $344,959.10 – $348,252.55 = –$3,293.49

When running the Pooling Distribution for February, in the Pooling Result Distribution grid, right-click a Participant line and then click View payment details. On the Item Select form, line items appear with the Description Result Distribution Adj. for VESSEL NAME, JAN 2017: