IMOS - Profit Share

Home > Chartering > Profit Share

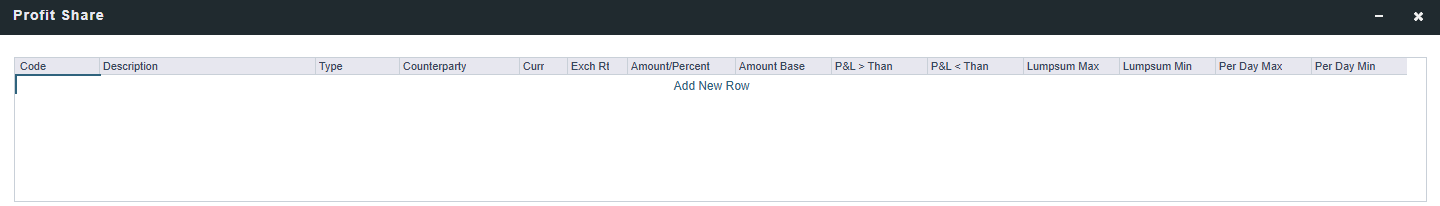

When voyage profit is to be shared with a third party, you can indicate amounts from the Voyage P&L to be considered as Profit Sharing or Premium Revenue on the Profit Share form. For Premium Income, if the vessel is a member of a pool, and the pool assignment is specified as Premium, the Premium amounts from the voyage will be distributed among all the Premium vessels in the pool.

To access the Profit Share form:

On the Estimate column, Estimate details, or Voyage Fixture menu, click Profit Share.

On the Voyage Manager, click Other Rev/Exp ▼ and then click Profit Share.

Data entered in this form in the Estimate flows to the Voyage Fixture when fixed, and to the Voyage when scheduled.

To use the Profit Share functionality, an Operations Ledger line item must exist in the Data Center with the code PNLSHARE.

The Voyage P&L includes Profit Sharing (including voyage and time charter) and Net Voy Profit total rows, as well as Net Daily Profit (Loss) as a result of profit sharing, in the Estimated and Actual columns. When a Profit Share Distribution is created, the corresponding amounts appear in the Posted column.

For a Counterparty with the Internal check box selected on its Address Book entry, a mirrored transaction will be created and automatically posted for that Counterparty. The Business Rule for the mirrored invoice is Source PTSR and Code per the Profit Share codes: PNLSHAREL, PNLSHAREP, PNLSHARER, PNLSHAREW. The mirrored invoice cannot be reversed on its own, but will be reversed automatically if the parent invoice is reversed.

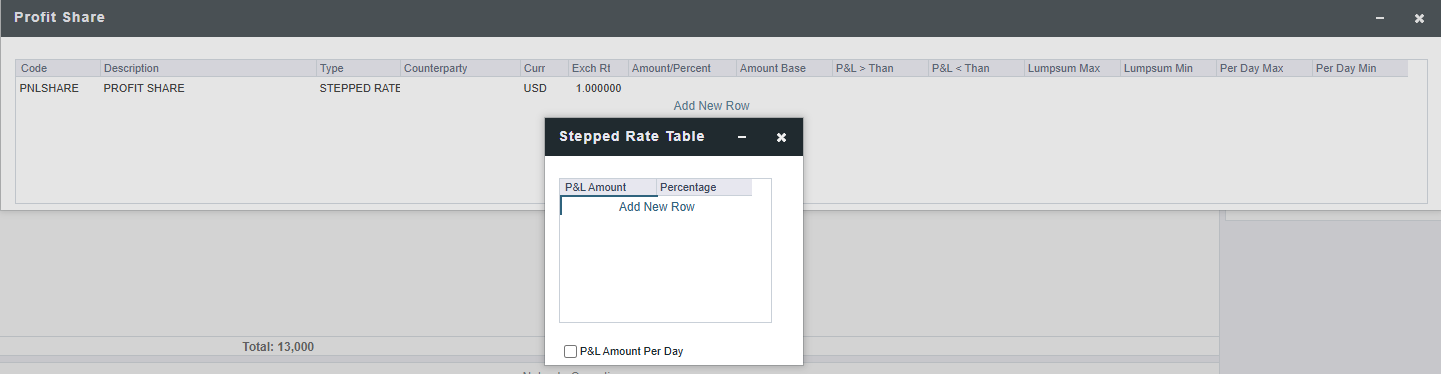

Defining Stepped Rates

You can define a series of profit ranges and the profit sharing rates that apply to each range.

On a Profit Share form line item, do the following:

Set Type to Stepped Rate.

Right-click the line item and then click Stepped Rate Table.

Enter P&L Amount ranges, in order of lowest to highest, with Percentage rates. Profit sharing is calculated as the sum of P&L Amounts in each range.

Examples: When the Voyage P&L = −$1,500, profit sharing = (−$500 × 0.01) + (−$1,000 × 0.02). When the Voyage P&L = $1,500, profit sharing = ($1,000 × 0.02) + ($500 × 0.01).The profit sharing rate is 0.00 for P&L Amounts below the lowest value entered.

The profit sharing rate entered for the highest P&L Amount applies to all profit equal to or greater than that amount.

When P&L Amount Per Day is selected, the value entered in the P&L Amount column is compared to the average daily voyage P&L amount, rather than to the total voyage P&L amount, to determine the profit share percentage that applies.

Voyage Profit Share in Monthly Closing Accruals

When running Monthly Accruals, by default, the Veson IMOS Platform prorates Lumpsum Profit Share based on the PRORATE accrual method: Voyage Days in Period / Total Voyage Days.

100% allocation of voyage profit share to a period based on the INVOICEDATE accrual method is not possible because there is no invoice date field on the Profit Share form.