IMOS - Pooling Admin Fee Distribution

Home > Pooling > Pooling Admin Fee Distribution

When managing a pool, some non-voyage expenses/revenues can be generated, such as office purchases and insurance. Admin Fee Distribution captures these expenses/revenues and distributes them to the pool partners along with the Pooling Distribution.

To distribute Admin Fees, do the following:

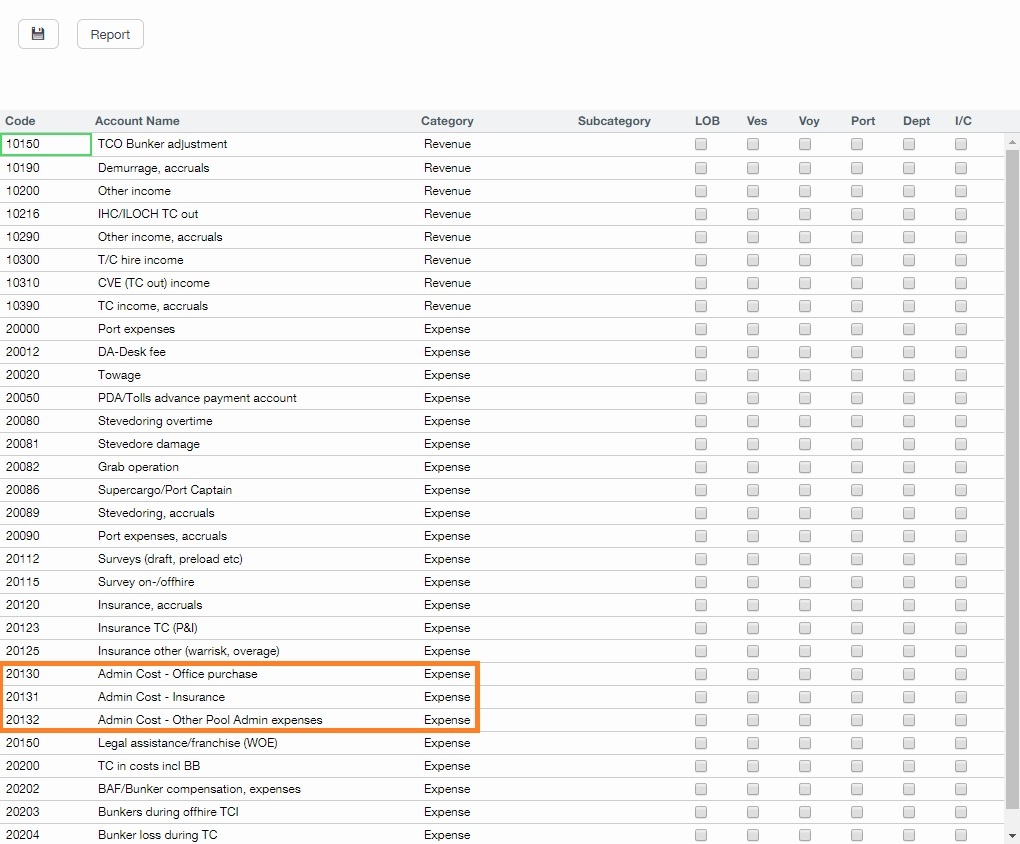

Set Up the Accounts for the Admin Fee

For Admin Fees to be captured, the accounts for these fees must be set up in the Chart of Accounts. The screenshot below includes the following accounts for pool admin expenses:

Code | Account Name |

|---|---|

20130 | Admin Cost - Office Purchase |

20131 | Admin Cost - Insurance |

20132 | Admin Cost - Other Pool Admin Expenses |

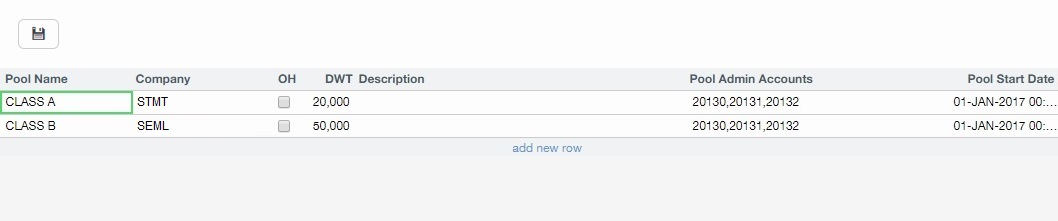

Select the Pool Admin Accounts

After the accounts are set up, on the Pools form, select them in the Pool Admin Accounts column. Make sure that all the accounts that you want to capture for Admin Fee Distribution are entered.

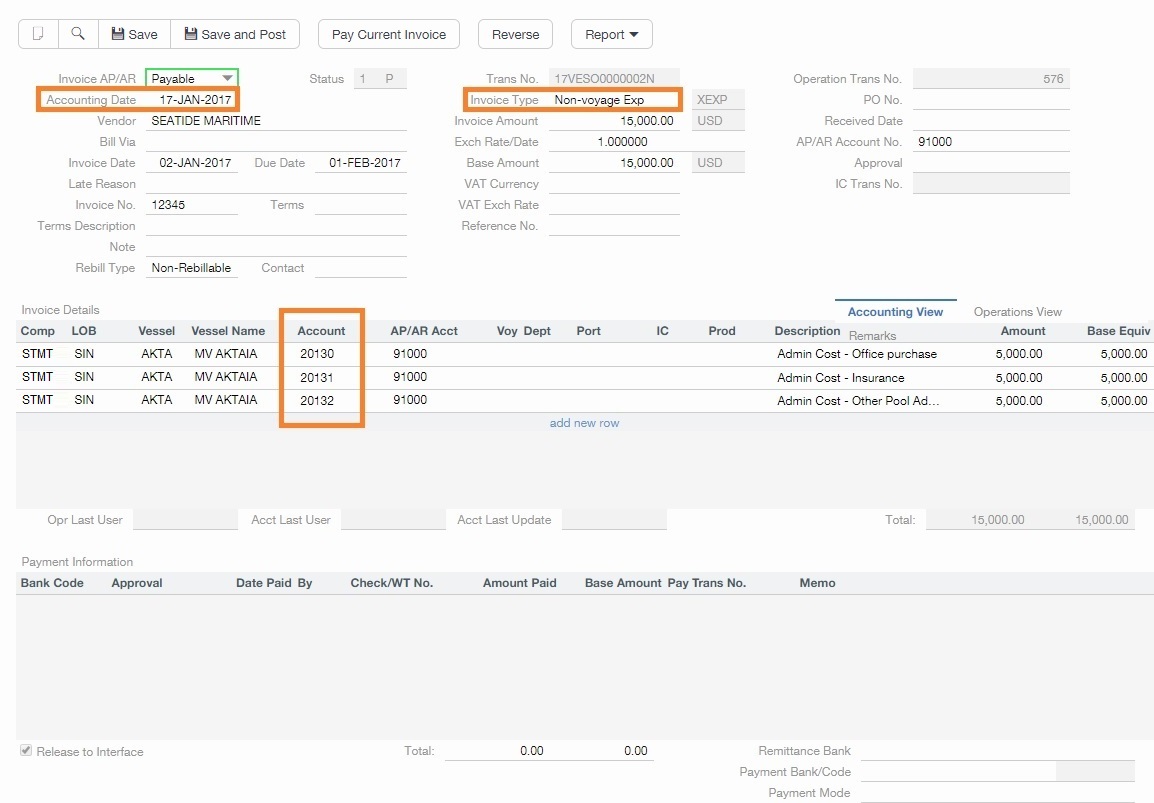

Create a Non-Voyage Exp/Rev or a Journal Entry for the Admin Fee

When expenses/revenues related to these accounts are incurred, they must be entered as Non-Voyage Expenses/Revenues or Journal Entries. In the Financials module, you can create them as Transaction Data Entries with Invoice Type Non-Voyage Exp/Rev or as Journal Entries. For both types, the Accounting Date must be in the Pooling Distribution period for which you want to distribute the Admin Fee.

Run Pooling Distribution

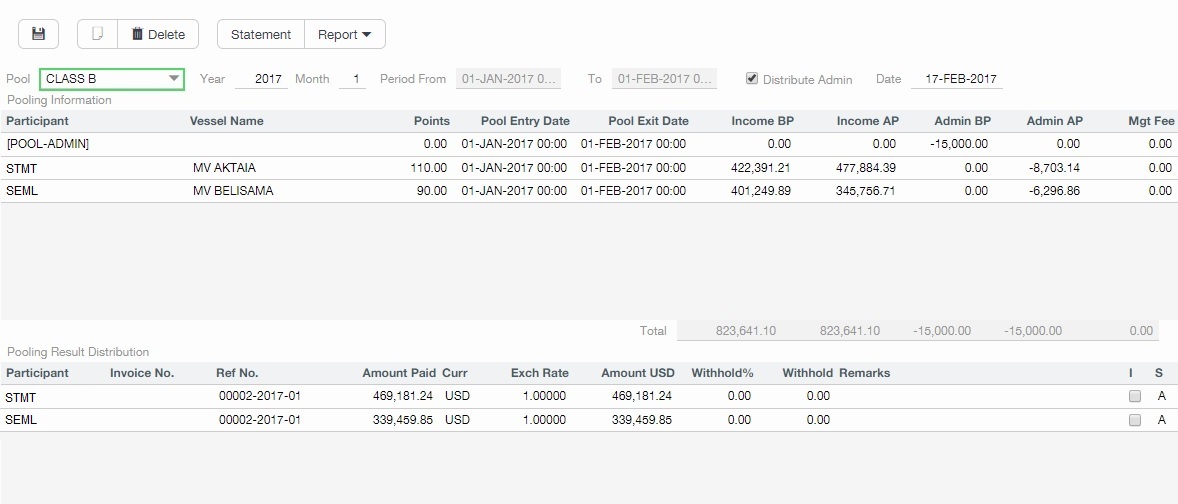

When running the Pooling Distribution, select the Distribute Admin check box.

Note: Eff Start Date and Eff End Date fields have been added to the Pooling Distribution form.

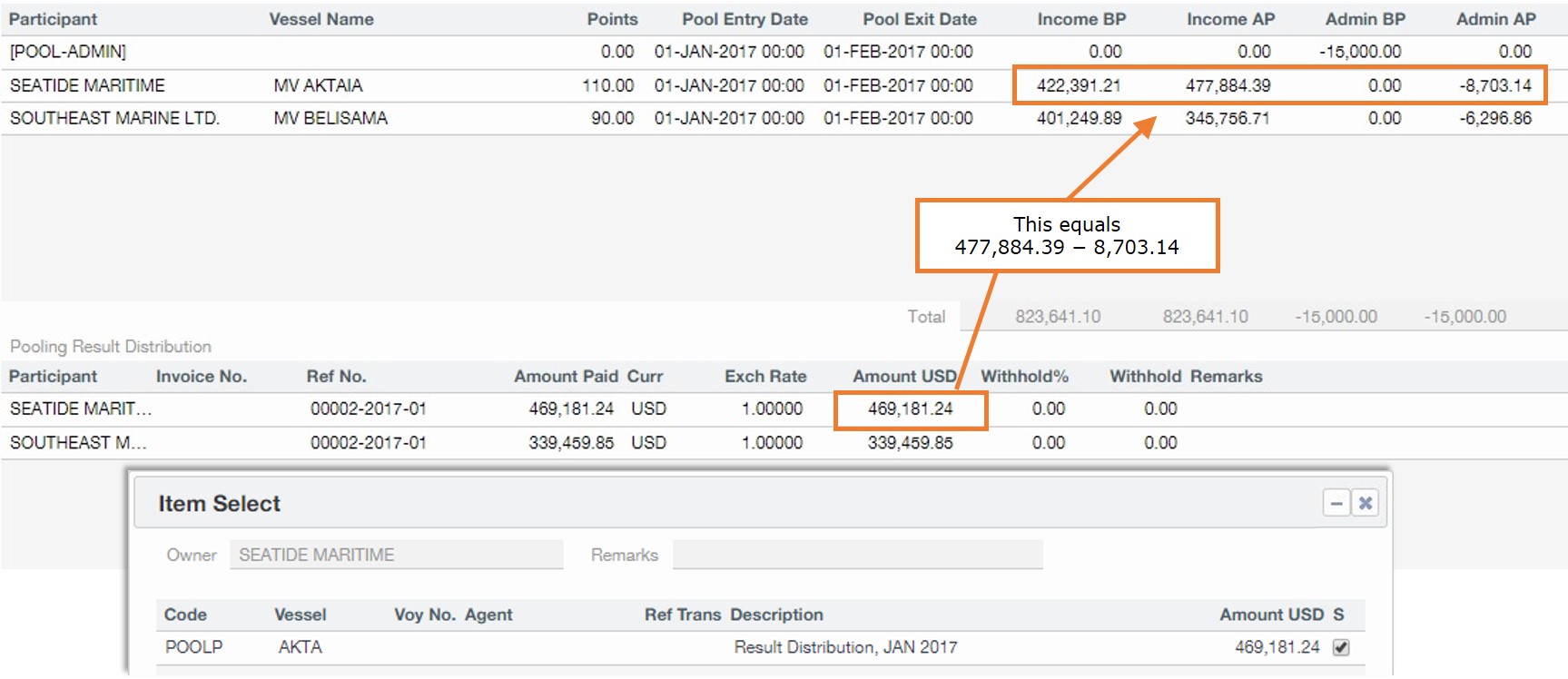

When selected, a new [POOL-ADMIN] line appears, with the Admin BP (Admin Before Pooling) and Admin AP (Admin After Pooling) columns populated for all the vessels. The Admin Fee is distributed to the vessel owners proportional to their Income After Pooling (Income AP).

Income AP of the vessel / Total income of the pool = Admin AP of the vessel / Total Admin Fee

In this example: $477,884.39 / ($477,884.39 + $345,756.71) = −$8,703.14 / (−$8,703.14 − $6,296.86)

Note: The payment details do not show the breakdown, but only the total distributed amount.