IMOS - Demurrage on Account

The Veson IMOS Platform is the market-leading cloud solution for commercial marine freight and fleet management.

Demurrage on Account allows partial demurrage invoices to be sent during a period, reducing the risk of large outstanding amounts. Each invoice is supported by an individual Laytime Calculation for the period invoiced. An incremental calculation creates a Final Demurrage Invoice by calculating demurrage for the entire voyage and subtracting the amounts already invoiced. This feature is intended to be used for contracts with billing of Demurrage on Account applied to all cargo handling ports for any cargoes included in the laytime calculation. It is not intended to apply to an isolated port.

The Demurrage on Account workflow is as follows:

Example Scenario

A typical Demurrage on Account scenario is that the vessel has arrived at the discharging port but will stay at anchorage for a longer period, and demurrage will be invoiced frequently, per the agreed terms. This page will use the following scenario as an example:

Demurrage on Account, Billing Days: 7

Basis: Calendar Days

Discharging at Amsterdam, waiting at anchorage

Set Up Demurrage on Account

Configuration

To configure Demurrage on Account, follow these steps:

Enable configuration flag CFGEnableDemurrageOnAccount.

Create a new Demurrage on Account Port Activity and link it to Port Function Discharging. This row indicates the end date for the Demurrage on Account calculation.

Conditions

The following conditions apply:

Ports must be Reversible.

Demurrage on Account works only with the Laytime Calculation Deduction method.

The Cargo form must be updated with the agreed terms.

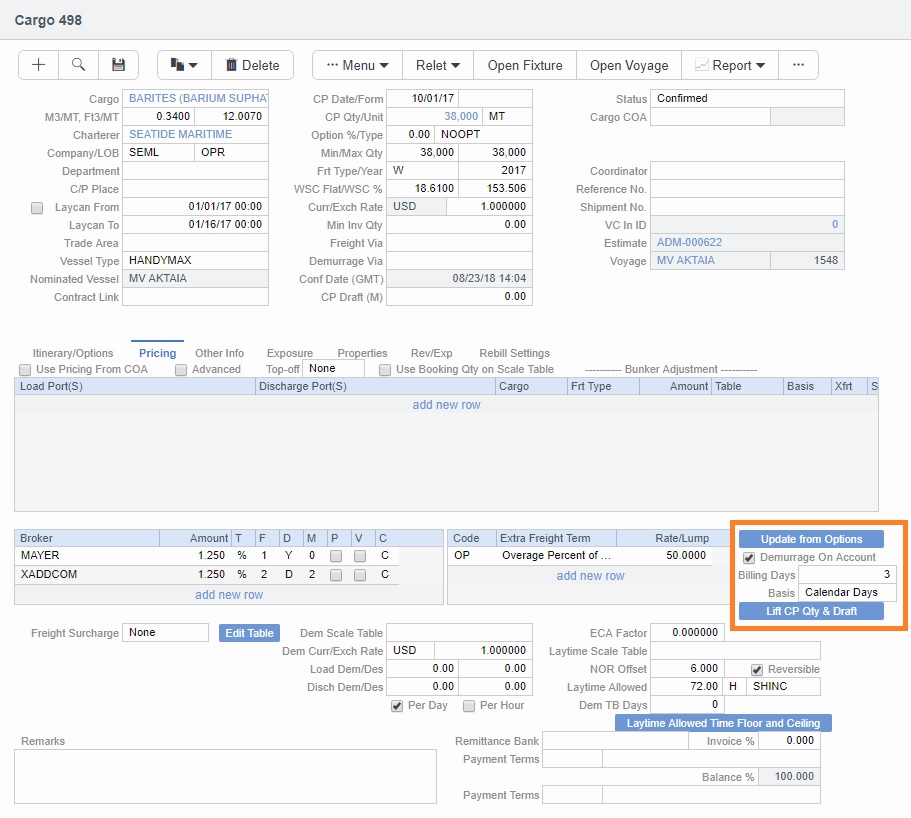

Create a Cargo

On the Cargo/VC In Pricing tab, do the following:

Select the Demurrage On Account check box to indicate that the contract terms allow Demurrage on Account.

Billing Days: Indicate the days on demurrage per invoice per period billed or how frequently Demurrage on Account can be billed. This number is added to the Period From date on the Laytime Calculation to determine the Period To date.

Basis: Select the method used:

Calendar days (as shown in this example): Any interruptions from the period invoiced will be deducted.

For a Period of 7 days, starting 11/02/2012 12:00, with an interruption of 0.5 days:

Period: 11/02/2012 12:00 – 11/09/2012 12:00 = 7 days; demurrage amount based on 6.5 days.Demurrage days: Demurrage will always be calculated for a full on-account period of 7 days, adding interruptions to the end date.

For a Period of 7 days, starting 11/02/2012 12:00, with an interruption of 0.5 days:

Period: 11/02/2012 12:00 – 11/10/2012 00:00 = 7.5 days; demurrage amount based on 7 days.

Select the Reversible check box.

Example:

Calculating Period To and Balance (Days)

The methods of calculation depend on the Basis field setting on the Cargo form Pricing tab (where the Billing Days quantity is set). If the Basis is set to:

Calendar Days:

Period To = Period From + Billing Days

Period From on the first Demurrage on Account calculation will be set to the start of demurrage for the first discharge port. On all successive Demurrage on Account calculations, the Period From will be set to the previous calculation's Period To value.

For example, if the Period From is May 21, 2016, and Billing Days were 3, Period To would be set to May 24, 2016.

Balance (Days) = Period To - Period From - Any deductions that fall in period from/to

For example, if the Period From is May 21, 2016, and Billing Days were 3, and there was a deduction of 1 day in this period, then Balance (Days) would be 3 days - 1 day = 2 days.

Demurrage Days:

Period To = Period From + Billing Days + Deductions

Period From on the first Demurrage on Account calculation will be set to the start of demurrage for the first discharge port. On all successive Demurrage on Account calculations, the Period From will be set to the previous calculation's Period To value.

For example, if the Period From is May 21, 2016, Billing Days are 3, and there is a deduction of exactly 1 day from May 22, 2016, through May 23, 2016, then Period To = May 21 + 3 + 1 = May 25, 2016.

Balance (Days) = Billing Days

For a new calculation: (Period To - Period From - Time Deducted) = Billing Days

Period To is auto-calculated so that the Period From/To duration always includes the number of demurrage days specified in the cargo contract.

Time Deducted is the total time deducted between Period From and Period To.

Deductions always start and end within a billing period (Period From to Period To).

Billing Days are defined on the Cargo Pricing tab.

Schedule and Manage the Voyage

Schedule a voyage from the Cargo.

Manage the voyage, including the following activities:

Itinerary: Maintain the ETD.

Port Activities: Create Port Activities with the information on hand. Select the Demurrage on Account Port Activity and set the date/time up to when Demurrage on Account should be calculated.

Example:

The vessel has arrived in Amsterdam, and the time of Departure is estimated.

On Port Activities for Amsterdam, Demurrage on Account can use the same Time as the latest port activity or the ETD from Amsterdam. The Time of Demurrage on Account, the most recent port activity, calculates the number of Billing Days.

Create a Laytime Calculation

Create a new Laytime Calculation from the voyage:

Import laytime for all ports.

Select the Laytime Expires check box and note that the demurrage will be calculated basis 7 days: Balance (Days).

Demurrage Amount = Actual demurrage, including date/time used in Demurrage on Account

Agreed Amount = 7 days demurrage @ USD $ 10,000

Example: If there was a deduction during the demurrage period, being the Calendar Days basis, the period would be 7 days, but the demurrage amount would be based on net demurrage days.

Save the calculation as Settled. The demurrage amount will be included in the P&L, and the invoice can be posted.

Invoice the first Demurrage on Account.

Steps for New Periods

Follow the same steps for each new period to be invoiced:

Maintain the ETD.

Update Port Activity Demurrage on Account date/time.

Create a new Laytime Calculation. (Do not reuse the previous one.)

Note that the next period appears, as well as Previously Invoiced.

Example: To see the past invoices and the periods, click the Previously Invoiced Amount value.When the last Laytime Calculation should be done for the remaining part, do the following.

Complete Port Activities.

Create a new Laytime Calculation for all ports.

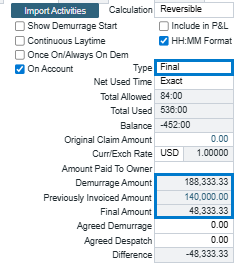

Select Type = Final and note the previous amount invoiced (less commission) and the balance to be invoiced.

Example: Total demurrage is calculated; the previous amounts invoiced appear and the Final Amount. Note, you need to enter the Agreed Amount, which will be the amount showing in the invoice.

Stepped Demurrage Rates

With Demurrage on Account, Laytime Calculations support stepped Demurrage Rates, which are set up on the Demurrage/Despatch Rates form. The following setup is required:

Cargo form settings, as described above.

New Laytime Calculation Setup:

Reversible is selected (default when selected on the Cargo).

All ports are selected and included in the Laytime Calculation.

Laytime Calculation: On Account is selected.

Add stepped rates to a Laytime Calculation before importing Port Activities. In the first on-account calculation, right-click a port in a Laytime Calculation and click Demurrage/Despatch Rates.

Step rates are automatically copied from the previous calculation when you save a subsequent calculation.

With a series of on-account calculations, editing the stepped rates in the most recent calculation will recalculate the demurrage for all periods, but previous calculations are not affected. Invoiced amounts from previous calculations are deducted from the newly calculated total demurrage amount.

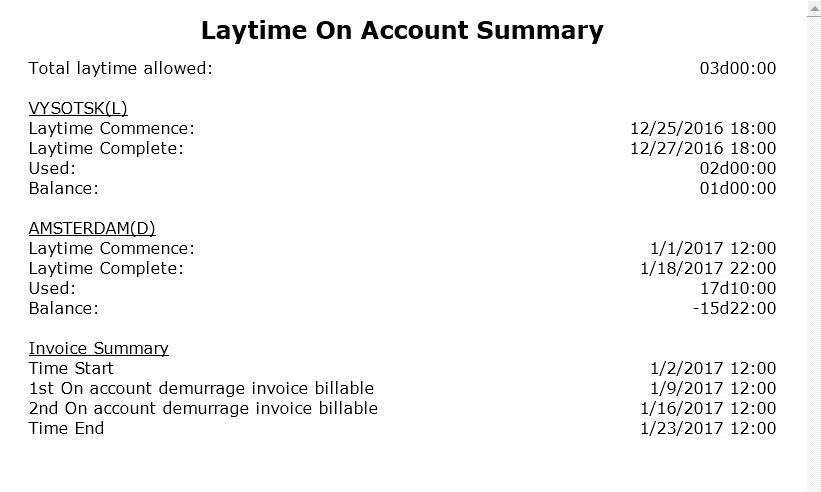

Run the Laytime On Account Summary Report

To create a report, on the Laytime Calculation form, click

Example: