IMOS - Profit Share - Time Charters

Home > Time Charters > Profit Share - Time Charters

Profit Sharing enables recording and storing profit share agreements on a Time Charter (TC) In or Head Fixture and using this data for payments and Trading calculations.

Profit Sharing Contracts

For profit sharing contracts with the Owner and other counterparties, you can record profit share contracts and issue invoices based on linked voyages.

On the TC In or Head Fixture:

Click Profit Sharing.

When configuration flag CFGTcJointVenture is enabled, click Profit Sharing and then click Profit Sharing Contracts.

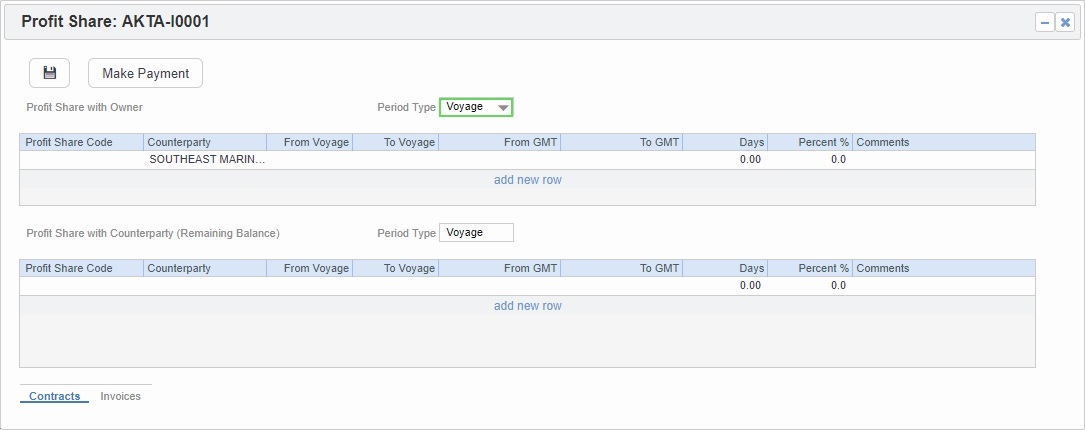

Contracts Tab

The Contracts tab has two sections.

In each section, record profit share contracts for a specific Period Type.

Profit Share with Owner

Profit Share with Counterparty

The Counterparty can be any Address Book contact other than the Owner.

The Counterparty profit share is applied to the balance remaining after profit sharing with the Owner.

In both sections:

To Voyage: For an in-progress TC with voyages that are not yet created, if Period Type is Voyage, leave this field blank to have it default to the latest voyage associated with the contract. When making subsequent payments for the same counterparty, previous payments will be reversed and recalculated on the invoice along with the addition of any newly created voyages.

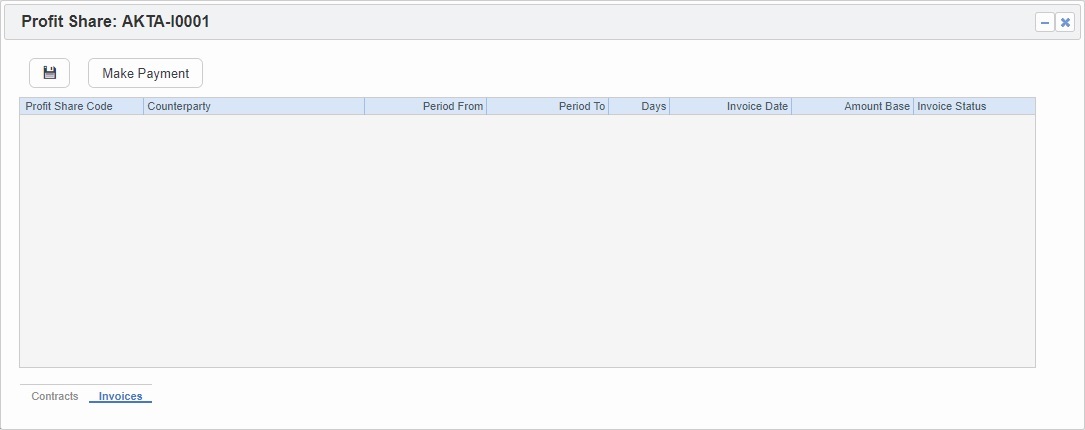

Invoices Tab and Payment

On the Invoices tab, to create an invoice, which is a payment for the profit share counterparty, click Make Payment.

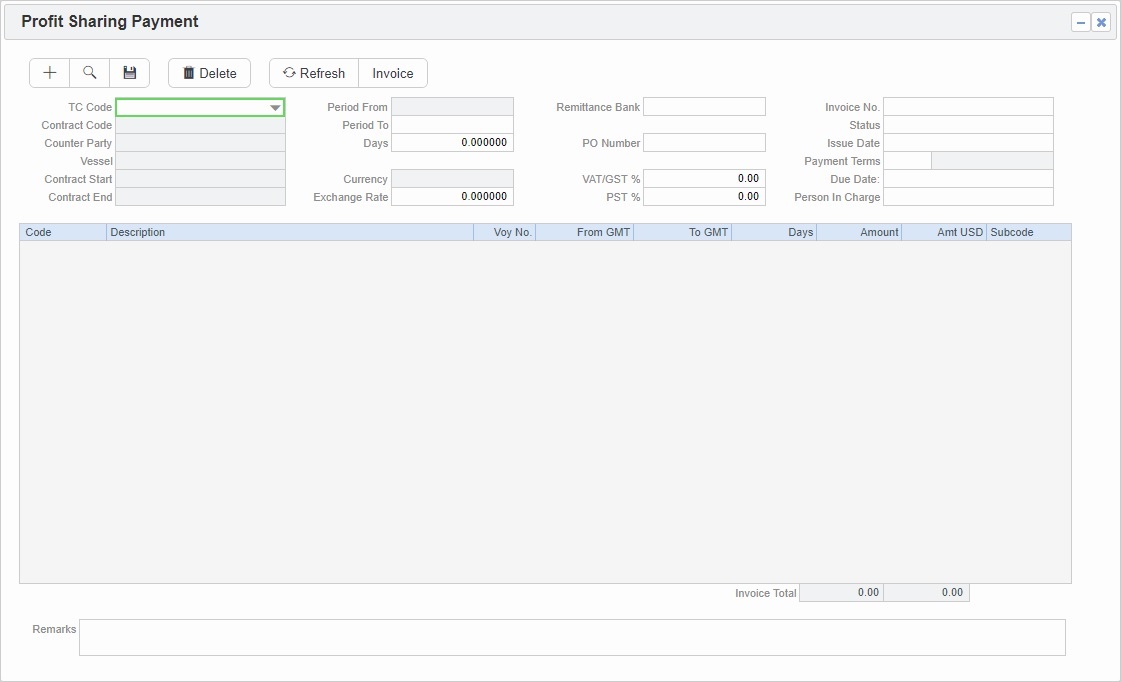

On the Profit Sharing Payment form:

Each line item represents a percentage applied on an overlapping voyage.

The amount is the profit share percentage applied on the prorated voyage P&L for that period.

Invoices are issued incrementally: Previous invoices are reversed, and the invoice is recalculated with the most up-to-date voyage P&L.

For every line item, a Subcode can be specified, to apply different Business Rules. The following Business Rules are required; both should be assigned to a Balance Sheet account.

TCPS: TCPNLSHARE: For the profit share amount

TCPS: PSADJ: For adjustments of the previously invoiced amounts

To create an invoice, click Invoice.

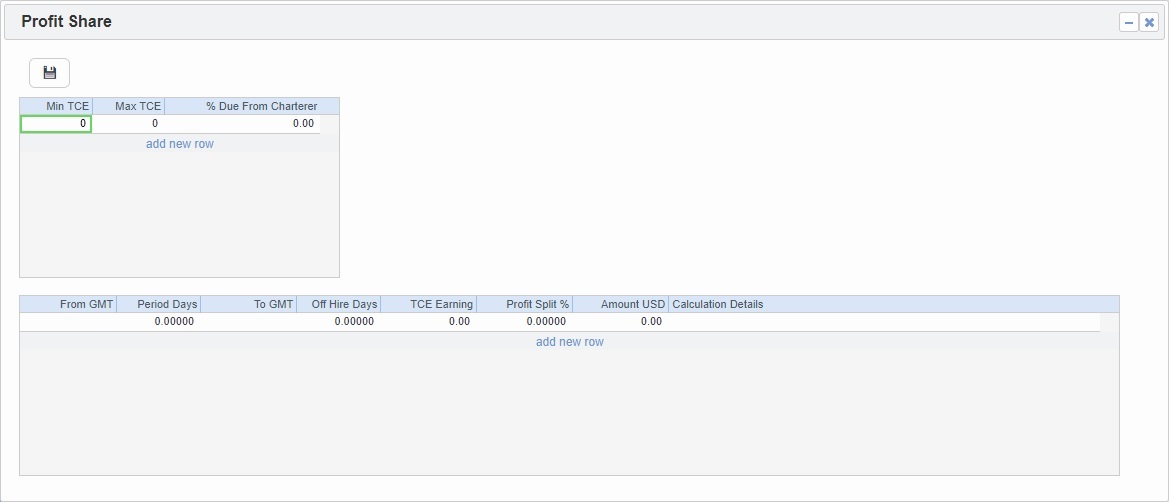

Profit Sharing for Owners Only

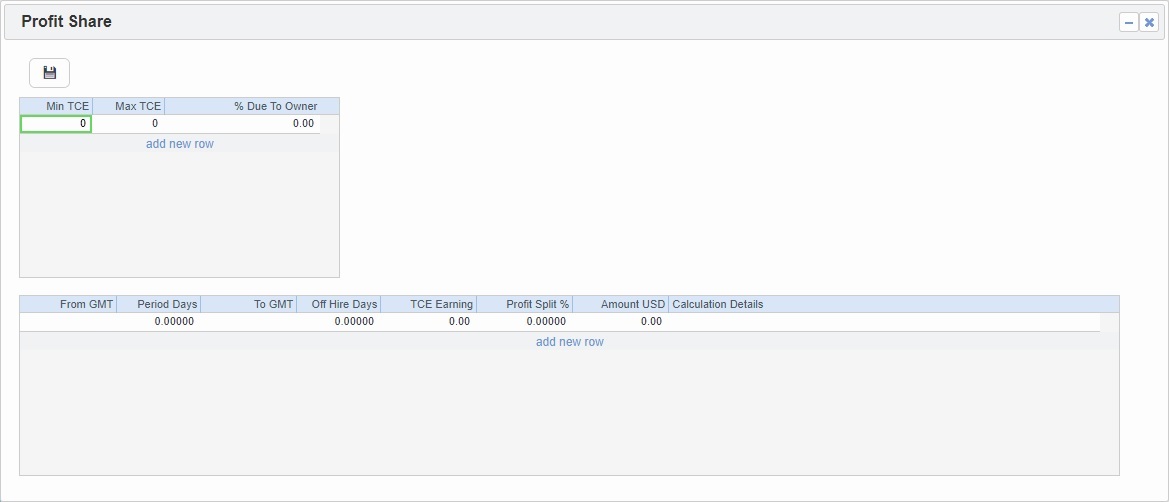

Configuration flag CFGTcJointVenture enables entering Owner Profit Sharing details manually in both the TC In and the TC Out. These profit sharing items will be included in the TC Invoices. By default, Profit Share will not be included in the Voyage P&L.

TC In

On the TC In, click Profit Sharing and then click Profit Sharing for Owners Only.

TC Out

On the TC Out, click Profit Sharing.

TC Invoices

The Profit Sharing for Owners Only amount is invoiced by including the amount in the TC Payment or TC Bill.

When you create a new TC Payment/Bill and select the Profit Sharing check box on the Item Select form, any uninvoiced profit share is included in the payment.