IMOS - Rev/Exp Tab - Cargo COA

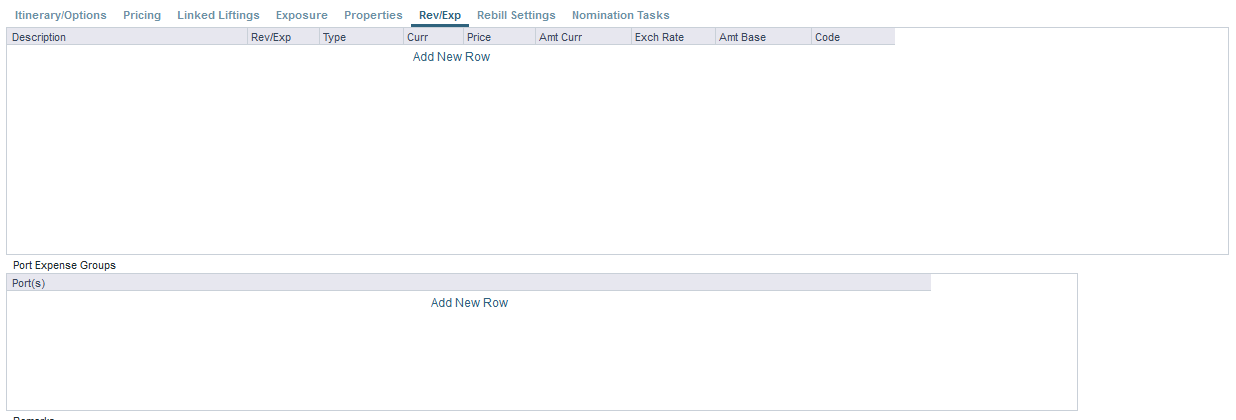

On the Rev/Exp tab, you can enter information about any revenues and expenses that will be inherited by the cargo liftings under the Cargo COA.

To rebill port expenses that exceed a cap, or to credit port expenses that do not meet a collar, you can configure Port Expense Cap/Collar Groups either here or at the Cargo level.

Under Port Expense Groups, click to add a row.

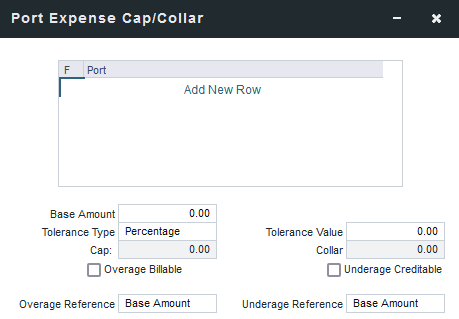

In the Port Expense Cap/Collar form, define the functions and ports included and the cap and collar amounts and tolerance information. Select whether overage is billable and/or underage is creditable.

The overage or underage can be rebilled through Expenses Rebill Management. Individual cost types can be excluded from the amount being compared to the cap or collar by selecting Excl from Cap Collar on the Ledger Expense Setup form. Rebillable cost items are excluded by default.