IMOS - Tax Rate

A connected platform for commercial contract management.

Configuration flag CFGEnableTaxGroup must be enabled, and you must have the Tax Rates Module Right selected, under Other in the Data Center.

The Tax Rate form enables you to link tax groups (Tax Codes) to at most three tax rates (Subcodes). On a Ready To Post invoice, when a Tax Group is selected for a line item, corresponding values automatically populate based on the percentages defined on the Tax Rate form.

On the Data Center menu … > under Other > click Tax Rates.

Using Tax Groups

To use tax groups, do the following:

Configure the Platform and Set Up Business Rules

If not all invoice lines should have Tax Codes, configuration flag CFGActRequireTaxCode must be set to N.

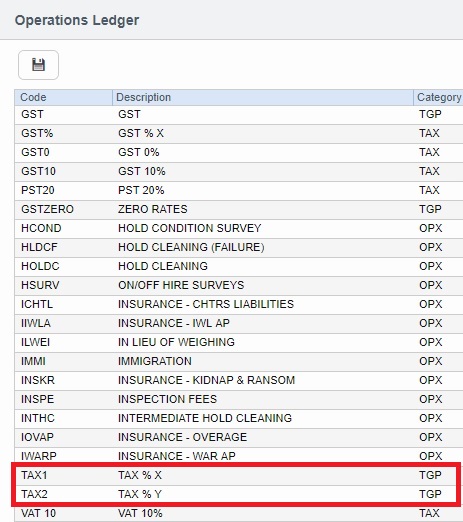

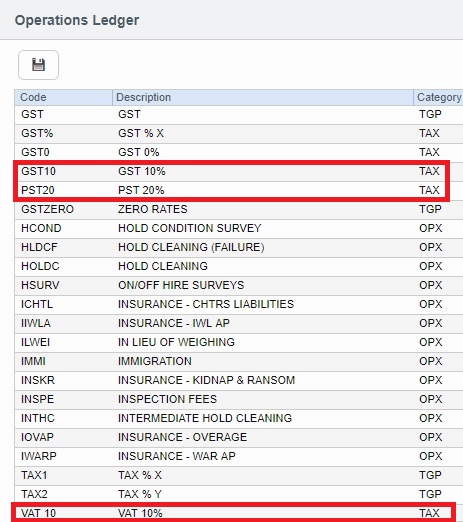

With the help of a Veson Nautical consultant, create Business Rules for the Operations Ledger types (Codes) used. Refer to the below examples for GST10, PST20, and VAT10.

Create Tax Groups and Tax Rates

Tax groups are created in the Operations Ledger with the Category TGP:

Tax rates are created with the Category TAX. In this example, GST10, PST20, and VAT10 are defined:

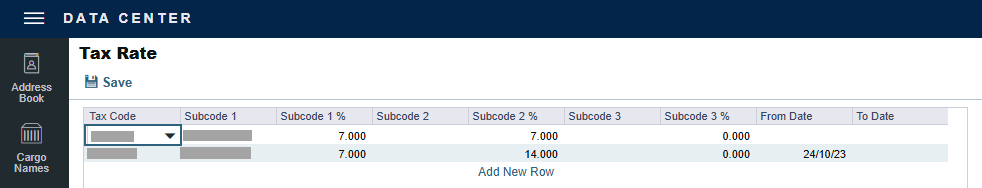

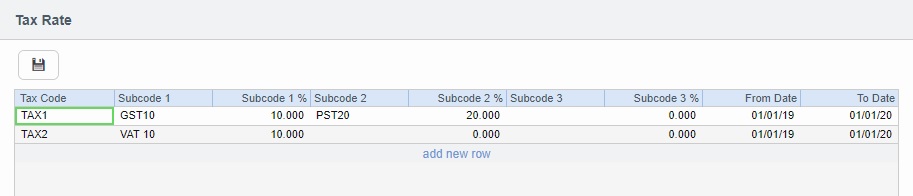

Link Tax Groups to Tax Rates

Tax groups (Tax Codes) are linked to tax rates (Subcodes) on the Tax Rate form, as shown below. From Date and To Date define the period during which the groupings apply.

In this example, for a line item on a Ready To Post invoice:

If Tax Code TAX1 is selected, two values populate for GST 10% and PST 20%.

If Tax Code TAX2 is selected, only one value populates for VAT 10%.

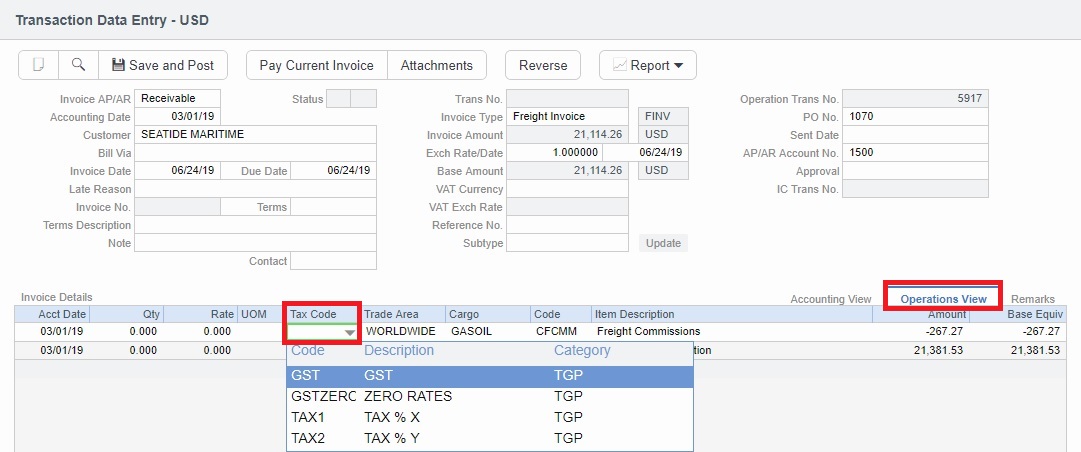

Retrieve Tax Rates when Posting Invoices

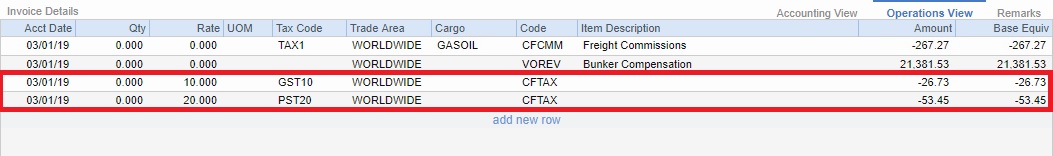

For a Ready To Post invoice, on the Transaction Data Entry Operation View tab, select a Tax Code (tax group) for each line item.

In this example, TAX1 is selected, and two values populate for GST 10% and PST 20%: